Annual Report 2001 - Carlsberg Group

Annual Report 2001 - Carlsberg Group

Annual Report 2001 - Carlsberg Group

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

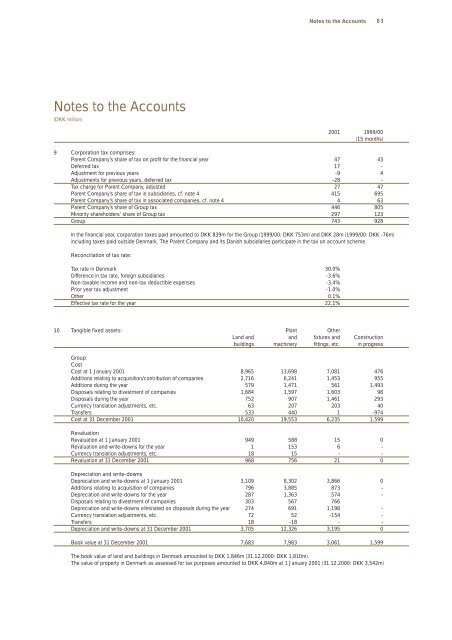

Notes to the Accounts<br />

83<br />

Notes to the Accounts<br />

(DKK million)<br />

<strong>2001</strong> 1999/00<br />

(15 months)<br />

9 Corporation tax comprises:<br />

Parent Company’s share of tax on profit for the financial year 47 43<br />

Deferred tax 17 -<br />

Adjustment for previous years -9 4<br />

Adjustments for previous years, deferred tax -28 -<br />

Tax charge for Parent Company, adjusted 27 47<br />

Parent Company’s share of tax in subsidiaries, cf. note 4 415 695<br />

Parent Company’s share of tax in associated companies, cf. note 4 4 63<br />

Parent Company’s share of <strong>Group</strong> tax 446 805<br />

Minority shareholders’ share of <strong>Group</strong> tax 297 123<br />

<strong>Group</strong> 743 928<br />

In the financial year, corporation taxes paid amounted to DKK 839m for the <strong>Group</strong> (1999/00: DKK 753m) and DKK 28m (1999/00: DKK -76m)<br />

including taxes paid outside Denmark. The Parent Company and its Danish subsidiaries participate in the tax on account scheme.<br />

Reconciliation of tax rate:<br />

Tax rate in Denmark 30.0%<br />

Difference in tax rate, foreign subsidiaries -3.6%<br />

Non-taxable income and non-tax deductible expenses -3.4%<br />

Prior year tax adjustment -1.0%<br />

Other 0.1%<br />

Effective tax rate for the year 22.1%<br />

10 Tangible fixed assets: Plant Other<br />

Land and and fixtures and Construction<br />

buildings machinery fittings, etc. in progress<br />

<strong>Group</strong>:<br />

Cost<br />

Cost at 1 January <strong>2001</strong> 8,965 13,698 7,081 476<br />

Additions relating to acquisition/contribution of companies 2,716 6,241 1,453 955<br />

Additions during the year 579 1,471 561 1,493<br />

Disposals relating to divestment of companies 1,684 1,597 1,603 98<br />

Disposals during the year 752 907 1,461 293<br />

Currency translation adjustments, etc. 63 207 203 40<br />

Transfers 533 440 1 -974<br />

Cost at 31 December <strong>2001</strong> 10,420 19,553 6,235 1,599<br />

Revaluation<br />

Revaluation at 1 January <strong>2001</strong> 949 588 15 0<br />

Revaluation and write-downs for the year 1 153 6 -<br />

Currency translation adjustments, etc. 18 15 - -<br />

Revaluation at 31 December <strong>2001</strong> 968 756 21 0<br />

Depreciation and write-downs<br />

Depreciation and write-downs at 1 January <strong>2001</strong> 3,109 8,302 3,866 0<br />

Additions relating to acquisition of companies 796 3,885 873 -<br />

Depreciation and write-downs for the year 287 1,363 574 -<br />

Disposals relating to divestment of companies 303 567 766<br />

Depreciation and write-downs eliminated on disposals during the year 274 691 1,198 -<br />

Currency translation adjustments, etc. 72 52 -154 -<br />

Transfers 18 -18 - -<br />

Depreciation and write-downs at 31 December <strong>2001</strong> 3,705 12,326 3,195 0<br />

Book value at 31 December <strong>2001</strong> 7,683 7,983 3,061 1,599<br />

The book value of land and buildings in Denmark amounted to DKK 1,846m (31.12.2000: DKK 1,810m).<br />

The value of property in Denmark as assessed for tax purposes amounted to DKK 4,840m at 1 January <strong>2001</strong> (31.12.2000: DKK 3,542m)

![[Name and Address] - Carlsberg Group](https://img.yumpu.com/49766377/1/184x260/name-and-address-carlsberg-group.jpg?quality=85)

![[Name and Address] - Carlsberg Group](https://img.yumpu.com/49015962/1/184x260/name-and-address-carlsberg-group.jpg?quality=85)