Vol. 2010, No. 11 (06/01/2010) PDF - Administrative Rules - Utah.gov

Vol. 2010, No. 11 (06/01/2010) PDF - Administrative Rules - Utah.gov

Vol. 2010, No. 11 (06/01/2010) PDF - Administrative Rules - Utah.gov

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

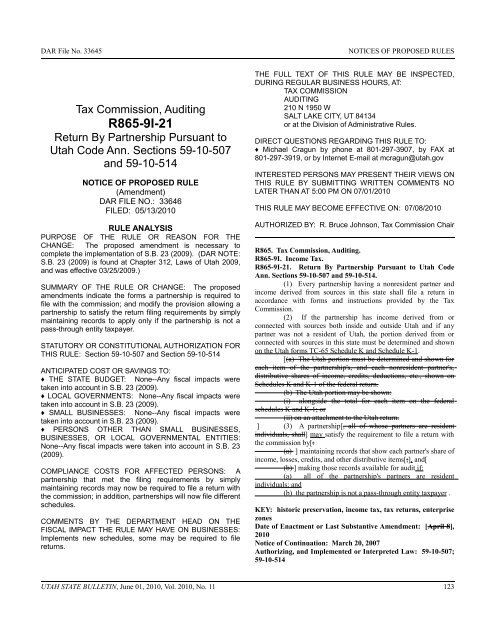

DAR File <strong>No</strong>. 33645<br />

NOTICES OF PROPOSED RULES<br />

33646<br />

Tax Commission, Auditing<br />

R865-9I-21<br />

Return By Partnership Pursuant to<br />

<strong>Utah</strong> Code Ann. Sections 59-10-507<br />

and 59-10-514<br />

NOTICE OF PROPOSED RULE<br />

(Amendment)<br />

DAR FILE NO.: 33646<br />

FILED: 05/13/<strong>2<strong>01</strong>0</strong><br />

RULE ANALYSIS<br />

PURPOSE OF THE RULE OR REASON FOR THE<br />

CHANGE: The proposed amendment is necessary to<br />

complete the implementation of S.B. 23 (2009). (DAR NOTE:<br />

S.B. 23 (2009) is found at Chapter 312, Laws of <strong>Utah</strong> 2009,<br />

and was effective 03/25/2009.)<br />

SUMMARY OF THE RULE OR CHANGE: The proposed<br />

amendments indicate the forms a partnership is required to<br />

file with the commission; and modify the provision allowing a<br />

partnership to satisfy the return filing requirements by simply<br />

maintaining records to apply only if the partnership is not a<br />

pass-through entity taxpayer.<br />

STATUTORY OR CONSTITUTIONAL AUTHORIZATION FOR<br />

THIS RULE: Section 59-10-507 and Section 59-10-514<br />

ANTICIPATED COST OR SAVINGS TO:<br />

♦ THE STATE BUDGET: <strong>No</strong>ne--Any fiscal impacts were<br />

taken into account in S.B. 23 (2009).<br />

♦ LOCAL GOVERNMENTS: <strong>No</strong>ne--Any fiscal impacts were<br />

taken into account in S.B. 23 (2009).<br />

♦ SMALL BUSINESSES: <strong>No</strong>ne--Any fiscal impacts were<br />

taken into account in S.B. 23 (2009).<br />

♦ PERSONS OTHER THAN SMALL BUSINESSES,<br />

BUSINESSES, OR LOCAL GOVERNMENTAL ENTITIES:<br />

<strong>No</strong>ne--Any fiscal impacts were taken into account in S.B. 23<br />

(2009).<br />

COMPLIANCE COSTS FOR AFFECTED PERSONS: A<br />

partnership that met the filing requirements by simply<br />

maintaining records may now be required to file a return with<br />

the commission; in addition, partnerships will now file different<br />

schedules.<br />

COMMENTS BY THE DEPARTMENT HEAD ON THE<br />

FISCAL IMPACT THE RULE MAY HAVE ON BUSINESSES:<br />

Implements new schedules, some may be required to file<br />

returns.<br />

THE FULL TEXT OF THIS RULE MAY BE INSPECTED,<br />

DURING REGULAR BUSINESS HOURS, AT:<br />

TAX COMMISSION<br />

AUDITING<br />

210 N 1950 W<br />

SALT LAKE CITY, UT 84134<br />

or at the Division of <strong>Administrative</strong> <strong>Rules</strong>.<br />

DIRECT QUESTIONS REGARDING THIS RULE TO:<br />

♦ Michael Cragun by phone at 8<strong>01</strong>-297-3907, by FAX at<br />

8<strong>01</strong>-297-3919, or by Internet E-mail at mcragun@utah.<strong>gov</strong><br />

INTERESTED PERSONS MAY PRESENT THEIR VIEWS ON<br />

THIS RULE BY SUBMITTING WRITTEN COMMENTS NO<br />

LATER THAN AT 5:00 PM ON 07/<strong>01</strong>/<strong>2<strong>01</strong>0</strong><br />

THIS RULE MAY BECOME EFFECTIVE ON: 07/08/<strong>2<strong>01</strong>0</strong><br />

AUTHORIZED BY: R. Bruce Johnson, Tax Commission Chair<br />

R865. Tax Commission, Auditing.<br />

R865-9I. Income Tax.<br />

R865-9I-21. Return By Partnership Pursuant to <strong>Utah</strong> Code<br />

Ann. Sections 59-10-507 and 59-10-514.<br />

(1) Every partnership having a nonresident partner and<br />

income derived from sources in this state shall file a return in<br />

accordance with forms and instructions provided by the Tax<br />

Commission.<br />

(2) If the partnership has income derived from or<br />

connected with sources both inside and outside <strong>Utah</strong> and if any<br />

partner was not a resident of <strong>Utah</strong>, the portion derived from or<br />

connected with sources in this state must be determined and shown<br />

on the <strong>Utah</strong> forms TC-65 Schedule K and Schedule K-1.<br />

[(a) The <strong>Utah</strong> portion must be determined and shown for<br />

each item of the partnership's, and each nonresident partner's,<br />

distributive shares of income, credits, deductions, etc., shown on<br />

Schedules K and K-1 of the federal return.<br />

(b) The <strong>Utah</strong> portion may be shown:<br />

(i) alongside the total for each item on the federal<br />

schedules K and K-1; or<br />

(ii) on an attachment to the <strong>Utah</strong> return.<br />

] (3) A partnership[, all of whose partners are resident<br />

individuals, shall] may satisfy the requirement to file a return with<br />

the commission by[:<br />

(a) ] maintaining records that show each partner's share of<br />

income, losses, credits, and other distributive items[;], and[<br />

(b) ] making those records available for audit if:<br />

(a) all of the partnership's partners are resident<br />

individuals; and<br />

(b) the partnership is not a pass-through entity taxpayer .<br />

KEY: historic preservation, income tax, tax returns, enterprise<br />

zones<br />

Date of Enactment or Last Substantive Amendment: [April 8],<br />

<strong>2<strong>01</strong>0</strong><br />

<strong>No</strong>tice of Continuation: March 20, 2007<br />

Authorizing, and Implemented or Interpreted Law: 59-10-507;<br />

59-10-514<br />

UTAH STATE BULLETIN, June <strong>01</strong>, <strong>2<strong>01</strong>0</strong>, <strong>Vol</strong>. <strong>2<strong>01</strong>0</strong>, <strong>No</strong>. <strong>11</strong> 123

![Lynx avoidance [PDF] - Wisconsin Department of Natural Resources](https://img.yumpu.com/41279089/1/159x260/lynx-avoidance-pdf-wisconsin-department-of-natural-resources.jpg?quality=85)