Download - Tenaga Nasional Berhad

Download - Tenaga Nasional Berhad

Download - Tenaga Nasional Berhad

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

TNB Financial Report 2002<br />

55<br />

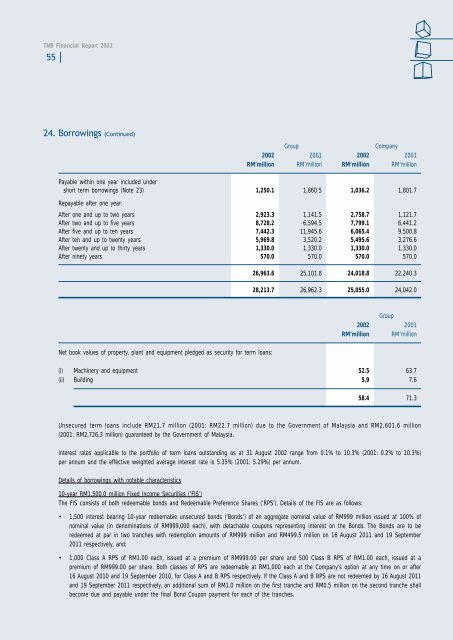

24. Borrowings (Continued)<br />

Group<br />

Company<br />

2002 2001 2002 2001<br />

RM’million RM’million RM’million RM’million<br />

Payable within one year included under<br />

short term borrowings (Note 23) 1,250.1 1,860.5 1,036.2 1,801.7<br />

Repayable after one year:<br />

After one and up to two years 2,923.3 1,141.5 2,758.7 1,121.7<br />

After two and up to five years 8,728.2 6,594.5 7,799.1 6,441.2<br />

After five and up to ten years 7,442.3 11,945.6 6,065.4 9,500.8<br />

After ten and up to twenty years 5,969.8 3,520.2 5,495.6 3,276.6<br />

After twenty and up to thirty years 1,330.0 1,330.0 1,330.0 1,330.0<br />

After ninety years 570.0 570.0 570.0 570.0<br />

26,963.6 25,101.8 24,018.8 22,240.3<br />

28,213.7 26,962.3 25,055.0 24,042.0<br />

Group<br />

2002 2001<br />

RM’million RM’million<br />

Net book values of property, plant and equipment pledged as security for term loans:<br />

(i) Machinery and equipment 52.5 63.7<br />

(ii) Building 5.9 7.6<br />

58.4 71.3<br />

Unsecured term loans include RM21.7 million (2001: RM22.7 million) due to the Government of Malaysia and RM2,601.6 million<br />

(2001: RM2,726.3 million) guaranteed by the Government of Malaysia.<br />

Interest rates applicable to the portfolio of term loans outstanding as at 31 August 2002 range from 0.1% to 10.3% (2001: 0.2% to 10.3%)<br />

per annum and the effective weighted average interest rate is 5.35% (2001: 5.29%) per annum.<br />

Details of borrowings with notable characteristics<br />

10-year RM1,500.0 million Fixed Income Securities (‘FIS’)<br />

The FIS consists of both redeemable bonds and Redeemable Preference Shares (‘RPS’). Details of the FIS are as follows:<br />

• 1,500 interest bearing 10-year redeemable unsecured bonds (‘Bonds’) of an aggregate nominal value of RM999 million issued at 100% of<br />

nominal value (in denominations of RM999,000 each), with detachable coupons representing interest on the Bonds. The Bonds are to be<br />

redeemed at par in two tranches with redemption amounts of RM999 million and RM499.5 million on 16 August 2011 and 19 September<br />

2011 respectively, and;<br />

• 1,000 Class A RPS of RM1.00 each, issued at a premium of RM999.00 per share and 500 Class B RPS of RM1.00 each, issued at a<br />

premium of RM999.00 per share. Both classes of RPS are redeemable at RM1,000 each at the Company’s option at any time on or after<br />

16 August 2010 and 19 September 2010, for Class A and B RPS respectively. If the Class A and B RPS are not redeemed by 16 August 2011<br />

and 19 September 2011 respectively, an additional sum of RM1.0 million on the first tranche and RM0.5 million on the second tranche shall<br />

become due and payable under the final Bond Coupon payment for each of the tranches.