You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

2005<br />

2006<br />

2007<br />

2008<br />

2009<br />

2010<br />

2011<br />

2012<br />

2013<br />

2014<br />

<strong>2015</strong><br />

No ships<br />

<strong>ECSA</strong><br />

<strong>The</strong> <strong>Tramp</strong> <strong>Shipping</strong> <strong><strong>Mar</strong>ket</strong><br />

example car manufacturers 9 etc) there is more focus on marketing and service levels than is the<br />

case with homogeneous bulk vessels.<br />

6. Sea Transport risk & investment strategy<br />

6.1 <strong>The</strong> risk management system<br />

Because shipping is a risky business for both shipowners and cargo shippers (shipping markets<br />

are unpredictable and highly volatile), they have developed a system which allows shippers with a<br />

future commitment to sea transport to spread their risk by developing a portfolio approach to<br />

sourcing transport, using four different approaches- ownership, period timechartering, spot<br />

chartering and COA.<br />

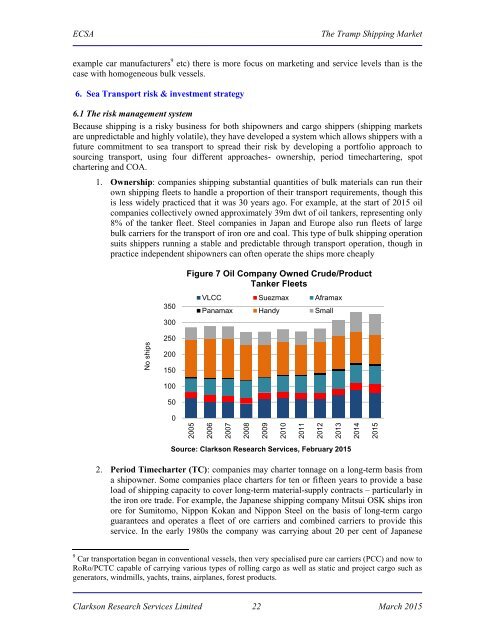

1. Ownership: companies shipping substantial quantities of bulk materials can run their<br />

own shipping fleets to handle a proportion of their transport requirements, though this<br />

is less widely practiced that it was 30 years ago. For example, at the start of <strong>2015</strong> oil<br />

companies collectively owned approximately 39m dwt of oil tankers, representing only<br />

8% of the tanker fleet. Steel companies in Japan and Europe also run fleets of large<br />

bulk carriers for the transport of iron ore and coal. This type of bulk shipping operation<br />

suits shippers running a stable and predictable through transport operation, though in<br />

practice independent shipowners can often operate the ships more cheaply<br />

350<br />

300<br />

Figure 7 Oil Company Owned Crude/Product<br />

Tanker Fleets<br />

VLCC Suezmax Aframax<br />

Panamax Handy Small<br />

250<br />

200<br />

150<br />

100<br />

50<br />

0<br />

Source: Clarkson Research Services, February <strong>2015</strong><br />

2. Period Timecharter (TC): companies may charter tonnage on a long-term basis from<br />

a shipowner. Some companies place charters for ten or fifteen years to provide a base<br />

load of shipping capacity to cover long-term material-supply contracts – particularly in<br />

the iron ore trade. For example, the Japanese shipping company Mitsui OSK ships iron<br />

ore for Sumitomo, Nippon Kokan and Nippon Steel on the basis of long-term cargo<br />

guarantees and operates a fleet of ore carriers and combined carriers to provide this<br />

service. In the early 1980s the company was carrying about 20 per cent of Japanese<br />

9 Car transportation began in conventional vessels, then very specialised pure car carriers (PCC) and now to<br />

RoRo/PCTC capable of carrying various types of rolling cargo as well as static and project cargo such as<br />

generators, windmills, yachts, trains, airplanes, forest products.<br />

Clarkson Research Services Limited 22 <strong>Mar</strong>ch <strong>2015</strong>