City and County of Denver Municipal Airport System ANNUAL ...

City and County of Denver Municipal Airport System ANNUAL ...

City and County of Denver Municipal Airport System ANNUAL ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

<strong>City</strong> <strong>and</strong> <strong>County</strong> <strong>of</strong> <strong>Denver</strong><br />

<strong>Municipal</strong> <strong>Airport</strong> <strong>System</strong><br />

NOTES TO FINANCIAL STATEMENTS<br />

December 31, 2010 <strong>and</strong> 2009<br />

economic resources measurement focus <strong>and</strong> the accrual basis <strong>of</strong> accounting (see note 22 for the description <strong>of</strong><br />

the impact <strong>of</strong> this st<strong>and</strong>ard.)<br />

(b)<br />

(c)<br />

(d)<br />

(e)<br />

Cash <strong>and</strong> Cash Equivalents<br />

Cash <strong>and</strong> cash equivalents, which the <strong>City</strong> manages, consist principally <strong>of</strong> U.S. Treasury securities, U.S. agency<br />

securities, <strong>and</strong> commercial paper with original maturities <strong>of</strong> less than 90 days.<br />

Investments<br />

Inventories<br />

Investments, which the <strong>City</strong> manages, are reported at fair value, which is primarily determined based on quoted<br />

market prices at December 31, 2010 <strong>and</strong> 2009. The <strong>Airport</strong> <strong>System</strong>’s investments are maintained in pools at the<br />

<strong>City</strong> <strong>and</strong> include U.S. Treasury securities, U.S. Agency securities, <strong>and</strong> commercial paper.<br />

Inventories consist <strong>of</strong> materials <strong>and</strong> supplies which have been valued at the lower <strong>of</strong> cost (weighted average<br />

cost method) or market.<br />

Capital Assets<br />

Capital assets are recorded at historical cost <strong>and</strong> consist <strong>of</strong> buildings, roadways, airfield improvements,<br />

machinery <strong>and</strong> equipment, l<strong>and</strong>, <strong>and</strong> l<strong>and</strong> rights at <strong>Denver</strong> International. Donated capital assets are reported at<br />

their estimated fair value at the time <strong>of</strong> acquisition plus ancillary charges, if any. Repairs <strong>and</strong> maintenance are<br />

charged to operations as incurred, unless they have the effect <strong>of</strong> improving <strong>and</strong> extending the life <strong>of</strong> an asset, in<br />

which case they are capitalized as part <strong>of</strong> the cost <strong>of</strong> the asset. Costs associated with ongoing construction<br />

activities <strong>of</strong> <strong>Denver</strong> International are included in construction in progress. Interest incurred during the<br />

construction phase is reflected in the capitalized value <strong>of</strong> the asset constructed, net <strong>of</strong> interest earned on the<br />

invested proceeds over the same period. The capitalized interest incurred for 2010 <strong>and</strong> 2009 was $3,370,616<br />

<strong>and</strong> $2,035,448, respectively.<br />

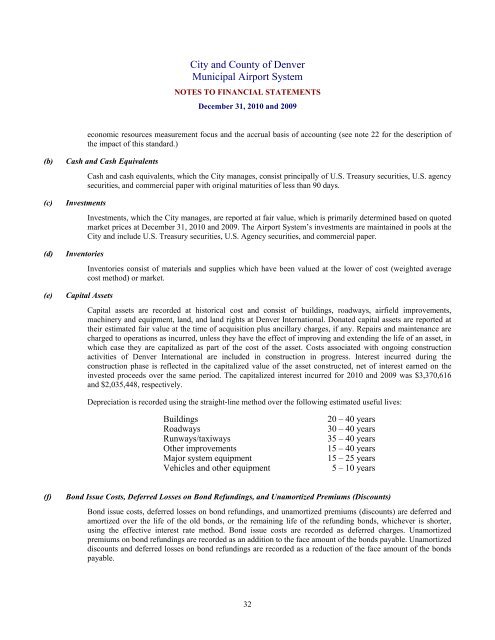

Depreciation is recorded using the straight-line method over the following estimated useful lives:<br />

Buildings<br />

Roadways<br />

Runways/taxiways<br />

Other improvements<br />

Major system equipment<br />

Vehicles <strong>and</strong> other equipment<br />

20 – 40 years<br />

30 – 40 years<br />

35 – 40 years<br />

15 – 40 years<br />

15 – 25 years<br />

5 – 10 years<br />

(f)<br />

Bond Issue Costs, Deferred Losses on Bond Refundings, <strong>and</strong> Unamortized Premiums (Discounts)<br />

Bond issue costs, deferred losses on bond refundings, <strong>and</strong> unamortized premiums (discounts) are deferred <strong>and</strong><br />

amortized over the life <strong>of</strong> the old bonds, or the remaining life <strong>of</strong> the refunding bonds, whichever is shorter,<br />

using the effective interest rate method. Bond issue costs are recorded as deferred charges. Unamortized<br />

premiums on bond refundings are recorded as an addition to the face amount <strong>of</strong> the bonds payable. Unamortized<br />

discounts <strong>and</strong> deferred losses on bond refundings are recorded as a reduction <strong>of</strong> the face amount <strong>of</strong> the bonds<br />

payable.<br />

32