Download - Tenaga Nasional Berhad

Download - Tenaga Nasional Berhad

Download - Tenaga Nasional Berhad

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

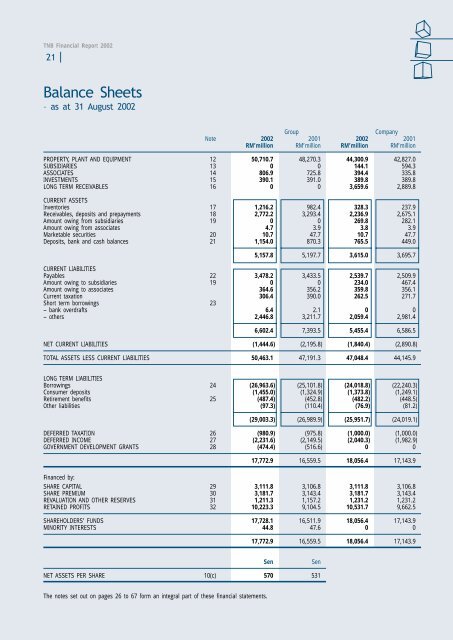

TNB Financial Report 2002<br />

21<br />

Balance Sheets<br />

– as at 31 August 2002<br />

Group<br />

Company<br />

Note 2002 2001 2002 2001<br />

RM’million RM’million RM’million RM’million<br />

PROPERTY, PLANT AND EQUIPMENT 12 50,710.7 48,270.3 44,300.9 42,827.0<br />

SUBSIDIARIES 13 0 0 144.1 594.3<br />

ASSOCIATES 14 806.9 725.8 394.4 335.8<br />

INVESTMENTS 15 390.1 391.0 389.8 389.8<br />

LONG TERM RECEIVABLES 16 0 0 3,659.6 2,889.8<br />

CURRENT ASSETS<br />

Inventories 17 1,216.2 982.4 328.3 237.9<br />

Receivables, deposits and prepayments 18 2,772.2 3,293.4 2,236.9 2,675.1<br />

Amount owing from subsidiaries 19 0 0 269.8 282.1<br />

Amount owing from associates 4.7 3.9 3.8 3.9<br />

Marketable securities 20 10.7 47.7 10.7 47.7<br />

Deposits, bank and cash balances 21 1,154.0 870.3 765.5 449.0<br />

5,157.8 5,197.7 3,615.0 3,695.7<br />

CURRENT LIABILITIES<br />

Payables 22 3,478.2 3,433.5 2,539.7 2,509.9<br />

Amount owing to subsidiaries 19 0 0 234.0 467.4<br />

Amount owing to associates 364.6 356.2 359.8 356.1<br />

Current taxation 306.4 390.0 262.5 271.7<br />

Short term borrowings 23<br />

– bank overdrafts 6.4 2.1 0 0<br />

– others 2,446.8 3,211.7 2,059.4 2,981.4<br />

6,602.4 7,393.5 5,455.4 6,586.5<br />

NET CURRENT LIABILITIES (1,444.6) (2,195.8) (1,840.4) (2,890.8)<br />

TOTAL ASSETS LESS CURRENT LIABILITIES 50,463.1 47,191.3 47,048.4 44,145.9<br />

LONG TERM LIABILITIES<br />

Borrowings 24 (26,963.6) (25,101.8) (24,018.8) (22,240.3)<br />

Consumer deposits (1,455.0) (1,324.9) (1,373.8) (1,249.1)<br />

Retirement benefits 25 (487.4) (452.8) (482.2) (448.5)<br />

Other liabilities (97.3) (110.4) (76.9) (81.2)<br />

(29,003.3) (26,989.9) (25,951.7) (24,019.1)<br />

DEFERRED TAXATION 26 (980.9) (975.8) (1,000.0) (1,000.0)<br />

DEFERRED INCOME 27 (2,231.6) (2,149.5) (2,040.3) (1,982.9)<br />

GOVERNMENT DEVELOPMENT GRANTS 28 (474.4) (516.6) 0 0<br />

17,772.9 16,559.5 18,056.4 17,143.9<br />

Financed by:<br />

SHARE CAPITAL 29 3,111.8 3,106.8 3,111.8 3,106.8<br />

SHARE PREMIUM 30 3,181.7 3,143.4 3,181.7 3,143.4<br />

REVALUATION AND OTHER RESERVES 31 1,211.3 1,157.2 1,231.2 1,231.2<br />

RETAINED PROFITS 32 10,223.3 9,104.5 10,531.7 9,662.5<br />

SHAREHOLDERS’ FUNDS 17,728.1 16,511.9 18,056.4 17,143.9<br />

MINORITY INTERESTS 44.8 47.6 0 0<br />

17,772.9 16,559.5 18,056.4 17,143.9<br />

Sen<br />

Sen<br />

NET ASSETS PER SHARE 10(c) 570 531<br />

The notes set out on pages 26 to 67 form an integral part of these financial statements.