Strategies for Executive Compensation: Design and Tax Issues for a ...

Strategies for Executive Compensation: Design and Tax Issues for a ...

Strategies for Executive Compensation: Design and Tax Issues for a ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

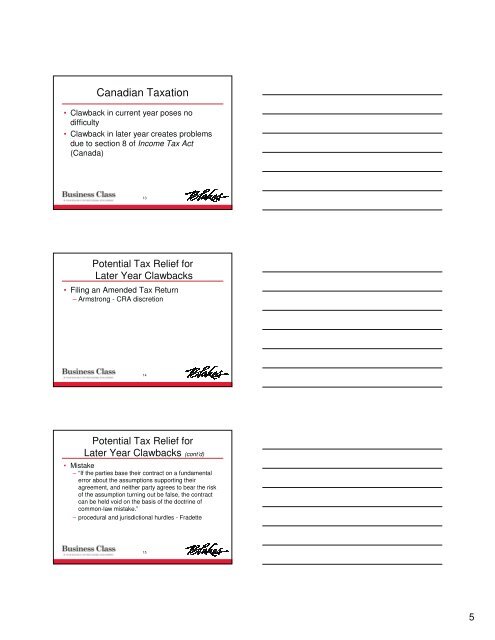

Canadian <strong>Tax</strong>ation<br />

• Clawback in current year poses no<br />

difficulty<br />

• Clawback in later year creates problems<br />

due to section 8 of Income <strong>Tax</strong> Act<br />

(Canada)<br />

13<br />

Potential <strong>Tax</strong> Relief <strong>for</strong><br />

Later Year Clawbacks<br />

• Filing an Amended <strong>Tax</strong> Return<br />

– Armstrong - CRA discretion<br />

14<br />

Potential <strong>Tax</strong> Relief <strong>for</strong><br />

Later Year Clawbacks (cont’d)<br />

• Mistake<br />

– “If the parties base their contract on a fundamental<br />

error about the assumptions supporting their<br />

agreement, <strong>and</strong> neither party agrees to bear the risk<br />

of the assumption turning out be false, the contract<br />

can be held void on the basis of the doctrine of<br />

common-law mistake.”<br />

– procedural <strong>and</strong> jurisdictional hurdles - Fradette<br />

15<br />

5