Strategies for Executive Compensation: Design and Tax Issues for a ...

Strategies for Executive Compensation: Design and Tax Issues for a ...

Strategies for Executive Compensation: Design and Tax Issues for a ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

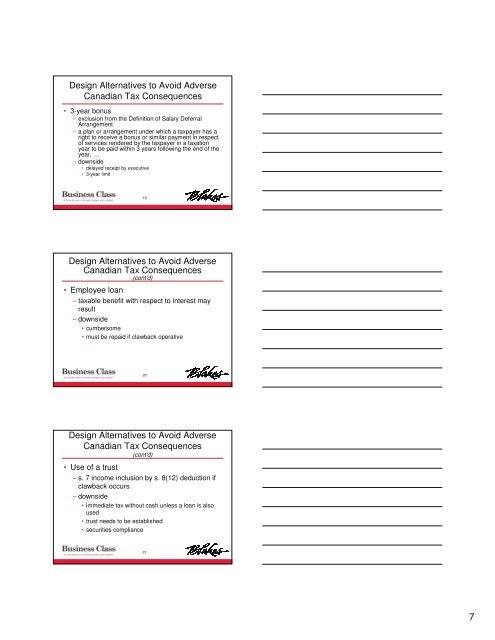

<strong>Design</strong> Alternatives to Avoid Adverse<br />

Canadian <strong>Tax</strong> Consequences<br />

• 3-year bonus<br />

– exclusion from the Definition of Salary Deferral<br />

Arrangement<br />

– a plan or arrangement under which a taxpayer has a<br />

right to receive a bonus or similar payment in respect<br />

of services rendered by the taxpayer in a taxation<br />

year to be paid within 3 years following the end of the<br />

year, …<br />

– downside<br />

• delayed receipt by executive<br />

• 3-year limit<br />

19<br />

<strong>Design</strong> Alternatives to Avoid Adverse<br />

Canadian <strong>Tax</strong> Consequences<br />

(cont’d)<br />

• Employee loan<br />

– taxable benefit with respect to interest may<br />

result<br />

– downside<br />

• cumbersome<br />

• must be repaid if clawback operative<br />

20<br />

<strong>Design</strong> Alternatives to Avoid Adverse<br />

Canadian <strong>Tax</strong> Consequences<br />

(cont’d)<br />

• Use of a trust<br />

– s. 7 income inclusion by s. 8(12) deduction if<br />

clawback occurs<br />

– downside<br />

• immediate tax without cash unless a loan is also<br />

used<br />

• trust needs to be established<br />

• securities compliance<br />

21<br />

7