annual report 2011

annual report 2011

annual report 2011

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

IOOF | <strong>annual</strong> <strong>report</strong> <strong>2011</strong><br />

Notes to the financial statements (cont’d)<br />

For the year ended 30 June <strong>2011</strong><br />

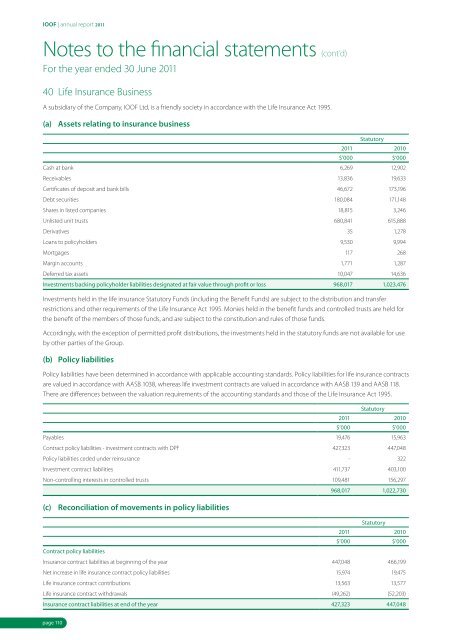

40 Life Insurance Business<br />

A subsidiary of the Company, IOOF Ltd, is a friendly society in accordance with the Life Insurance Act 1995.<br />

(a) Assets relating to insurance business<br />

Statutory<br />

<strong>2011</strong> 2010<br />

$’000 $’000<br />

Cash at bank 6,269 12,902<br />

Receivables 13,836 19,633<br />

Certificates of deposit and bank bills 46,672 173,196<br />

Debt securities 180,084 171,148<br />

Shares in listed companies 18,815 3,246<br />

Unlisted unit trusts 680,841 615,888<br />

Derivatives 35 1,278<br />

Loans to policyholders 9,530 9,994<br />

Mortgages 117 268<br />

Margin accounts 1,771 1,287<br />

Deferred tax assets 10,047 14,636<br />

Investments backing policyholder liabilities designated at fair value through profit or loss 968,017 1,023,476<br />

Investments held in the life insurance Statutory Funds (including the Benefit Funds) are subject to the distribution and transfer<br />

restrictions and other requirements of the Life Insurance Act 1995. Monies held in the benefit funds and controlled trusts are held for<br />

the benefit of the members of those funds, and are subject to the constitution and rules of those funds.<br />

Accordingly, with the exception of permitted profit distributions, the investments held in the statutory funds are not available for use<br />

by other parties of the Group.<br />

(b) Policy liabilities<br />

Policy liabilities have been determined in accordance with applicable accounting standards. Policy liabilities for life insurance contracts<br />

are valued in accordance with AASB 1038, whereas life investment contracts are valued in accordance with AASB 139 and AASB 118.<br />

There are differences between the valuation requirements of the accounting standards and those of the Life Insurance Act 1995.<br />

Statutory<br />

<strong>2011</strong> 2010<br />

$’000 $’000<br />

Payables 19,476 15,963<br />

Contract policy liabilities - investment contracts with DPF 427,323 447,048<br />

Policy liabilities ceded under reinsurance - 322<br />

Investment contract liabilities 411,737 403,100<br />

Non-controlling interests in controlled trusts 109,481 156,297<br />

968,017 1,022,730<br />

(c) Reconciliation of movements in policy liabilities<br />

Statutory<br />

<strong>2011</strong> 2010<br />

$’000 $’000<br />

Contract policy liabilities<br />

Insurance contract liabilities at beginning of the year 447,048 466,199<br />

Net increase in life insurance contract policy liabilities 15,974 19,475<br />

Life insurance contract contributions 13,563 13,577<br />

Life insurance contract withdrawals (49,262) (52,203)<br />

Insurance contract liabilities at end of the year 427,323 447,048<br />

page 110