Download - Tenaga Nasional Berhad

Download - Tenaga Nasional Berhad

Download - Tenaga Nasional Berhad

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

TNB Financial Report 2002<br />

34<br />

Notes to the Financial Statements (Continued)<br />

– 31 August 2002<br />

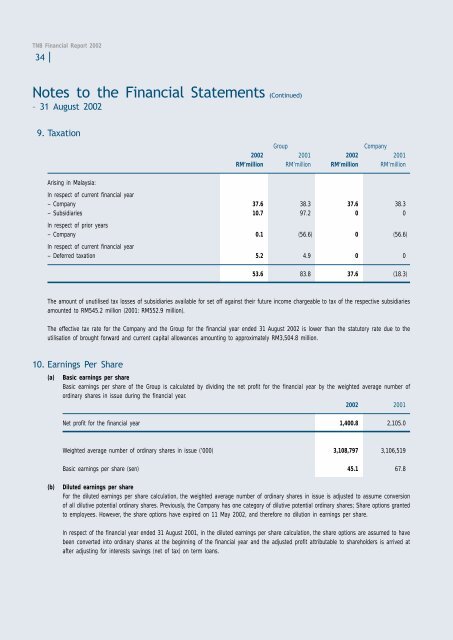

9. Taxation<br />

Group<br />

Company<br />

2002 2001 2002 2001<br />

RM’million RM’million RM’million RM’million<br />

Arising in Malaysia:<br />

In respect of current financial year<br />

– Company 37.6 38.3 37.6 38.3<br />

– Subsidiaries 10.7 97.2 0 0<br />

In respect of prior years<br />

– Company 0.1 (56.6) 0 (56.6)<br />

In respect of current financial year<br />

– Deferred taxation 5.2 4.9 0 0<br />

53.6 83.8 37.6 (18.3)<br />

The amount of unutilised tax losses of subsidiaries available for set off against their future income chargeable to tax of the respective subsidiaries<br />

amounted to RM545.2 million (2001: RM552.9 million).<br />

The effective tax rate for the Company and the Group for the financial year ended 31 August 2002 is lower than the statutory rate due to the<br />

utilisation of brought forward and current capital allowances amounting to approximately RM3,504.8 million.<br />

10. Earnings Per Share<br />

(a)<br />

Basic earnings per share<br />

Basic earnings per share of the Group is calculated by dividing the net profit for the financial year by the weighted average number of<br />

ordinary shares in issue during the financial year.<br />

2002 2001<br />

Net profit for the financial year 1,400.8 2,105.0<br />

Weighted average number of ordinary shares in issue (’000) 3,108,797 3,106,519<br />

Basic earnings per share (sen) 45.1 67.8<br />

(b)<br />

Diluted earnings per share<br />

For the diluted earnings per share calculation, the weighted average number of ordinary shares in issue is adjusted to assume conversion<br />

of all dilutive potential ordinary shares. Previously, the Company has one category of dilutive potential ordinary shares; Share options granted<br />

to employees. However, the share options have expired on 11 May 2002, and therefore no dilution in earnings per share.<br />

In respect of the financial year ended 31 August 2001, in the diluted earnings per share calculation, the share options are assumed to have<br />

been converted into ordinary shares at the beginning of the financial year and the adjusted profit attributable to shareholders is arrived at<br />

after adjusting for interests savings (net of tax) on term loans.