You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

28<br />

NIVESHAK<br />

Article Cover Finsight of the Story Month<br />

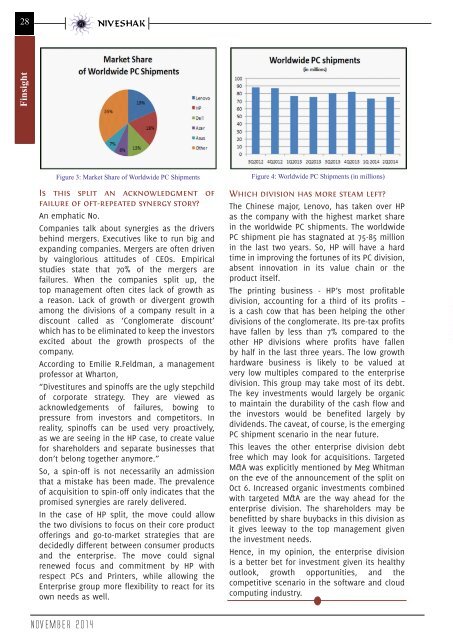

Figure 3: Market Share of Worldwide PC Shipments<br />

Is this split an acknowledgment of<br />

failure of oft-repeated synergy story?<br />

An emphatic No.<br />

Companies talk about synergies as the drivers<br />

behind mergers. Executives like to run big and<br />

expanding companies. Mergers are often driven<br />

by vainglorious attitudes of CEOs. Empirical<br />

studies state that 70% of the mergers are<br />

failures. When the companies split up, the<br />

top management often cites lack of growth as<br />

a reason. Lack of growth or divergent growth<br />

among the divisions of a company result in a<br />

discount called as ‘Conglomerate discount’<br />

which has to be eliminated to keep the investors<br />

excited about the growth prospects of the<br />

company.<br />

According to Emilie R.Feldman, a management<br />

professor at Wharton,<br />

“Divestitures and spinoffs are the ugly stepchild<br />

of corporate strategy. They are viewed as<br />

acknowledgements of failures, bowing to<br />

pressure from investors and competitors. In<br />

reality, spinoffs can be used very proactively,<br />

as we are seeing in the HP case, to create value<br />

for shareholders and separate businesses that<br />

don’t belong together anymore.”<br />

So, a spin-off is not necessarily an admission<br />

that a mistake has been made. The prevalence<br />

of acquisition to spin-off only indicates that the<br />

promised synergies are rarely delivered.<br />

In the case of HP split, the move could allow<br />

the two divisions to focus on their core product<br />

offerings and go-to-market strategies that are<br />

decidedly different between consumer products<br />

and the enterprise. The move could signal<br />

renewed focus and commitment by HP with<br />

respect PCs and Printers, while allowing the<br />

Enterprise group more flexibility to react for its<br />

own needs as well.<br />

Figure 4: Worldwide PC Shipments (in millions)<br />

Which division has more steam left?<br />

The Chinese major, Lenovo, has taken over HP<br />

as the company with the highest market share<br />

in the worldwide PC shipments. The worldwide<br />

PC shipment pie has stagnated at 75-85 million<br />

in the last two years. So, HP will have a hard<br />

time in improving the fortunes of its PC division,<br />

absent innovation in its value chain or the<br />

product itself.<br />

The printing business - HP’s most profitable<br />

division, accounting for a third of its profits –<br />

is a cash cow that has been helping the other<br />

divisions of the conglomerate. Its pre-tax profits<br />

have fallen by less than 7% compared to the<br />

other HP divisions where profits have fallen<br />

by half in the last three years. The low growth<br />

hardware business is likely to be valued at<br />

very low multiples compared to the enterprise<br />

division. This group may take most of its debt.<br />

The key investments would largely be organic<br />

to maintain the durability of the cash flow and<br />

the investors would be benefited largely by<br />

dividends. The caveat, of course, is the emerging<br />

PC shipment scenario in the near future.<br />

This leaves the other enterprise division debt<br />

free which may look for acquisitions. Targeted<br />

M&A was explicitly mentioned by Meg Whitman<br />

on the eve of the announcement of the split on<br />

Oct 6. Increased organic investments combined<br />

with targeted M&A are the way ahead for the<br />

enterprise division. The shareholders may be<br />

benefitted by share buybacks in this division as<br />

it gives leeway to the top management given<br />

the investment needs.<br />

Hence, in my opinion, the enterprise division<br />

is a better bet for investment given its healthy<br />

outlook, growth opportunities, and the<br />

competitive scenario in the software and cloud<br />

computing industry.<br />

NOVEMBER 2014