Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

24<br />

NIVESHAK<br />

Article Cover FinLife of the Story Month<br />

in the asset prices is halted at the resistance/<br />

support level. In double top reversal pattern<br />

the asset prices attempt to break the resistance<br />

levels twice after which downward trend in price<br />

movement pushes the prices lower. Similarly<br />

in double bottom reversal pattern prices try to<br />

break down below the support level, however<br />

has sustained in those levels by buying seen at<br />

the support level. After the two bounce-offs the<br />

asset prices starts moving in an upward trend.<br />

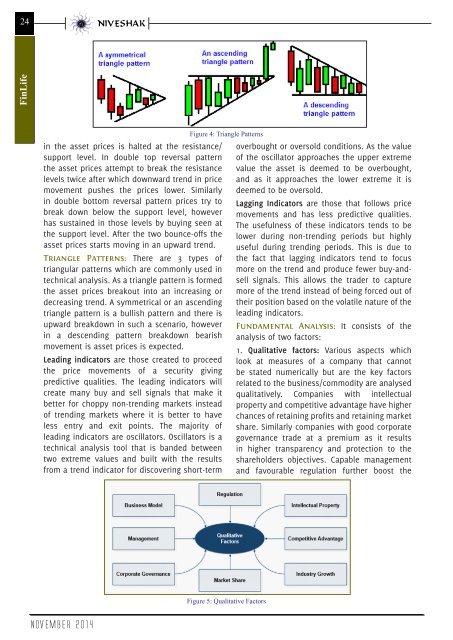

Triangle Patterns: There are 3 types of<br />

triangular patterns which are commonly used in<br />

technical analysis. As a triangle pattern is formed<br />

the asset prices breakout into an increasing or<br />

decreasing trend. A symmetrical or an ascending<br />

triangle pattern is a bullish pattern and there is<br />

upward breakdown in such a scenario, however<br />

in a descending pattern breakdown bearish<br />

movement is asset prices is expected.<br />

Leading indicators are those created to proceed<br />

the price movements of a security giving<br />

predictive qualities. The leading indicators will<br />

create many buy and sell signals that make it<br />

better for choppy non-trending markets instead<br />

of trending markets where it is better to have<br />

less entry and exit points. The majority of<br />

leading indicators are oscillators. Oscillators is a<br />

technical analysis tool that is banded between<br />

two extreme values and built with the results<br />

from a trend indicator for discovering short-term<br />

Figure 4: Triangle Patterns<br />

overbought or oversold conditions. As the value<br />

of the oscillator approaches the upper extreme<br />

value the asset is deemed to be overbought,<br />

and as it approaches the lower extreme it is<br />

deemed to be oversold.<br />

Lagging Indicators are those that follows price<br />

movements and has less predictive qualities.<br />

The usefulness of these indicators tends to be<br />

lower during non-trending periods but highly<br />

useful during trending periods. This is due to<br />

the fact that lagging indicators tend to focus<br />

more on the trend and produce fewer buy-andsell<br />

signals. This allows the trader to capture<br />

more of the trend instead of being forced out of<br />

their position based on the volatile nature of the<br />

leading indicators.<br />

Fundamental Analysis: It consists of the<br />

analysis of two factors:<br />

1. Qualitative factors: Various aspects which<br />

look at measures of a company that cannot<br />

be stated numerically but are the key factors<br />

related to the business/commodity are analysed<br />

qualitatively. Companies with intellectual<br />

property and competitive advantage have higher<br />

chances of retaining profits and retaining market<br />

share. Similarly companies with good corporate<br />

governance trade at a premium as it results<br />

in higher transparency and protection to the<br />

shareholders objectives. Capable management<br />

and favourable regulation further boost the<br />

Figure 5: Qualitative Factors<br />

NOVEMBER 2014