Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

NIVESHAK 23<br />

Article Cover FinLife of the Story Month<br />

volatile. A support level is a price level where<br />

the price tends to find support as it is going<br />

down. This means the price is more likely to<br />

“bounce” off this level rather than break<br />

through it. A resistance level is the opposite of a<br />

support level. It is where the price tends to find<br />

resistance as it is going up. This means the price<br />

is more likely to “bounce” off this level rather<br />

than break through it. However, once the price<br />

has passed this level, by an amount exceeding<br />

some noise, it is likely that it will continue rising<br />

until it finds another resistance level.<br />

Pivot Point for Current = High (previous period) +<br />

Low (previous period) + Close (previous period)<br />

Resistance 1 = (2 x Pivot Point) – Low (previous<br />

period)<br />

Support 1 = (2 x Pivot Point) – High (previous<br />

period)<br />

Resistance 2 = (Pivot Point – Support 1) +<br />

Resistance 1<br />

Support 2 = Pivot Point – (Resistance 1 – Support<br />

1)<br />

Resistance 3 = (Pivot Point – Support 2) +<br />

Resistance 2<br />

Support 3 = Pivot Point – (Resistance 2 – Support<br />

2)<br />

Various Chart patterns like Head and Shoulders,<br />

Cup and Handle, Double<br />

Tops and Bottom etc.<br />

are used to further<br />

analyse the trends<br />

in the prices. Based<br />

on the time frame of<br />

the charts (Hourly,<br />

Daily, monthly,<br />

Yearly) similar time<br />

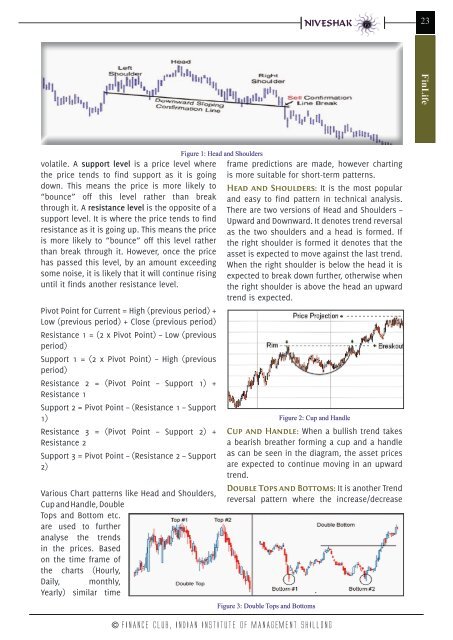

Figure 1: Head and Shoulders<br />

frame predictions are made, however charting<br />

is more suitable for short-term patterns.<br />

Head and Shoulders: It is the most popular<br />

and easy to find pattern in technical analysis.<br />

There are two versions of Head and Shoulders –<br />

Upward and Downward. It denotes trend reversal<br />

as the two shoulders and a head is formed. If<br />

the right shoulder is formed it denotes that the<br />

asset is expected to move against the last trend.<br />

When the right shoulder is below the head it is<br />

expected to break down further, otherwise when<br />

the right shoulder is above the head an upward<br />

trend is expected.<br />

Figure 2: Cup and Handle<br />

Cup and Handle: When a bullish trend takes<br />

a bearish breather forming a cup and a handle<br />

as can be seen in the diagram, the asset prices<br />

are expected to continue moving in an upward<br />

trend.<br />

Double Tops and Bottoms: It is another Trend<br />

reversal pattern where the increase/decrease<br />

Figure 3: Double Tops and Bottoms<br />

© FINANCE CLUB, INDIAN INSTITUTE Of MANAGEMENT SHILLONG