You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

NIVESHAK 25<br />

Article Cover FinLife of the Story Month<br />

price of the equity.<br />

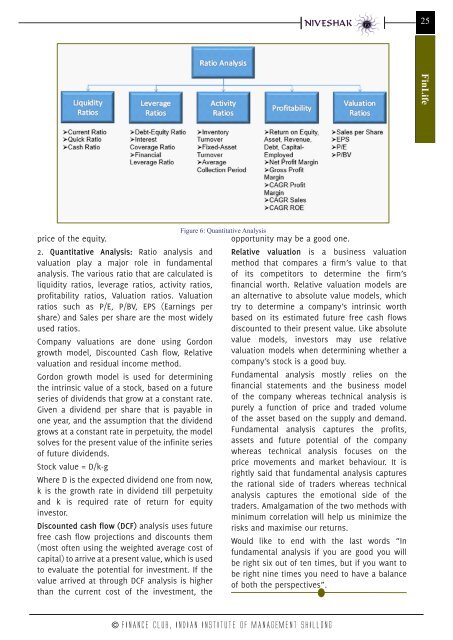

2. Quantitative Analysis: Ratio analysis and<br />

valuation play a major role in fundamental<br />

analysis. The various ratio that are calculated is<br />

liquidity ratios, leverage ratios, activity ratios,<br />

profitability ratios, Valuation ratios. Valuation<br />

ratios such as P/E, P/BV, EPS (Earnings per<br />

share) and Sales per share are the most widely<br />

used ratios.<br />

Company valuations are done using Gordon<br />

growth model, Discounted Cash flow, Relative<br />

valuation and residual income method.<br />

Gordon growth model is used for determining<br />

the intrinsic value of a stock, based on a future<br />

series of dividends that grow at a constant rate.<br />

Given a dividend per share that is payable in<br />

one year, and the assumption that the dividend<br />

grows at a constant rate in perpetuity, the model<br />

solves for the present value of the infinite series<br />

of future dividends.<br />

Stock value = D/k-g<br />

Where D is the expected dividend one from now,<br />

k is the growth rate in dividend till perpetuity<br />

and k is required rate of return for equity<br />

investor.<br />

Discounted cash flow (DCF) analysis uses future<br />

free cash flow projections and discounts them<br />

(most often using the weighted average cost of<br />

capital) to arrive at a present value, which is used<br />

to evaluate the potential for investment. If the<br />

value arrived at through DCF analysis is higher<br />

than the current cost of the investment, the<br />

Figure 6: Quantitative Analysis<br />

opportunity may be a good one.<br />

Relative valuation is a business valuation<br />

method that compares a firm’s value to that<br />

of its competitors to determine the firm’s<br />

financial worth. Relative valuation models are<br />

an alternative to absolute value models, which<br />

try to determine a company’s intrinsic worth<br />

based on its estimated future free cash flows<br />

discounted to their present value. Like absolute<br />

value models, investors may use relative<br />

valuation models when determining whether a<br />

company’s stock is a good buy.<br />

Fundamental analysis mostly relies on the<br />

financial statements and the business model<br />

of the company whereas technical analysis is<br />

purely a function of price and traded volume<br />

of the asset based on the supply and demand.<br />

Fundamental analysis captures the profits,<br />

assets and future potential of the company<br />

whereas technical analysis focuses on the<br />

price movements and market behaviour. It is<br />

rightly said that fundamental analysis captures<br />

the rational side of traders whereas technical<br />

analysis captures the emotional side of the<br />

traders. Amalgamation of the two methods with<br />

minimum correlation will help us minimize the<br />

risks and maximise our returns.<br />

Would like to end with the last words “In<br />

fundamental analysis if you are good you will<br />

be right six out of ten times, but if you want to<br />

be right nine times you need to have a balance<br />

of both the perspectives”.<br />

© FINANCE CLUB, INDIAN INSTITUTE Of MANAGEMENT SHILLONG