City and County of Denver Municipal Airport System ANNUAL ...

City and County of Denver Municipal Airport System ANNUAL ...

City and County of Denver Municipal Airport System ANNUAL ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

<strong>City</strong> <strong>and</strong> <strong>County</strong> <strong>of</strong> <strong>Denver</strong><br />

<strong>Municipal</strong> <strong>Airport</strong> <strong>System</strong><br />

NOTES TO FINANCIAL STATEMENTS<br />

December 31, 2010 <strong>and</strong> 2009<br />

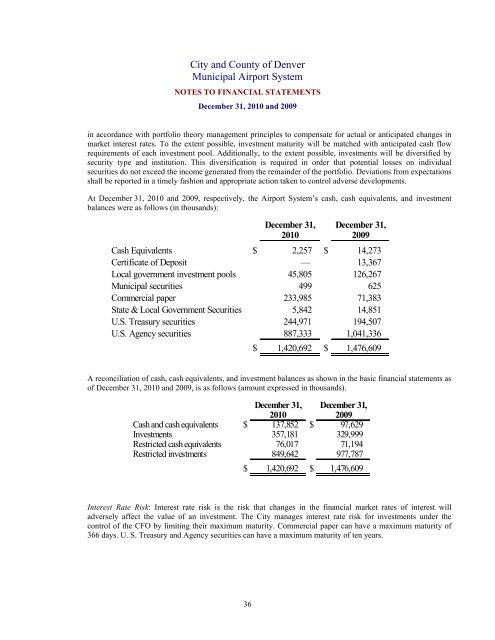

in accordance with portfolio theory management principles to compensate for actual or anticipated changes in<br />

market interest rates. To the extent possible, investment maturity will be matched with anticipated cash flow<br />

requirements <strong>of</strong> each investment pool. Additionally, to the extent possible, investments will be diversified by<br />

security type <strong>and</strong> institution. This diversification is required in order that potential losses on individual<br />

securities do not exceed the income generated from the remainder <strong>of</strong> the portfolio. Deviations from expectations<br />

shall be reported in a timely fashion <strong>and</strong> appropriate action taken to control adverse developments.<br />

At December 31, 2010 <strong>and</strong> 2009, respectively, the <strong>Airport</strong> <strong>System</strong>’s cash, cash equivalents, <strong>and</strong> investment<br />

balances were as follows (in thous<strong>and</strong>s):<br />

December 31, December 31,<br />

2010 2009<br />

Cash Equivalents $ 2,257 $ 14,273<br />

Certificate <strong>of</strong> Deposit — 13,367<br />

Local government investment pools 45,805 126,267<br />

<strong>Municipal</strong> securities 499 625<br />

Commercial paper 233,985 71,383<br />

State & Local Government Securities 5,842 14,851<br />

U.S. Treasury securities 244,971 194,507<br />

U.S. Agency securities 887,333 1,041,336<br />

$ 1,420,692 $ 1,476,609<br />

A reconciliation <strong>of</strong> cash, cash equivalents, <strong>and</strong> investment balances as shown in the basic financial statements as<br />

<strong>of</strong> December 31, 2010 <strong>and</strong> 2009, is as follows (amount expressed in thous<strong>and</strong>s).<br />

December 31, December 31,<br />

2010 2009<br />

Cash <strong>and</strong> cash equivalents $ 137,852 $ 97,629<br />

Investments 357,181 329,999<br />

Restricted cash equivalents 76,017 71,194<br />

Restricted investments 849,642 977,787<br />

$ 1,420,692 $ 1,476,609<br />

Interest Rate Risk: Interest rate risk is the risk that changes in the financial market rates <strong>of</strong> interest will<br />

adversely affect the value <strong>of</strong> an investment. The <strong>City</strong> manages interest rate risk for investments under the<br />

control <strong>of</strong> the CFO by limiting their maximum maturity. Commercial paper can have a maximum maturity <strong>of</strong><br />

366 days. U. S. Treasury <strong>and</strong> Agency securities can have a maximum maturity <strong>of</strong> ten years.<br />

36