2 an introduction to cost terms and purposes - Pearson Learning ...

2 an introduction to cost terms and purposes - Pearson Learning ...

2 an introduction to cost terms and purposes - Pearson Learning ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

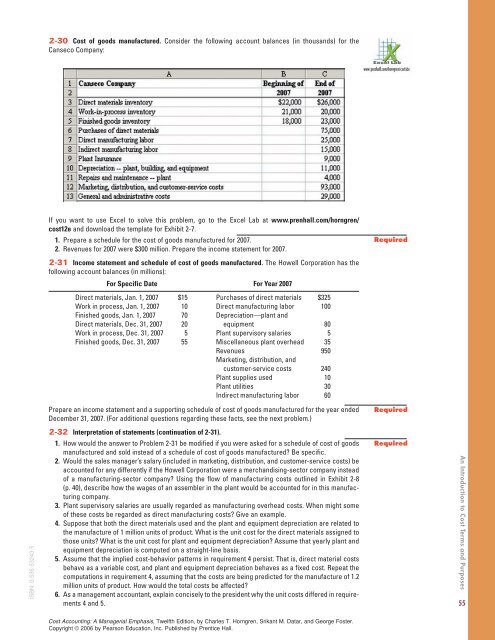

2-30 Cost of goods m<strong>an</strong>ufactured. Consider the following account bal<strong>an</strong>ces (in thous<strong>an</strong>ds) for the<br />

C<strong>an</strong>seco Comp<strong>an</strong>y:<br />

If you w<strong>an</strong>t <strong>to</strong> use Excel <strong>to</strong> solve this problem, go <strong>to</strong> the Excel Lab at www.prenhall.com/horngren/<br />

<strong>cost</strong>12e <strong>an</strong>d download the template for Exhibit 2-7.<br />

1. Prepare a schedule for the <strong>cost</strong> of goods m<strong>an</strong>ufactured for 2007.<br />

2. Revenues for 2007 were $300 million. Prepare the income statement for 2007.<br />

Required<br />

2-31 Income statement <strong>an</strong>d schedule of <strong>cost</strong> of goods m<strong>an</strong>ufactured. The Howell Corporation has the<br />

following account bal<strong>an</strong>ces (in millions):<br />

For Specific Date For Year 2007<br />

Direct materials, J<strong>an</strong>. 1, 2007 $15 Purchases of direct materials $325<br />

Work in process, J<strong>an</strong>. 1, 2007 10 Direct m<strong>an</strong>ufacturing labor 100<br />

Finished goods, J<strong>an</strong>. 1, 2007 70 Depreciation—pl<strong>an</strong>t <strong>an</strong>d<br />

Direct materials, Dec. 31, 2007 20 equipment 80<br />

Work in process, Dec. 31, 2007 5 Pl<strong>an</strong>t supervisory salaries 5<br />

Finished goods, Dec. 31, 2007 55 Miscell<strong>an</strong>eous pl<strong>an</strong>t overhead 35<br />

Revenues 950<br />

Marketing, distribution, <strong>an</strong>d<br />

cus<strong>to</strong>mer-service <strong>cost</strong>s 240<br />

Pl<strong>an</strong>t supplies used 10<br />

Pl<strong>an</strong>t utilities 30<br />

Indirect m<strong>an</strong>ufacturing labor 60<br />

Prepare <strong>an</strong> income statement <strong>an</strong>d a supporting schedule of <strong>cost</strong> of goods m<strong>an</strong>ufactured for the year ended<br />

December 31, 2007. (For additional questions regarding these facts, see the next problem.)<br />

Required<br />

2-32 Interpretation of statements (continuation of 2-31).<br />

1. How would the <strong>an</strong>swer <strong>to</strong> Problem 2-31 be modified if you were asked for a schedule of <strong>cost</strong> of goods<br />

m<strong>an</strong>ufactured <strong>an</strong>d sold instead of a schedule of <strong>cost</strong> of goods m<strong>an</strong>ufactured? Be specific.<br />

2. Would the sales m<strong>an</strong>ager’s salary (included in marketing, distribution, <strong>an</strong>d cus<strong>to</strong>mer-service <strong>cost</strong>s) be<br />

accounted for <strong>an</strong>y differently if the Howell Corporation were a merch<strong>an</strong>dising-sec<strong>to</strong>r comp<strong>an</strong>y instead<br />

of a m<strong>an</strong>ufacturing-sec<strong>to</strong>r comp<strong>an</strong>y? Using the flow of m<strong>an</strong>ufacturing <strong>cost</strong>s outlined in Exhibit 2-8<br />

(p. 40), describe how the wages of <strong>an</strong> assembler in the pl<strong>an</strong>t would be accounted for in this m<strong>an</strong>ufacturing<br />

comp<strong>an</strong>y.<br />

3. Pl<strong>an</strong>t supervisory salaries are usually regarded as m<strong>an</strong>ufacturing overhead <strong>cost</strong>s. When might some<br />

of these <strong>cost</strong>s be regarded as direct m<strong>an</strong>ufacturing <strong>cost</strong>s? Give <strong>an</strong> example.<br />

4. Suppose that both the direct materials used <strong>an</strong>d the pl<strong>an</strong>t <strong>an</strong>d equipment depreciation are related <strong>to</strong><br />

the m<strong>an</strong>ufacture of 1 million units of product. What is the unit <strong>cost</strong> for the direct materials assigned <strong>to</strong><br />

those units? What is the unit <strong>cost</strong> for pl<strong>an</strong>t <strong>an</strong>d equipment depreciation? Assume that yearly pl<strong>an</strong>t <strong>an</strong>d<br />

equipment depreciation is computed on a straight-line basis.<br />

5. Assume that the implied <strong>cost</strong>-behavior patterns in requirement 4 persist. That is, direct material <strong>cost</strong>s<br />

behave as a variable <strong>cost</strong>, <strong>an</strong>d pl<strong>an</strong>t <strong>an</strong>d equipment depreciation behaves as a fixed <strong>cost</strong>. Repeat the<br />

computations in requirement 4, assuming that the <strong>cost</strong>s are being predicted for the m<strong>an</strong>ufacture of 1.2<br />

million units of product. How would the <strong>to</strong>tal <strong>cost</strong>s be affected?<br />

6. As a m<strong>an</strong>agement account<strong>an</strong>t, explain concisely <strong>to</strong> the president why the unit <strong>cost</strong>s differed in requirements<br />

4 <strong>an</strong>d 5.<br />

ISBN: 0-536-53243-5<br />

Required<br />

An Introduction <strong>to</strong> Cost Terms <strong>an</strong>d Purposes<br />

55<br />

Cost Accounting: A M<strong>an</strong>agerial Emphasis, Twelfth Edition, by Charles T. Horngren, Srik<strong>an</strong>t M. Datar, <strong>an</strong>d George Foster.<br />

Copyright © 2006 by <strong>Pearson</strong> Education, Inc. Published by Prentice Hall.