Mileage-Based User Fee Winners and Losers - RAND Corporation

Mileage-Based User Fee Winners and Losers - RAND Corporation

Mileage-Based User Fee Winners and Losers - RAND Corporation

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

This alternative is intended to create a price-based incentive for improved fuel economy<br />

while not allowing improved fuel economy to erode revenue. This alternative, which has also been<br />

referred to as a “green mileage fee” elsewhere in the literature, levies a high MBUF on vehicles<br />

whose combined city/highway fuel economy rating falls below a specified threshold <strong>and</strong> levies a low<br />

MBUF on vehicles whose fuel economy exceeds the threshold (Agrawal, Dill, <strong>and</strong> Nixon 2009). Any<br />

threshold could be adopted <strong>and</strong> it could be adjusted each year as the average fuel economy<br />

improves.<br />

For this analysis, the threshold is set at the median EPA fuel economy rating so that<br />

approximately half of all household vehicles would have a tax cut <strong>and</strong> the other half would have a<br />

tax increase. 42 In the 2008-09 population of vehicles, the median EPA fuel economy rating is 25.1<br />

MPG. Therefore, for alternative 7, the threshold is set at 25.1 MPG. In this alternative the rates are<br />

intentionally extreme; the high rate is set to 2.94 cents per mile, which is the highest federal tax per<br />

mile by any household, <strong>and</strong> the low rate is set to 0.28 cents per mile which is the least federal tax<br />

paid per mile by any household. This rate structure is intended to have the opposite effect of the<br />

equivalent flat rate MBUF. The distribution of vehicle fuel economy is more or less bell shaped<br />

around the mean <strong>and</strong> the majority of households have “average” fuel efficiency. Therefore, with a<br />

single equivalent flat rate, most households will have a very minor change in their price per mile.<br />

With the tiered-rate MBUF, most households have either a large increase or a large decrease in their<br />

tax rate. The alternative creates an incentive structure where no household with poor fuel efficiency<br />

will increase VMT <strong>and</strong> no household with high fuel efficiency will reduce VMT.<br />

The primary disadvantage of this type of fee is that it creates a “notch” at the point of the<br />

threshold (Sallee <strong>and</strong> Slemrod 2010). There are large benefits to being on one side of this arbitrary<br />

disjoint <strong>and</strong> large costs to being on the other. Were this type of policy to be adopted as proposed in<br />

this illustrative alternative, similar to current fuel economy regulations, it would very likely distort the<br />

market for vehicles (Sallee <strong>and</strong> Slemrod 2010; Sallee 2010). In addition to the mean MPG threshold<br />

with the extreme rates, five alternatives with higher thresholds <strong>and</strong> lower rates are considered as<br />

specified in Table 4.2. The alternatives use thresholds that are increased by 10 <strong>and</strong> 25 percent of the<br />

median MPG, from 25.1 MPG to 27.6 MPG <strong>and</strong> 31.4 MPG. With the higher threshold, fewer<br />

vehicles will qualify for the low rate. The extreme rates are replaced with lower notional values that<br />

are approximately midpoints between the equivalent flat rate <strong>and</strong> the extreme rate. The lower rates<br />

will reduce annual household taxes, relative to the high rates, for all households except those with<br />

the most fuel efficient vehicles. With the higher threshold, the 0.5 cent per mile MBUF provides<br />

only a small discount to the 0.59 cents, or less, those vehicles were paying with the current fuel tax. 43<br />

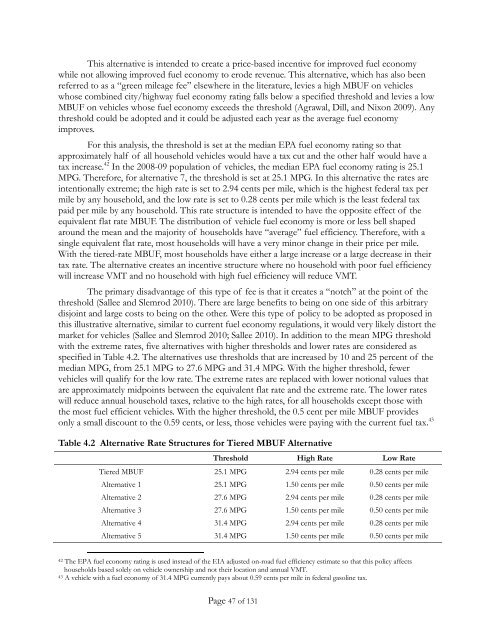

Table 4.2 Alternative Rate Structures for Tiered MBUF Alternative<br />

Threshold High Rate Low Rate<br />

Tiered MBUF 25.1 MPG 2.94 cents per mile 0.28 cents per mile<br />

Alternative 1 25.1 MPG 1.50 cents per mile 0.50 cents per mile<br />

Alternative 2 27.6 MPG 2.94 cents per mile 0.28 cents per mile<br />

Alternative 3 27.6 MPG 1.50 cents per mile 0.50 cents per mile<br />

Alternative 4 31.4 MPG 2.94 cents per mile 0.28 cents per mile<br />

Alternative 5 31.4 MPG 1.50 cents per mile 0.50 cents per mile<br />

42 The EPA fuel economy rating is used instead of the EIA adjusted on-road fuel efficiency estimate so that this policy affects<br />

households based solely on vehicle ownership <strong>and</strong> not their location <strong>and</strong> annual VMT.<br />

43 A vehicle with a fuel economy of 31.4 MPG currently pays about 0.59 cents per mile in federal gasoline tax.<br />

Page 47 of 131