City and County of Denver Municipal Airport System ANNUAL ...

City and County of Denver Municipal Airport System ANNUAL ...

City and County of Denver Municipal Airport System ANNUAL ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

<strong>City</strong> <strong>and</strong> <strong>County</strong> <strong>of</strong> <strong>Denver</strong><br />

<strong>Municipal</strong> <strong>Airport</strong> <strong>System</strong><br />

NOTES TO FINANCIAL STATEMENTS<br />

December 31, 2010 <strong>and</strong> 2009<br />

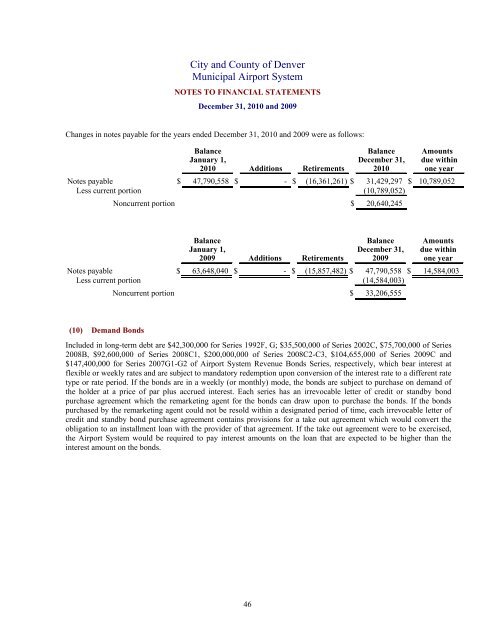

Changes in notes payable for the years ended December 31, 2010 <strong>and</strong> 2009 were as follows:<br />

Balance Balance Amounts<br />

January 1, December 31, due within<br />

2010 Additions Retirements 2010 one year<br />

Notes payable $ 47,790,558 $ - $ (16,361,261) $ 31,429,297 $ 10,789,052<br />

Less current portion (10,789,052)<br />

Noncurrent portion $ 20,640,245<br />

Balance Balance Amounts<br />

January 1, December 31, due within<br />

2009 Additions Retirements 2009 one year<br />

Notes payable $ 63,648,040 $ - $ (15,857,482) $ 47,790,558 $ 14,584,003<br />

Less current portion (14,584,003)<br />

Noncurrent portion $ 33,206,555<br />

(10) Dem<strong>and</strong> Bonds<br />

Included in long-term debt are $42,300,000 for Series 1992F, G; $35,500,000 <strong>of</strong> Series 2002C, $75,700,000 <strong>of</strong> Series<br />

2008B, $92,600,000 <strong>of</strong> Series 2008C1, $200,000,000 <strong>of</strong> Series 2008C2-C3, $104,655,000 <strong>of</strong> Series 2009C <strong>and</strong><br />

$147,400,000 for Series 2007G1-G2 <strong>of</strong> <strong>Airport</strong> <strong>System</strong> Revenue Bonds Series, respectively, which bear interest at<br />

flexible or weekly rates <strong>and</strong> are subject to m<strong>and</strong>atory redemption upon conversion <strong>of</strong> the interest rate to a different rate<br />

type or rate period. If the bonds are in a weekly (or monthly) mode, the bonds are subject to purchase on dem<strong>and</strong> <strong>of</strong><br />

the holder at a price <strong>of</strong> par plus accrued interest. Each series has an irrevocable letter <strong>of</strong> credit or st<strong>and</strong>by bond<br />

purchase agreement which the remarketing agent for the bonds can draw upon to purchase the bonds. If the bonds<br />

purchased by the remarketing agent could not be resold within a designated period <strong>of</strong> time, each irrevocable letter <strong>of</strong><br />

credit <strong>and</strong> st<strong>and</strong>by bond purchase agreement contains provisions for a take out agreement which would convert the<br />

obligation to an installment loan with the provider <strong>of</strong> that agreement. If the take out agreement were to be exercised,<br />

the <strong>Airport</strong> <strong>System</strong> would be required to pay interest amounts on the loan that are expected to be higher than the<br />

interest amount on the bonds.<br />

46