Mileage-Based User Fee Winners and Losers - RAND Corporation

Mileage-Based User Fee Winners and Losers - RAND Corporation

Mileage-Based User Fee Winners and Losers - RAND Corporation

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

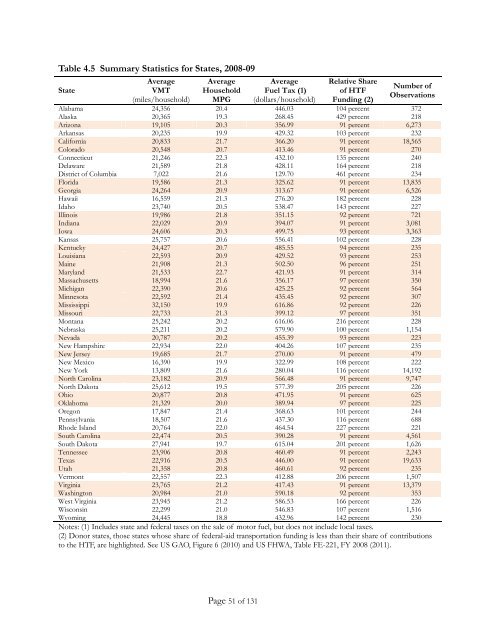

Table 4.5 Summary Statistics for States, 2008-09<br />

State<br />

Average<br />

VMT<br />

(miles/household)<br />

Average<br />

Household<br />

MPG<br />

Average<br />

Fuel Tax (1)<br />

(dollars/household)<br />

Relative Share<br />

of HTF<br />

Funding (2)<br />

Number of<br />

Observations<br />

Alabama 24,356 20.4 446.03 104 percent 372<br />

Alaska 20,365 19.3 268.45 429 percent 218<br />

Arizona 19,105 20.3 356.99 91 percent 6,273<br />

Arkansas 20,235 19.9 429.32 103 percent 232<br />

California 20,833 21.7 366.20 91 percent 18,565<br />

Colorado 20,548 20.7 413.46 91 percent 270<br />

Connecticut 21,246 22.3 432.10 135 percent 240<br />

Delaware 21,589 21.8 428.11 164 percent 218<br />

District of Columbia 7,022 21.6 129.70 461 percent 234<br />

Florida 19,586 21.3 325.62 91 percent 13,835<br />

Georgia 24,264 20.9 313.67 91 percent 6,526<br />

Hawaii 16,559 21.3 276.20 182 percent 228<br />

Idaho 23,740 20.5 538.47 143 percent 227<br />

Illinois 19,986 21.8 351.15 92 percent 721<br />

Indiana 22,029 20.9 394.07 91 percent 3,081<br />

Iowa 24,606 20.3 499.75 93 percent 3,363<br />

Kansas 25,757 20.6 556.41 102 percent 228<br />

Kentucky 24,427 20.7 485.55 94 percent 235<br />

Louisiana 22,593 20.9 429.52 93 percent 253<br />

Maine 21,908 21.3 502.50 96 percent 251<br />

Maryl<strong>and</strong> 21,533 22.7 421.93 91 percent 314<br />

Massachusetts 18,994 21.6 356.17 97 percent 350<br />

Michigan 22,390 20.6 425.25 92 percent 564<br />

Minnesota 22,592 21.4 435.45 92 percent 307<br />

Mississippi 32,150 19.9 616.86 92 percent 226<br />

Missouri 22,733 21.3 399.12 97 percent 351<br />

Montana 25,242 20.2 616.06 216 percent 228<br />

Nebraska 25,211 20.2 579.90 100 percent 1,154<br />

Nevada 20,787 20.2 455.39 93 percent 223<br />

New Hampshire 22,934 22.0 404.26 107 percent 235<br />

New Jersey 19,685 21.7 270.00 91 percent 479<br />

New Mexico 16,390 19.9 322.99 108 percent 222<br />

New York 13,809 21.6 280.04 116 percent 14,192<br />

North Carolina 23,182 20.9 566.48 91 percent 9,747<br />

North Dakota 25,612 19.5 577.39 205 percent 226<br />

Ohio 20,877 20.8 471.95 91 percent 625<br />

Oklahoma 21,329 20.0 389.94 97 percent 225<br />

Oregon 17,847 21.4 368.63 101 percent 244<br />

Pennsylvania 18,507 21.6 437.30 116 percent 688<br />

Rhode Isl<strong>and</strong> 20,764 22.0 464.54 227 percent 221<br />

South Carolina 22,474 20.5 390.28 91 percent 4,561<br />

South Dakota 27,941 19.7 615.04 201 percent 1,626<br />

Tennessee 23,906 20.8 460.49 91 percent 2,243<br />

Texas 22,916 20.5 446.00 91 percent 19,633<br />

Utah 21,358 20.8 460.61 92 percent 235<br />

Vermont 22,557 22.3 412.88 206 percent 1,507<br />

Virginia 23,765 21.2 417.43 91 percent 13,379<br />

Washington 20,984 21.0 590.18 92 percent 353<br />

West Virginia 23,945 21.2 586.53 166 percent 226<br />

Wisconsin 22,299 21.0 546.83 107 percent 1,516<br />

Wyoming 24,445 18.8 432.96 142 percent 230<br />

Notes: (1) Includes state <strong>and</strong> federal taxes on the sale of motor fuel, but does not include local taxes.<br />

(2) Donor states, those states whose share of federal-aid transportation funding is less than their share of contributions<br />

to the HTF, are highlighted. See US GAO, Figure 6 (2010) <strong>and</strong> US FHWA, Table FE-221, FY 2008 (2011).<br />

Page 51 of 131