GOVERNMENT OF INDIA North Eastern Railway ... - Tenders India

GOVERNMENT OF INDIA North Eastern Railway ... - Tenders India

GOVERNMENT OF INDIA North Eastern Railway ... - Tenders India

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

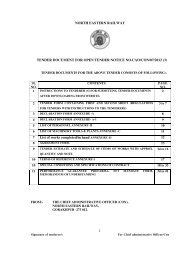

Dy.CSTE/Con/ IZN/02 of 2011 <strong>North</strong> <strong>Eastern</strong> <strong>Railway</strong><br />

(a) In terms of clause No. 45 of General Condition of Contract<br />

measurements of the work in progress shall be taken and recorded in<br />

the prescribed official Measurement Book from time to time and at such<br />

intervals as in the opinion of the engineer-in-charge shall be proper<br />

having regard to the progress of the work. The contractor shall be<br />

present at the site and shall sign the results of the measurements (which<br />

shall also be signed by the engineer-in-charge or his authorized<br />

representative) recorded in the aforesaid measurement book as an<br />

acknowledgement of his acceptance of the accuracy of the<br />

measurements.<br />

(b) 90% of the charges for execution of each activity will be paid to the<br />

contractor on its completion duly verified by the <strong>Railway</strong><br />

representative. This will be subject to the submission of written<br />

certificate of the <strong>Railway</strong> representative that the work has completely<br />

been done in all respect.<br />

(c) 10% against the execution of each activity will be paid to the<br />

contractor after the completion of the entire work..<br />

2.15 DEDUCTION <strong>OF</strong> INCOME TAX:<br />

The railway shall at the time of arranging payment to the contractor be<br />

entitled to deduct Income Tax on the gross amount of each bill, at specified<br />

rate decided by <strong>Railway</strong> Board from time to time . An Income Tax Deduction<br />

Certificate can be issued to the firm on demand and the final settlement of<br />

Income Tax should be made with concerned income tax authority.<br />

2.16 DEDUCTION <strong>OF</strong> SALES TAX :<br />

Deduction of the sales tax at a rate applicable in the state of U. P. will be made<br />

at source from the payment made to the Contractor for carrying out works by<br />

the N. E. <strong>Railway</strong> Administration. In view of the above, <strong>Railway</strong><br />

Administration decided to deduct the Sales Tax from each running bill and<br />

deposit the same in treasury of Respective Governments and any adjustment of<br />

deduction to be made on final bill. The % (Percentage) of deduction will vary<br />

as per the directive of the State Govt.<br />

2.17 ATTENDING DEFECTS WITHIN FREE MAINTENANCE PERIOD UNDER<br />

WARRANTY:<br />

The contractor shall be bound to rectify free of cost at site any defects and/or<br />

short comings that may arise in the work executed for a period of 365 (Three<br />

hundred sixty five ) days after completion and taking over of the installation<br />

by the railway (as defined in clause No. 2.5 ). The aforesaid maintenance<br />

period of 365 days shall be reckoned from the date of taking over the work by<br />

the railway, excluding day(s) that will elapse, from the date of sending the<br />

intimation by the railway, to the Contractor (at his last known address) up to<br />

the date of completion of rectification. Should any dispute arise as to the<br />

correctness of the defects pointed out, the decision of Engineer-in-charge in<br />

this regard shall be final and binding. The necessary disconnection of working<br />

Signature of Tenderer(s)<br />

Date…………………<br />

26