Download - Tenaga Nasional Berhad

Download - Tenaga Nasional Berhad

Download - Tenaga Nasional Berhad

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

TNB Financial Report 2002<br />

51<br />

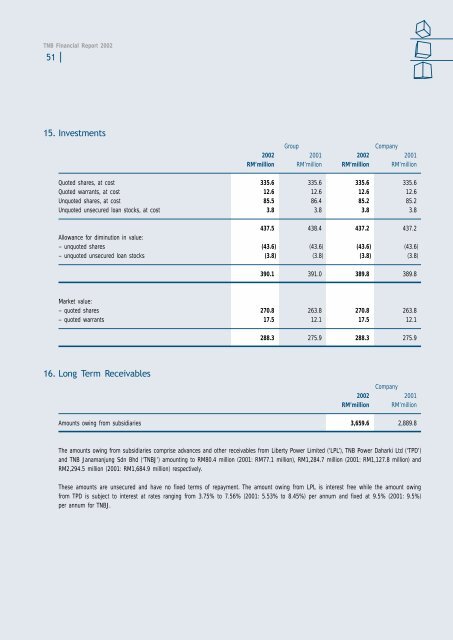

15. Investments<br />

Group<br />

Company<br />

2002 2001 2002 2001<br />

RM’million RM’million RM’million RM’million<br />

Quoted shares, at cost 335.6 335.6 335.6 335.6<br />

Quoted warrants, at cost 12.6 12.6 12.6 12.6<br />

Unquoted shares, at cost 85.5 86.4 85.2 85.2<br />

Unquoted unsecured loan stocks, at cost 3.8 3.8 3.8 3.8<br />

437.5 438.4 437.2 437.2<br />

Allowance for diminution in value:<br />

– unquoted shares (43.6) (43.6) (43.6) (43.6)<br />

– unquoted unsecured loan stocks (3.8) (3.8) (3.8) (3.8)<br />

390.1 391.0 389.8 389.8<br />

Market value:<br />

– quoted shares 270.8 263.8 270.8 263.8<br />

– quoted warrants 17.5 12.1 17.5 12.1<br />

288.3 275.9 288.3 275.9<br />

16. Long Term Receivables<br />

Company<br />

2002 2001<br />

RM’million RM’million<br />

Amounts owing from subsidiaries 3,659.6 2,889.8<br />

The amounts owing from subsidiaries comprise advances and other receivables from Liberty Power Limited (‘LPL’), TNB Power Daharki Ltd (‘TPD’)<br />

and TNB Janamanjung Sdn Bhd (‘TNBJ’) amounting to RM80.4 million (2001: RM77.1 million), RM1,284.7 million (2001: RM1,127.8 million) and<br />

RM2,294.5 million (2001: RM1,684.9 million) respectively.<br />

These amounts are unsecured and have no fixed terms of repayment. The amount owing from LPL is interest free while the amount owing<br />

from TPD is subject to interest at rates ranging from 3.75% to 7.56% (2001: 5.53% to 8.45%) per annum and fixed at 9.5% (2001: 9.5%)<br />

per annum for TNBJ.