Strategies for Executive Compensation: Design and Tax Issues for a ...

Strategies for Executive Compensation: Design and Tax Issues for a ...

Strategies for Executive Compensation: Design and Tax Issues for a ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

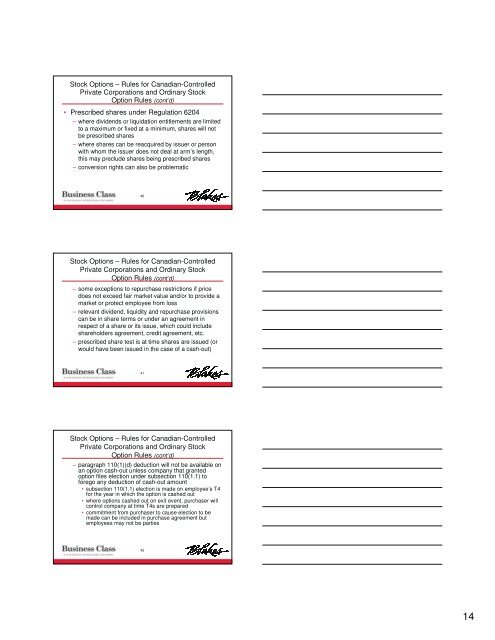

Stock Options – Rules <strong>for</strong> Canadian-Controlled<br />

Private Corporations <strong>and</strong> Ordinary Stock<br />

Option Rules (cont’d)<br />

• Prescribed shares under Regulation 6204<br />

– where dividends or liquidation entitlements are limited<br />

to a maximum or fixed at a minimum, shares will not<br />

be prescribed shares<br />

– where shares can be reacquired by issuer or person<br />

with whom the issuer does not deal at arm’s length,<br />

this may preclude shares being prescribed shares<br />

– conversion rights can also be problematic<br />

40<br />

Stock Options – Rules <strong>for</strong> Canadian-Controlled<br />

Private Corporations <strong>and</strong> Ordinary Stock<br />

Option Rules (cont’d)<br />

– some exceptions to repurchase restrictions if price<br />

does not exceed fair market value <strong>and</strong>/or to provide a<br />

market or protect employee from loss<br />

– relevant dividend, liquidity <strong>and</strong> repurchase provisions<br />

can be in share terms or under an agreement in<br />

respect of a share or its issue, which could include<br />

shareholders agreement, credit agreement, etc.<br />

– prescribed share test is at time shares are issued (or<br />

would have been issued in the case of a cash-out)<br />

41<br />

Stock Options – Rules <strong>for</strong> Canadian-Controlled<br />

Private Corporations <strong>and</strong> Ordinary Stock<br />

Option Rules (cont’d)<br />

– paragraph 110(1)(d) deduction will not be available on<br />

an option cash-out unless company that granted<br />

option files election under subsection 110(1.1) to<br />

<strong>for</strong>ego any deduction of cash-out amount<br />

• subsection 110(1.1) election is made on employee’s T4<br />

<strong>for</strong> the year in which the option is cashed out<br />

• where options cashed out on exit event, purchaser will<br />

control company at time T4s are prepared<br />

• commitment from purchaser to cause election to be<br />

made can be included in purchase agreement but<br />

employees may not be parties<br />

42<br />

14