2 an introduction to cost terms and purposes - Pearson Learning ...

2 an introduction to cost terms and purposes - Pearson Learning ...

2 an introduction to cost terms and purposes - Pearson Learning ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

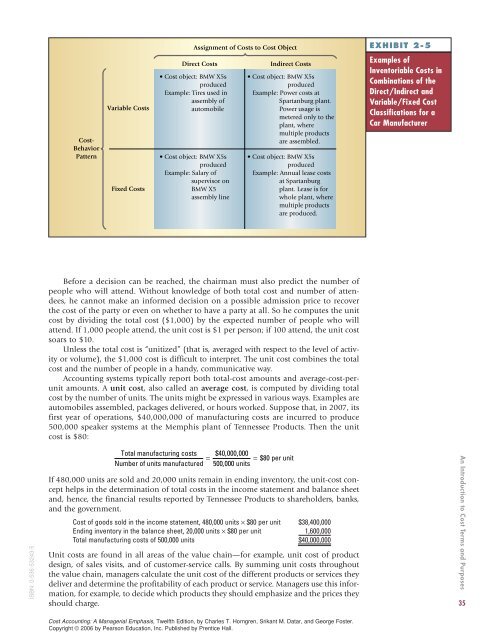

Assignment of Costs <strong>to</strong> Cost Object<br />

EXHIBIT 2-5<br />

Cost-<br />

Behavior<br />

Pattern<br />

Variable Costs<br />

Fixed Costs<br />

Direct Costs<br />

• Cost object: BMW X5s<br />

produced<br />

Example: Tires used in<br />

assembly of<br />

au<strong>to</strong>mobile<br />

• Cost object: BMW X5s<br />

produced<br />

Example: Salary of<br />

supervisor on<br />

BMW X5<br />

assembly line<br />

Indirect Costs<br />

• Cost object: BMW X5s<br />

produced<br />

Example: Power <strong>cost</strong>s at<br />

Spart<strong>an</strong>burg pl<strong>an</strong>t.<br />

Power usage is<br />

metered only <strong>to</strong> the<br />

pl<strong>an</strong>t, where<br />

multiple products<br />

are assembled.<br />

• Cost object: BMW X5s<br />

produced<br />

Example: Annual lease <strong>cost</strong>s<br />

at Spart<strong>an</strong>burg<br />

pl<strong>an</strong>t. Lease is for<br />

whole pl<strong>an</strong>t, where<br />

multiple products<br />

are produced.<br />

Examples of<br />

Inven<strong>to</strong>riable Costs in<br />

Combinations of the<br />

Direct/Indirect <strong>an</strong>d<br />

Variable/Fixed Cost<br />

Classifications for a<br />

Car M<strong>an</strong>ufacturer<br />

Before a decision c<strong>an</strong> be reached, the chairm<strong>an</strong> must also predict the number of<br />

people who will attend. Without knowledge of both <strong>to</strong>tal <strong>cost</strong> <strong>an</strong>d number of attendees,<br />

he c<strong>an</strong>not make <strong>an</strong> informed decision on a possible admission price <strong>to</strong> recover<br />

the <strong>cost</strong> of the party or even on whether <strong>to</strong> have a party at all. So he computes the unit<br />

<strong>cost</strong> by dividing the <strong>to</strong>tal <strong>cost</strong> ($1,000) by the expected number of people who will<br />

attend. If 1,000 people attend, the unit <strong>cost</strong> is $1 per person; if 100 attend, the unit <strong>cost</strong><br />

soars <strong>to</strong> $10.<br />

Unless the <strong>to</strong>tal <strong>cost</strong> is “unitized” (that is, averaged with respect <strong>to</strong> the level of activity<br />

or volume), the $1,000 <strong>cost</strong> is difficult <strong>to</strong> interpret. The unit <strong>cost</strong> combines the <strong>to</strong>tal<br />

<strong>cost</strong> <strong>an</strong>d the number of people in a h<strong>an</strong>dy, communicative way.<br />

Accounting systems typically report both <strong>to</strong>tal-<strong>cost</strong> amounts <strong>an</strong>d average-<strong>cost</strong>-perunit<br />

amounts. A unit <strong>cost</strong>, also called <strong>an</strong> average <strong>cost</strong>, is computed by dividing <strong>to</strong>tal<br />

<strong>cost</strong> by the number of units. The units might be expressed in various ways. Examples are<br />

au<strong>to</strong>mobiles assembled, packages delivered, or hours worked. Suppose that, in 2007, its<br />

first year of operations, $40,000,000 of m<strong>an</strong>ufacturing <strong>cost</strong>s are incurred <strong>to</strong> produce<br />

500,000 speaker systems at the Memphis pl<strong>an</strong>t of Tennessee Products. Then the unit<br />

<strong>cost</strong> is $80:<br />

ISBN: 0-536-53243-5<br />

Total m<strong>an</strong>ufacturing <strong>cost</strong>s<br />

Number of units m<strong>an</strong>ufactured<br />

$40,000,000<br />

= = $ 80 per unit<br />

500,<br />

000 units<br />

If 480,000 units are sold <strong>an</strong>d 20,000 units remain in ending inven<strong>to</strong>ry, the unit-<strong>cost</strong> concept<br />

helps in the determination of <strong>to</strong>tal <strong>cost</strong>s in the income statement <strong>an</strong>d bal<strong>an</strong>ce sheet<br />

<strong>an</strong>d, hence, the fin<strong>an</strong>cial results reported by Tennessee Products <strong>to</strong> shareholders, b<strong>an</strong>ks,<br />

<strong>an</strong>d the government.<br />

Cost of goods sold in the income statement, 480,000 units × $80 per unit $38,400,000<br />

Ending inven<strong>to</strong>ry in the bal<strong>an</strong>ce sheet, 20,000 units × $80 per unit 1,600,000<br />

Total m<strong>an</strong>ufacturing <strong>cost</strong>s of 500,000 units $40,000,000<br />

Unit <strong>cost</strong>s are found in all areas of the value chain—for example, unit <strong>cost</strong> of product<br />

design, of sales visits, <strong>an</strong>d of cus<strong>to</strong>mer-service calls. By summing unit <strong>cost</strong>s throughout<br />

the value chain, m<strong>an</strong>agers calculate the unit <strong>cost</strong> of the different products or services they<br />

deliver <strong>an</strong>d determine the profitability of each product or service. M<strong>an</strong>agers use this information,<br />

for example, <strong>to</strong> decide which products they should emphasize <strong>an</strong>d the prices they<br />

should charge.<br />

An Introduction <strong>to</strong> Cost Terms <strong>an</strong>d Purposes<br />

35<br />

Cost Accounting: A M<strong>an</strong>agerial Emphasis, Twelfth Edition, by Charles T. Horngren, Srik<strong>an</strong>t M. Datar, <strong>an</strong>d George Foster.<br />

Copyright © 2006 by <strong>Pearson</strong> Education, Inc. Published by Prentice Hall.