Annual Report 2012 - singapore land limited

Annual Report 2012 - singapore land limited

Annual Report 2012 - singapore land limited

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Singapore Land Limited - <strong>Annual</strong> <strong>Report</strong> <strong>2012</strong><br />

65<br />

NOTES TO THE FINANCIAL STATEMENTS<br />

For the fi nancial year ended 31 December <strong>2012</strong><br />

2. SIGNIFICANT ACCOUNTING POLICIES (continued)<br />

2.23 Share capital<br />

Ordinary shares are classifi ed as equity. Incremental costs directly attributable to the issuance of new ordinary<br />

shares are deducted against the share capital account.<br />

2.24 Dividends to Company’s shareholders<br />

Dividends to Company’s shareholders are recognised when the dividends are approved for payment.<br />

3. CRITICAL ACCOUNTING ESTIMATES, ASSUMPTIONS AND JUDGEMENTS<br />

Estimates, assumptions and judgements are continually evaluated and are based on historical experience and<br />

other factors, including expectations of future events that are believed to be reasonable under the circumstances.<br />

The Group on its own or in reliance on third party experts, applies estimates and judgements in the following<br />

key areas:<br />

(i)<br />

(ii)<br />

(iii)<br />

the determination of investment property values by independent professional valuers (note 2.8). The carrying<br />

amount of investment properties is disclosed in note 16;<br />

the assessment of the stage of completion, extent of the construction costs incurred and the estimated total<br />

construction costs of properties held for sale under development (note 2.2(b)) and allowance for foreseeable<br />

losses (note 2.7). The carrying amount of properties held for sale under development is disclosed in note 19;<br />

the assessment of impairment of investments in associated companies and joint ventures, property, plant<br />

and equipment (note 2.10). The carrying amounts of invesments in associated companies and joint ventures,<br />

property, plant and equipment are disclosed in notes 13, 14 and 17 respectively; and<br />

(iv)<br />

the assessment of adequacy of provision for income taxes (note 2.17). The carrying amounts of current<br />

income tax and deferred income tax are disclosed in notes 8 and 23 respectively.<br />

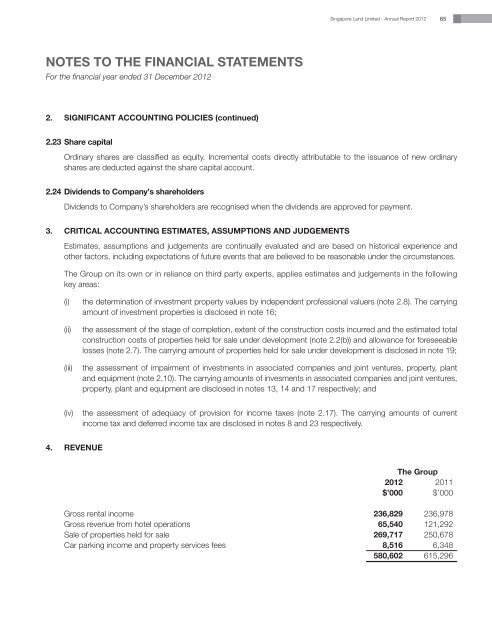

4. REVENUE<br />

The Group<br />

<strong>2012</strong> 2011<br />

$’000 $’000<br />

Gross rental income 236,829 236,978<br />

Gross revenue from hotel operations 65,540 121,292<br />

Sale of properties held for sale 269,717 250,678<br />

Car parking income and property services fees 8,516 6,348<br />

580,602 615,296