Download - Tenaga Nasional Berhad

Download - Tenaga Nasional Berhad

Download - Tenaga Nasional Berhad

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

TNB Financial Report 2002<br />

27<br />

2. Summary of Significant Accounting Policies (Continued)<br />

(d)<br />

Goodwill<br />

Goodwill arising on consolidation represents the excess of the purchase price over the fair value of the net assets of the subsidiary at the<br />

date of acquisition. Goodwill is written off to reserves in the year of acquisition.<br />

Negative goodwill represents the excess of the fair value of the Group’s share of identifiable net assets acquired over the purchase price.<br />

Negative goodwill is accounted for as movement in reserves in the year of acquisition.<br />

(e)<br />

Foreign currency<br />

Foreign currency transactions are converted into Ringgit Malaysia at exchange rates ruling at the transaction dates unless hedged by forward<br />

foreign exchange contracts, in which case the rates specified in such forward contracts are used. Monetary assets and liabilities in foreign<br />

currencies are translated at exchange rates ruling at the balance sheet date unless hedged by forward foreign exchange contracts, in which<br />

case the rates specified in such forward contracts are used. All exchange differences are dealt with through the income statement.<br />

Income statements of foreign entities are translated into Ringgit Malaysia at average rates of exchange for the financial year. Balance sheets<br />

are translated into Ringgit Malaysia at the rates of exchange ruling at the balance sheet date. Exchange differences arising from the<br />

translation of the results for the financial year at average rates and assets and liabilities at year end rates, and the restatement at year<br />

end rates of the opening net investments in foreign subsidiaries are taken to a foreign currency translation reserve account as a component<br />

of shareholders’ funds.<br />

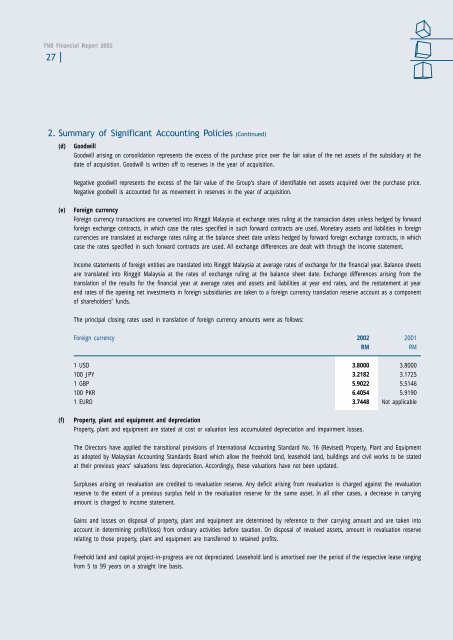

The principal closing rates used in translation of foreign currency amounts were as follows:<br />

Foreign currency 2002 2001<br />

RM<br />

RM<br />

1 USD 3.8000 3.8000<br />

100 JPY 3.2182 3.1725<br />

1 GBP 5.9022 5.5146<br />

100 PKR 6.4054 5.9190<br />

1 EURO 3.7448 Not applicable<br />

(f)<br />

Property, plant and equipment and depreciation<br />

Property, plant and equipment are stated at cost or valuation less accumulated depreciation and impairment losses.<br />

The Directors have applied the transitional provisions of International Accounting Standard No. 16 (Revised) Property, Plant and Equipment<br />

as adopted by Malaysian Accounting Standards Board which allow the freehold land, leasehold land, buildings and civil works to be stated<br />

at their previous years’ valuations less depreciation. Accordingly, these valuations have not been updated.<br />

Surpluses arising on revaluation are credited to revaluation reserve. Any deficit arising from revaluation is charged against the revaluation<br />

reserve to the extent of a previous surplus held in the revaluation reserve for the same asset. In all other cases, a decrease in carrying<br />

amount is charged to income statement.<br />

Gains and losses on disposal of property, plant and equipment are determined by reference to their carrying amount and are taken into<br />

account in determining profit/(loss) from ordinary activities before taxation. On disposal of revalued assets, amount in revaluation reserve<br />

relating to those property, plant and equipment are transferred to retained profits.<br />

Freehold land and capital project-in-progress are not depreciated. Leasehold land is amortised over the period of the respective lease ranging<br />

from 5 to 99 years on a straight line basis.