2006 Interim Reportï¼A Share.pdf - ä¸å½é¶è¡

2006 Interim Reportï¼A Share.pdf - ä¸å½é¶è¡

2006 Interim Reportï¼A Share.pdf - ä¸å½é¶è¡

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Management Discussion & Analysis<br />

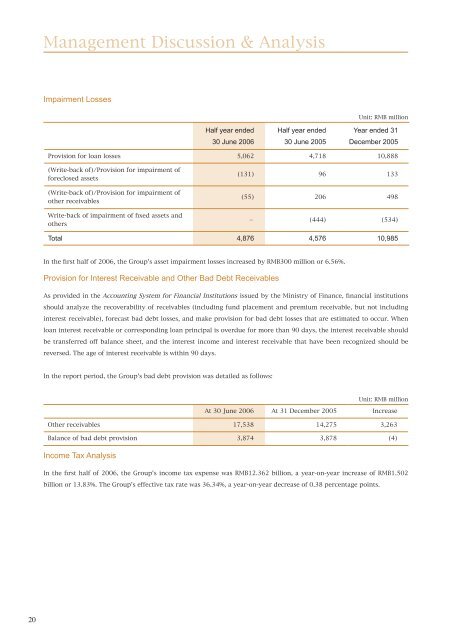

Impairment Losses<br />

Half year ended<br />

30 June <strong>2006</strong><br />

Half year ended<br />

30 June 2005<br />

Unit: RMB million<br />

Year ended 31<br />

December 2005<br />

Provision for loan losses 5,062 4,718 10,888<br />

(Write-back of)/Provision for impairment of<br />

foreclosed assets<br />

(Write-back of)/Provision for impairment of<br />

other receivables<br />

Write-back of impairment of fixed assets and<br />

others<br />

(131) 96 133<br />

(55) 206 498<br />

- (444) (534)<br />

Total 4,876 4,576 10,985<br />

In the first half of <strong>2006</strong>, the Group's asset impairment losses increased by RMB300 million or 6.56%.<br />

Provision for Interest Receivable and Other Bad Debt Receivables<br />

As provided in the Accounting System for Financial Institutions issued by the Ministry of Finance, financial institutions<br />

should analyze the recoverability of receivables (including fund placement and premium receivable, but not including<br />

interest receivable), forecast bad debt losses, and make provision for bad debt losses that are estimated to occur. When<br />

loan interest receivable or corresponding loan principal is overdue for more than 90 days, the interest receivable should<br />

be transferred off balance sheet, and the interest income and interest receivable that have been recognized should be<br />

reversed. The age of interest receivable is within 90 days.<br />

In the report period, the Group's bad debt provision was detailed as follows:<br />

Unit: RMB million<br />

At 30 June <strong>2006</strong> At 31 December 2005 Increase<br />

Other receivables 17,538 14,275 3,263<br />

Balance of bad debt provision 3,874 3,878 (4)<br />

Income Tax Analysis<br />

In the first half of <strong>2006</strong>, the Group's income tax expense was RMB12.362 billion, a year-on-year increase of RMB1.502<br />

billion or 13.83%. The Group's effective tax rate was 36.34%, a year-on-year decrease of 0.38 percentage points.<br />

20