Strategies for Executive Compensation: Design and Tax Issues for a ...

Strategies for Executive Compensation: Design and Tax Issues for a ...

Strategies for Executive Compensation: Design and Tax Issues for a ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

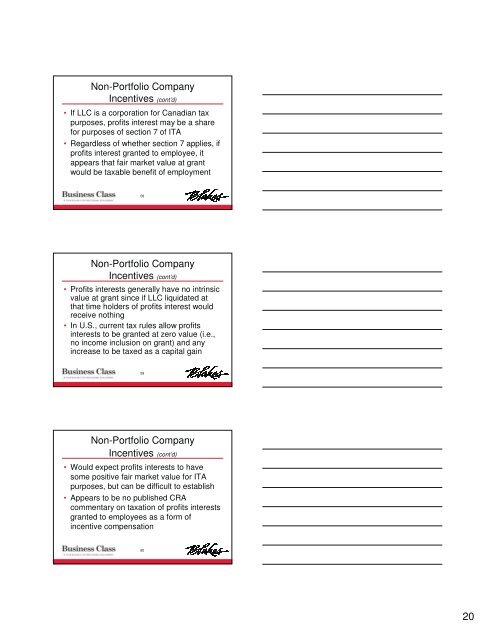

Non-Portfolio Company<br />

Incentives (cont’d)<br />

• If LLC is a corporation <strong>for</strong> Canadian tax<br />

purposes, profits interest may be a share<br />

<strong>for</strong> purposes of section 7 of ITA<br />

• Regardless of whether section 7 applies, if<br />

profits interest granted to employee, it<br />

appears that fair market value at grant<br />

would be taxable benefit of employment<br />

58<br />

Non-Portfolio Company<br />

Incentives (cont’d)<br />

• Profits interests generally have no intrinsic<br />

value at grant since if LLC liquidated at<br />

that time holders of profits interest would<br />

receive nothing<br />

• In U.S., current tax rules allow profits<br />

interests to be granted at zero value (i.e.,<br />

no income inclusion on grant) <strong>and</strong> any<br />

increase to be taxed as a capital gain<br />

59<br />

Non-Portfolio Company<br />

Incentives (cont’d)<br />

• Would expect profits interests to have<br />

some positive fair market value <strong>for</strong> ITA<br />

purposes, but can be difficult to establish<br />

• Appears to be no published CRA<br />

commentary on taxation of profits interests<br />

granted to employees as a <strong>for</strong>m of<br />

incentive compensation<br />

60<br />

20