2 an introduction to cost terms and purposes - Pearson Learning ...

2 an introduction to cost terms and purposes - Pearson Learning ...

2 an introduction to cost terms and purposes - Pearson Learning ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

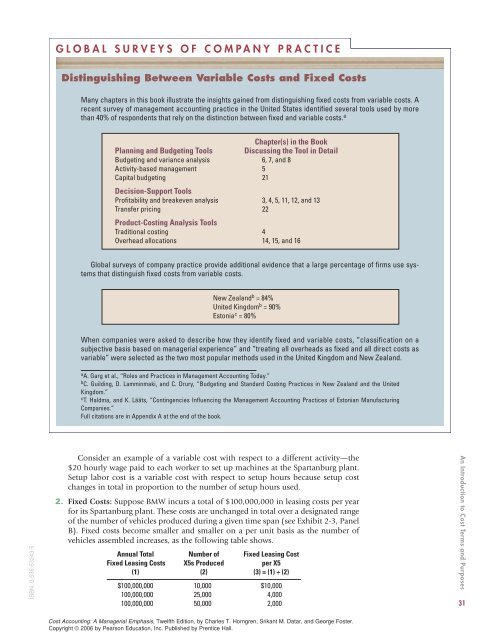

GLOBAL SURVEYS OF COMPANY PRACTICE<br />

Distinguishing Between Variable Costs <strong>an</strong>d Fixed Costs<br />

M<strong>an</strong>y chapters in this book illustrate the insights gained from distinguishing fixed <strong>cost</strong>s from variable <strong>cost</strong>s. A<br />

recent survey of m<strong>an</strong>agement accounting practice in the United States identified several <strong>to</strong>ols used by more<br />

th<strong>an</strong> 40% of respondents that rely on the distinction between fixed <strong>an</strong>d variable <strong>cost</strong>s. a<br />

Chapter(s) in the Book<br />

Pl<strong>an</strong>ning <strong>an</strong>d Budgeting Tools Discussing the Tool in Detail<br />

Budgeting <strong>an</strong>d vari<strong>an</strong>ce <strong>an</strong>alysis 6, 7, <strong>an</strong>d 8<br />

Activity-based m<strong>an</strong>agement 5<br />

Capital budgeting 21<br />

Decision-Support Tools<br />

Profitability <strong>an</strong>d breakeven <strong>an</strong>alysis 3, 4, 5, 11, 12, <strong>an</strong>d 13<br />

Tr<strong>an</strong>sfer pricing 22<br />

Product-Costing Analysis Tools<br />

Traditional <strong>cost</strong>ing 4<br />

Overhead allocations 14, 15, <strong>an</strong>d 16<br />

Global surveys of comp<strong>an</strong>y practice provide additional evidence that a large percentage of firms use systems<br />

that distinguish fixed <strong>cost</strong>s from variable <strong>cost</strong>s.<br />

New Zeal<strong>an</strong>d b = 84%<br />

United Kingdom b = 90%<br />

Es<strong>to</strong>nia c = 80%<br />

When comp<strong>an</strong>ies were asked <strong>to</strong> describe how they identify fixed <strong>an</strong>d variable <strong>cost</strong>s, “classification on a<br />

subjective basis based on m<strong>an</strong>agerial experience” <strong>an</strong>d “treating all overheads as fixed <strong>an</strong>d all direct <strong>cost</strong>s as<br />

variable” were selected as the two most popular methods used in the United Kingdom <strong>an</strong>d New Zeal<strong>an</strong>d.<br />

a A. Garg et al., “Roles <strong>an</strong>d Practices in M<strong>an</strong>agement Accounting Today.”<br />

b C. Guilding, D. Lamminmaki, <strong>an</strong>d C. Drury, “Budgeting <strong>an</strong>d St<strong>an</strong>dard Costing Practices in New Zeal<strong>an</strong>d <strong>an</strong>d the United<br />

Kingdom.”<br />

c T. Haldma, <strong>an</strong>d K. Lääts, “Contingencies Influencing the M<strong>an</strong>agement Accounting Practices of Es<strong>to</strong>ni<strong>an</strong> M<strong>an</strong>ufacturing<br />

Comp<strong>an</strong>ies.”<br />

Full citations are in Appendix A at the end of the book.<br />

ISBN: 0-536-53243-5<br />

Consider <strong>an</strong> example of a variable <strong>cost</strong> with respect <strong>to</strong> a different activity—the<br />

$20 hourly wage paid <strong>to</strong> each worker <strong>to</strong> set up machines at the Spart<strong>an</strong>burg pl<strong>an</strong>t.<br />

Setup labor <strong>cost</strong> is a variable <strong>cost</strong> with respect <strong>to</strong> setup hours because setup <strong>cost</strong><br />

ch<strong>an</strong>ges in <strong>to</strong>tal in proportion <strong>to</strong> the number of setup hours used.<br />

2. Fixed Costs: Suppose BMW incurs a <strong>to</strong>tal of $100,000,000 in leasing <strong>cost</strong>s per year<br />

for its Spart<strong>an</strong>burg pl<strong>an</strong>t. These <strong>cost</strong>s are unch<strong>an</strong>ged in <strong>to</strong>tal over a designated r<strong>an</strong>ge<br />

of the number of vehicles produced during a given time sp<strong>an</strong> (see Exhibit 2-3, P<strong>an</strong>el<br />

B). Fixed <strong>cost</strong>s become smaller <strong>an</strong>d smaller on a per unit basis as the number of<br />

vehicles assembled increases, as the following table shows.<br />

Annual Total Number of Fixed Leasing Cost<br />

Fixed Leasing Costs X5s Produced per X5<br />

(1) (2) (3) = (1) ÷ (2)<br />

$100,000,000 10,000 $10,000<br />

100,000,000 25,000 4,000<br />

100,000,000 50,000 2,000<br />

An Introduction <strong>to</strong> Cost Terms <strong>an</strong>d Purposes<br />

31<br />

Cost Accounting: A M<strong>an</strong>agerial Emphasis, Twelfth Edition, by Charles T. Horngren, Srik<strong>an</strong>t M. Datar, <strong>an</strong>d George Foster.<br />

Copyright © 2006 by <strong>Pearson</strong> Education, Inc. Published by Prentice Hall.