Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

22<br />

Article Cover FinLife of the Story Month<br />

NIVESHAK<br />

Fundamental or Technical Analysis:<br />

An Amalgamation of both the<br />

perspectives<br />

Rahul Bajaj<br />

IIM Shillong<br />

“The best way to have a million is to start with two million and trade<br />

in the financial markets using technical analysis “<br />

A lot of negativity has been built over the years<br />

around technical trading, however this powerful<br />

tool when used in conjunction with fundamental<br />

analysis can help enhance the returns of any<br />

trader. Difference between the two perspectives<br />

is that the technical analyst uses statistics and<br />

assets traded volume and historical prices data<br />

to forecast the prices whereas the fundamental<br />

trader calculates the assets intrinsic value<br />

through current performance and future<br />

projections. Technical analysis relies on patterns,<br />

historical prices to repeat in the future whereas<br />

fundamental analysis relies that the expected<br />

company future performance to reflect in the<br />

prices. However it is possible that history and<br />

market behaviour do not repeat in the former,<br />

and market behaviour/sentiment not being in<br />

sync with the fundamentals in the latter. Traders<br />

who invest in assets with good fundamentals at<br />

the right time can help maximise the returns for<br />

investors. Let us look at both the perspectives<br />

and how they can be used together.<br />

Technical analysis is applicable to stocks,<br />

indices, commodities, futures or any tradable<br />

instrument where the price is influenced by<br />

the forces of supply and demand. Technical<br />

analysts use combination of the open, high,<br />

low, or close for a given security over a specific<br />

time frame. The time frame can be based on<br />

intraday (1-minute, 5-minutes, 10-minutes,<br />

15-minutes, 30-minutes or hourly), daily, weekly<br />

or monthly price data and last a few hours<br />

or many years. As it can be done across time<br />

frames, it is possible to find short-term as well<br />

as long-term trends using technical analysis.<br />

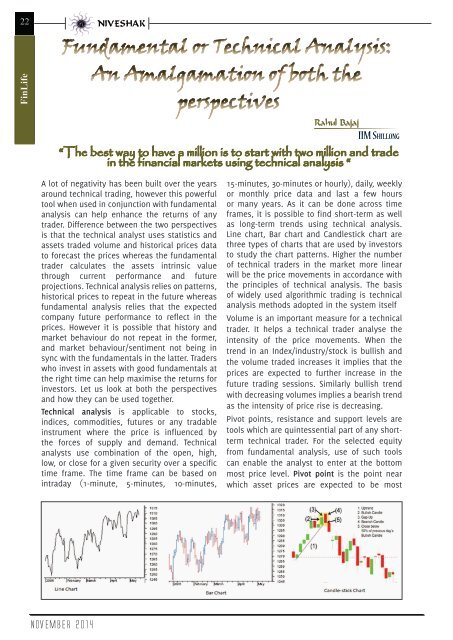

Line chart, Bar chart and Candlestick chart are<br />

three types of charts that are used by investors<br />

to study the chart patterns. Higher the number<br />

of technical traders in the market more linear<br />

will be the price movements in accordance with<br />

the principles of technical analysis. The basis<br />

of widely used algorithmic trading is technical<br />

analysis methods adopted in the system itself<br />

Volume is an important measure for a technical<br />

trader. It helps a technical trader analyse the<br />

intensity of the price movements. When the<br />

trend in an Index/industry/stock is bullish and<br />

the volume traded increases it implies that the<br />

prices are expected to further increase in the<br />

future trading sessions. Similarly bullish trend<br />

with decreasing volumes implies a bearish trend<br />

as the intensity of price rise is decreasing.<br />

Pivot points, resistance and support levels are<br />

tools which are quintessential part of any shortterm<br />

technical trader. For the selected equity<br />

from fundamental analysis, use of such tools<br />

can enable the analyst to enter at the bottom<br />

most price level. Pivot point is the point near<br />

which asset prices are expected to be most<br />

NOVEMBER 2014