Download - Tenaga Nasional Berhad

Download - Tenaga Nasional Berhad

Download - Tenaga Nasional Berhad

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

TNB Financial Report 2002<br />

63<br />

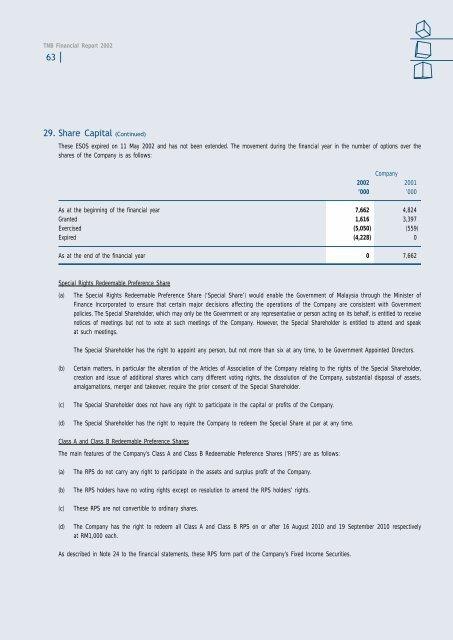

29. Share Capital (Continued)<br />

These ESOS expired on 11 May 2002 and has not been extended. The movement during the financial year in the number of options over the<br />

shares of the Company is as follows:<br />

Company<br />

2002 2001<br />

’000 ’000<br />

As at the beginning of the financial year 7,662 4,824<br />

Granted 1,616 3,397<br />

Exercised (5,050) (559)<br />

Expired (4,228) 0<br />

As at the end of the financial year 0 7,662<br />

Special Rights Redeemable Preference Share<br />

(a)<br />

The Special Rights Redeemable Preference Share (‘Special Share’) would enable the Government of Malaysia through the Minister of<br />

Finance Incorporated to ensure that certain major decisions affecting the operations of the Company are consistent with Government<br />

policies. The Special Shareholder, which may only be the Government or any representative or person acting on its behalf, is entitled to receive<br />

notices of meetings but not to vote at such meetings of the Company. However, the Special Shareholder is entitled to attend and speak<br />

at such meetings.<br />

The Special Shareholder has the right to appoint any person, but not more than six at any time, to be Government Appointed Directors.<br />

(b)<br />

Certain matters, in particular the alteration of the Articles of Association of the Company relating to the rights of the Special Shareholder,<br />

creation and issue of additional shares which carry different voting rights, the dissolution of the Company, substantial disposal of assets,<br />

amalgamations, merger and takeover, require the prior consent of the Special Shareholder.<br />

(c)<br />

The Special Shareholder does not have any right to participate in the capital or profits of the Company.<br />

(d)<br />

The Special Shareholder has the right to require the Company to redeem the Special Share at par at any time.<br />

Class A and Class B Redeemable Preference Shares<br />

The main features of the Company’s Class A and Class B Redeemable Preference Shares (‘RPS’) are as follows:<br />

(a)<br />

The RPS do not carry any right to participate in the assets and surplus profit of the Company.<br />

(b)<br />

The RPS holders have no voting rights except on resolution to amend the RPS holders’ rights.<br />

(c)<br />

These RPS are not convertible to ordinary shares.<br />

(d)<br />

The Company has the right to redeem all Class A and Class B RPS on or after 16 August 2010 and 19 September 2010 respectively<br />

at RM1,000 each.<br />

As described in Note 24 to the financial statements, these RPS form part of the Company’s Fixed Income Securities.