MCBOI_2011-2012

MCBOI_2011-2012

MCBOI_2011-2012

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

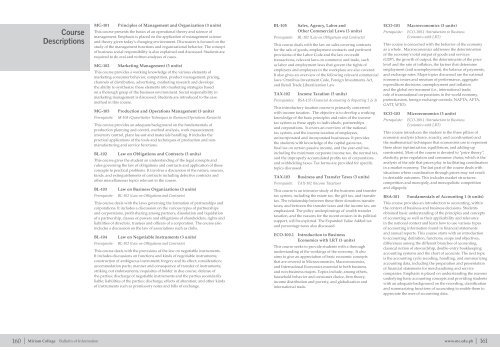

Course<br />

Descriptions<br />

MG-101<br />

Principles of Management and Organization (3 units)<br />

This course presents the basics of an operational theory and science of<br />

management. Emphasis is placed on the application of management science<br />

and theory given today’s changing environment. Discussion is focused on the<br />

study of the management functions and organizational behavior. The concept<br />

of business social responsibility is also explained and discussed. Students are<br />

required to do oral and written analyses of cases.<br />

MG-102<br />

Marketing Management (3 units)<br />

This course provides a working knowledge of the various elements of<br />

marketing-consumer behavior, competition, product management, pricing,<br />

channels of distribution, advertising, marketing research and develops<br />

the ability to synthesize these elements into marketing strategies based<br />

on a thorough grasp of the business environment. Social responsibility in<br />

marketing management is discussed. Students are introduced to the case<br />

method in this course.<br />

MG-105<br />

Prerequisite:<br />

Production and Operations Management (3 units)<br />

M-108 (Quantitative Techniques in Business/Operations Research)<br />

This course provides an adequate background on the fundamentals of<br />

production planning and control, method analysis, work measurement,<br />

inventory control, plant lay-out and materials handling. It includes the<br />

practical applications of the tools and techniques of production and nonmanufacturing<br />

and service functions.<br />

BL-102<br />

Law on Obligations and Contracts (3 units)<br />

This course gives the student an understanding of the legal concepts and<br />

rules governing the law of obligations and contracts and application of these<br />

concepts to practical problems. It involves a discussion of the nature, sources,<br />

kinds, and extinguishments of contracts including defective contracts and<br />

other miscellaneous topics relevant to the course.<br />

BL-103<br />

Prerequisite:<br />

Law on Business Organizations (3 units)<br />

BL-102 (Law on Obligations and Contracts)<br />

This course deals with the laws governing the formation of partnerships and<br />

corporations. It includes a discussion on the various types of partnerships<br />

and corporations, profit sharing among partners, dissolution and liquidation<br />

of a partnership, classes of powers and obligations of shareholders, rights and<br />

liabilities of directors, trustees and officers of a corporation. The course also<br />

includes a discussion on the law of associations such as clubs.<br />

BL-104<br />

Prerequisite:<br />

Law on Negotiable Instruments (3 units)<br />

BL-102 (Law on Obligations and Contracts)<br />

This course deals with the provisions of the law on negotiable instruments.<br />

It includes discussions on functions and kinds of negotiable instruments;<br />

construction of ambiguous instrument; forgery and its effect; consideration;<br />

accommodation party; manner and consequence of transfer of instruments;<br />

striking out endorsements; requisites of holder in due course; defense of<br />

the parties; discharge of negotiable instruments and the parties secondarily<br />

liable; liabilities of the parties; discharge; effects of alteration; and other kinds<br />

of instruments such as promissory notes and bills of exchange.<br />

BL-105<br />

Prerequisite:<br />

Sales, Agency, Labor and<br />

Other Commercial Laws (3 units)<br />

BL-102 (Law on Obligations and Contracts)<br />

This course deals with the law on sales covering contracts<br />

for the sale of goods, employment contracts and pertinent<br />

provisions of the Labor Code and the law on credit<br />

transactions, relevant laws on commerce and trade, such<br />

as labor and employment laws that govern the rights of<br />

employers and employees in the workplace are also covered.<br />

It also gives an overview of the following relevant commercial<br />

laws: Omnibus Investment Code, Foreign Investments Act,<br />

and Retail Trade Liberalization Law.<br />

TAX-102<br />

Income Taxation (3 units)<br />

Prerequisites: BSA-135 (Financial Accounting & Reporting 2 & 3)<br />

This introductory taxation course is primarily concerned<br />

with income taxation. The objective is to develop a working<br />

knowledge of the basic principles and rules of the income<br />

tax system as these apply to individuals, partnerships<br />

and corporations. It covers an overview of the national<br />

tax system, and the income taxation of employees,<br />

unincorporated and incorporated businesses. It provides<br />

the students with knowledge of the capital gains tax,<br />

final tax on certain passive income, and the year-end tax,<br />

including the minimum corporate income tax, the normal tax,<br />

and the improperly accumulated profits tax of corporations<br />

and withholding taxes. Tax forms are provided for specific<br />

topics discussed.<br />

TAX-103<br />

Prerequisite:<br />

Business and Transfer Taxes (3 units)<br />

TAX-102 (Income Taxation)<br />

This course is an intensive study of the business and transfer<br />

tax system, including the estate tax, the gift tax, and transfer<br />

tax. The relationship between these three donatives transfer<br />

taxes, and between the transfer taxes and the income tax, are<br />

emphasized. The policy underpinnings of wealth transfer<br />

taxation, and the reasons for the recent erosion in its political<br />

support, will be explored. The Expanded Value Added tax<br />

and percentage taxes also discussed.<br />

ECO-100.1 Introduction to Business<br />

Economics with LRT (3 units)<br />

This course seeks to provide students with a thorough<br />

understanding of the workings of the economy. It also<br />

aims to give an appreciation of basic economic concepts<br />

that are covered in Microeconomics, Macroeconomics,<br />

and International Economics essential to both business<br />

and non‐business majors. Topics include, among others,<br />

household behavior and consumer choice, firm theory,<br />

income distribution and poverty, and globalization and<br />

international trade.<br />

ECO-101<br />

Prerequisite:<br />

Macroeconomics (3 units)<br />

ECO-100.1 (Introduction to Business<br />

Economics with LRT)<br />

This course is concerned with the behavior of the economy<br />

as a whole. Macroeconomics addresses the determination<br />

of the economy’s total output of goods and services<br />

(GDP), the growth of output, the determinants of the price<br />

level and the rate of inflation, the factors that determine<br />

employment (and unemployment), the balance of payments,<br />

and exchange rates. Major topics discussed are the national<br />

economic issues and measure of performance, aggregate<br />

expenditure decisions, unemployment and inflation<br />

and the global environment (i.e., international trade,<br />

role of transnational corporations in the world economy,<br />

protectionism, foreign exchange controls, NAFTA, AFTA,<br />

GATT, WTO).<br />

ECO-103<br />

Prerequisite:<br />

Microeconomics (3 units)<br />

ECO-100.1 (Introduction to Business<br />

Economics with LRT)<br />

This course introduces the student to the three pillars of<br />

economic analysis (choice, scarcity, and coordination) and<br />

the mathematical techniques that economists use to represent<br />

these ideas (optimization, equilibrium, and adding-up<br />

constraints). Most of the course is devoted to “price theory”,<br />

elasticity, price regulation and consumer choice, which is the<br />

analysis of the role that prices play in facilitating coordination<br />

in a market economy. The last part of the course deals with<br />

situations where coordination through prices may not result<br />

in desirable outcomes. This includes market structures:<br />

competition and monopoly, and monopolistic competition<br />

and oligopoly.<br />

BSA-101<br />

Fundamentals of Accounting 1 (6 units)<br />

This course provides an introduction to accounting, within<br />

the context of business and business decisions. Students<br />

obtained basic understanding of the principles and concepts<br />

of accounting as well as their applicability and relevance<br />

in the national context and learn how to use various types<br />

of accounting information found in financial statements<br />

and annual reports. This course starts with an introduction<br />

to accounting: definition, functions, scope and objectives,<br />

differences among the different branches of accounting,<br />

classical notion of stewardship, double-entry bookkeeping<br />

accounting systems and the chart of accounts. The next topic<br />

is the accounting cycle-recoding, handling, and summarizing<br />

accounting data, including the preparation and presentation<br />

of financial statements for merchandising and service<br />

companies. Emphasis is placed on understanding the reasons<br />

underlying basic accounting concepts and providing students<br />

with an adequate background on the recording, classification<br />

and summarizing functions of accounting to enable them to<br />

appreciate the uses of accounting data.<br />

160 | Miriam College Bulletin of Information<br />

www.mc.edu.ph | 161