City and County of Denver Municipal Airport System ANNUAL ...

City and County of Denver Municipal Airport System ANNUAL ...

City and County of Denver Municipal Airport System ANNUAL ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

<strong>City</strong> <strong>and</strong> <strong>County</strong> <strong>of</strong> <strong>Denver</strong><br />

<strong>Municipal</strong> <strong>Airport</strong> <strong>System</strong><br />

NOTES TO FINANCIAL STATEMENTS<br />

December 31, 2010 <strong>and</strong> 2009<br />

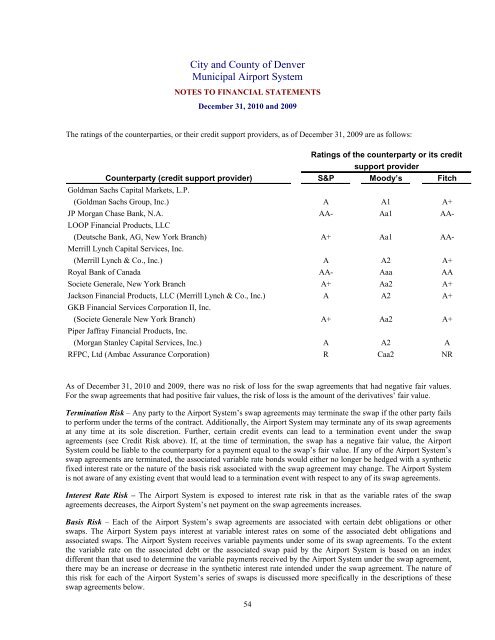

The ratings <strong>of</strong> the counterparties, or their credit support providers, as <strong>of</strong> December 31, 2009 are as follows:<br />

Ratings <strong>of</strong> the counterparty or its credit<br />

support provider<br />

Counterparty (credit support provider) S&P Moody’s Fitch<br />

Goldman Sachs Capital Markets, L.P.<br />

(Goldman Sachs Group, Inc.) A A1 A+<br />

JP Morgan Chase Bank, N.A. AA- Aa1 AA-<br />

LOOP Financial Products, LLC<br />

(Deutsche Bank, AG, New York Branch) A+ Aa1 AA-<br />

Merrill Lynch Capital Services, Inc.<br />

(Merrill Lynch & Co., Inc.) A A2 A+<br />

Royal Bank <strong>of</strong> Canada AA- Aaa AA<br />

Societe Generale, New York Branch A+ Aa2 A+<br />

Jackson Financial Products, LLC (Merrill Lynch & Co., Inc.) A A2 A+<br />

GKB Financial Services Corporation II, Inc.<br />

(Societe Generale New York Branch) A+ Aa2 A+<br />

Piper Jaffray Financial Products, Inc.<br />

(Morgan Stanley Capital Services, Inc.) A A2 A<br />

RFPC, Ltd (Ambac Assurance Corporation) R Caa2 NR<br />

As <strong>of</strong> December 31, 2010 <strong>and</strong> 2009, there was no risk <strong>of</strong> loss for the swap agreements that had negative fair values.<br />

For the swap agreements that had positive fair values, the risk <strong>of</strong> loss is the amount <strong>of</strong> the derivatives’ fair value.<br />

Termination Risk – Any party to the <strong>Airport</strong> <strong>System</strong>’s swap agreements may terminate the swap if the other party fails<br />

to perform under the terms <strong>of</strong> the contract. Additionally, the <strong>Airport</strong> <strong>System</strong> may terminate any <strong>of</strong> its swap agreements<br />

at any time at its sole discretion. Further, certain credit events can lead to a termination event under the swap<br />

agreements (see Credit Risk above). If, at the time <strong>of</strong> termination, the swap has a negative fair value, the <strong>Airport</strong><br />

<strong>System</strong> could be liable to the counterparty for a payment equal to the swap’s fair value. If any <strong>of</strong> the <strong>Airport</strong> <strong>System</strong>’s<br />

swap agreements are terminated, the associated variable rate bonds would either no longer be hedged with a synthetic<br />

fixed interest rate or the nature <strong>of</strong> the basis risk associated with the swap agreement may change. The <strong>Airport</strong> <strong>System</strong><br />

is not aware <strong>of</strong> any existing event that would lead to a termination event with respect to any <strong>of</strong> its swap agreements.<br />

Interest Rate Risk – The <strong>Airport</strong> <strong>System</strong> is exposed to interest rate risk in that as the variable rates <strong>of</strong> the swap<br />

agreements decreases, the <strong>Airport</strong> <strong>System</strong>’s net payment on the swap agreements increases.<br />

Basis Risk – Each <strong>of</strong> the <strong>Airport</strong> <strong>System</strong>’s swap agreements are associated with certain debt obligations or other<br />

swaps. The <strong>Airport</strong> <strong>System</strong> pays interest at variable interest rates on some <strong>of</strong> the associated debt obligations <strong>and</strong><br />

associated swaps. The <strong>Airport</strong> <strong>System</strong> receives variable payments under some <strong>of</strong> its swap agreements. To the extent<br />

the variable rate on the associated debt or the associated swap paid by the <strong>Airport</strong> <strong>System</strong> is based on an index<br />

different than that used to determine the variable payments received by the <strong>Airport</strong> <strong>System</strong> under the swap agreement,<br />

there may be an increase or decrease in the synthetic interest rate intended under the swap agreement. The nature <strong>of</strong><br />

this risk for each <strong>of</strong> the <strong>Airport</strong> <strong>System</strong>’s series <strong>of</strong> swaps is discussed more specifically in the descriptions <strong>of</strong> these<br />

swap agreements below.<br />

54