Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

NIVESHAK 27<br />

Cover Classroom Finsight Story<br />

investors would receive a tax free distribution<br />

of shares in the new company.<br />

This move marks a reversal for Meg Whitman, the<br />

former eBay boss who was roped in three years<br />

ago to turnaround the then ailing technology<br />

conglomerate. One of her first acts was to ditch<br />

the plan to shed the PC division laid out by her<br />

predecessor, Léo Apotheker, though she has<br />

since then left the option open for more radical<br />

actions to deal with HP’s problems.<br />

With growth stuttering in the last few years<br />

post the merger of HP with the then noted PC<br />

manufacturer, Compaq, and the onslaught of<br />

tablet computers leading to the shrinkage of<br />

revenue from PC division, Meg Whitman felt<br />

that this is the best time to divide the company<br />

to prepare the company for the next stage of<br />

growth.<br />

A glimpse of the financials of HP<br />

Based on last year’s revenues, both parts of<br />

HP would have ranked among the 50 largest<br />

US companies. HP’s PC and printer businesses<br />

produced revenues of $55.9bn in its last<br />

financial year, almost identical to the combined<br />

$55.7bn of its enterprise computing, services<br />

and software divisions.<br />

HP’s finances in FY2013:<br />

• Total revenue of $112.3 billion was down 7%<br />

year over year<br />

• Enterprise systems revenue of $28.2 billion fell<br />

5% year over year<br />

• Its operating margin increased from 13.9% to<br />

15.3%<br />

• Enterprise services revenue of $23.5 billion<br />

was down 8% year over year<br />

• Its operating margin fell from 6.9% to 2.9%<br />

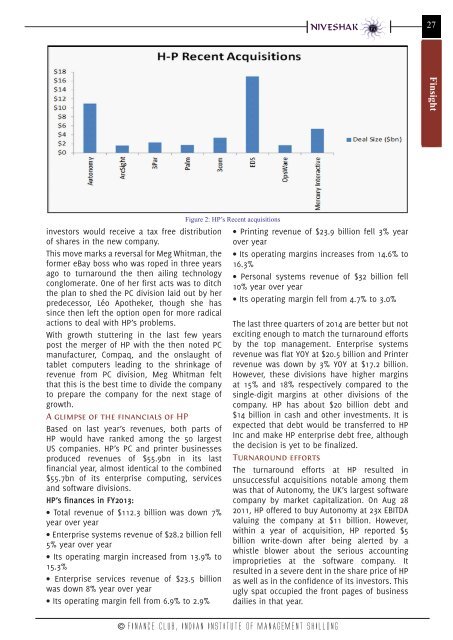

Figure 2: HP’s Recent acquisitions<br />

• Printing revenue of $23.9 billion fell 3% year<br />

over year<br />

• Its operating margins increases from 14.6% to<br />

16.3%<br />

• Personal systems revenue of $32 billion fell<br />

10% year over year<br />

• Its operating margin fell from 4.7% to 3.0%<br />

The last three quarters of 2014 are better but not<br />

exciting enough to match the turnaround efforts<br />

by the top management. Enterprise systems<br />

revenue was flat YOY at $20.5 billion and Printer<br />

revenue was down by 3% YOY at $17.2 billion.<br />

However, these divisions have higher margins<br />

at 15% and 18% respectively compared to the<br />

single-digit margins at other divisions of the<br />

company. HP has about $20 billion debt and<br />

$14 billion in cash and other investments. It is<br />

expected that debt would be transferred to HP<br />

Inc and make HP enterprise debt free, although<br />

the decision is yet to be finalized.<br />

Turnaround efforts<br />

The turnaround efforts at HP resulted in<br />

unsuccessful acquisitions notable among them<br />

was that of Autonomy, the UK’s largest software<br />

company by market capitalization. On Aug 28<br />

2011, HP offered to buy Autonomy at 23x EBITDA<br />

valuing the company at $11 billion. However,<br />

within a year of acquisition, HP reported $5<br />

billion write-down after being alerted by a<br />

whistle blower about the serious accounting<br />

improprieties at the software company. It<br />

resulted in a severe dent in the share price of HP<br />

as well as in the confidence of its investors. This<br />

ugly spat occupied the front pages of business<br />

dailies in that year.<br />

© FINANCE CLUB, INDIAN INSTITUTE OF MANAGEMENT SHILLONG