MCBOI_2011-2012

MCBOI_2011-2012

MCBOI_2011-2012

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

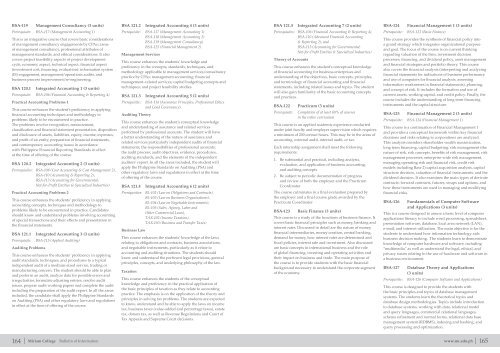

BSA-119<br />

Management Consultancy (3 units)<br />

BSA 121.2<br />

Integrated Accounting 4 (3 units)<br />

BSA 121.5<br />

Integrated Accounting 7 (2 units)<br />

BSA-124<br />

Financial Management 1 (3 units)<br />

Prerequisite: BSA-117 (Management Accounting 1)<br />

This is an integrative course that covers basic considerations<br />

of management consultancy engagements by CPAs; areas<br />

of management consultancy, professional attributes of<br />

management standards, and ethical considerations. It also<br />

covers project feasibility aspects of project development<br />

cycle, economic aspect, technical aspect, financial aspect<br />

(investment cost, financing, evaluation): information system<br />

(IS) engagement, management/operations audits, and<br />

business process improvement/re-engineering.<br />

BSA 120.1<br />

Integrated Accounting 1 (3 units)<br />

Prerequisite: BSA-106 (Financial Accounting & Reporting 4)<br />

Practical Accounting Problems 1<br />

This course enhances the student’s proficiency in applying<br />

financial accounting techniques and methodology to<br />

problems likely to be encountered in practice.<br />

The problems involve recognition, measurement,<br />

classification and financial statement presentation, disposition<br />

and disclosure of assets, liabilities, equity, income, expenses,<br />

and profit of an entity, preparation of financial statements,<br />

and contemporary accounting issues in accordance<br />

with Philippine Financial Reporting Standards in effect<br />

at the time of offering of the course.<br />

BSA 120.2<br />

Integrated Accounting 2 (3 units)<br />

Prerequisites: BSA-108 (Cost Accounting & Cost Management 2),<br />

BSA-110 (Accounting & Reporting 2),<br />

BSA‐113 (Accounting for Governmental,<br />

Not-for-Profit Entities & Specialized Industries)<br />

Practical Accounting Problems 2<br />

This course enhances the students’ proficiency in applying<br />

accounting concepts, techniques and methodology to<br />

problems likely to be encountered in practice. Candidates<br />

should know and understand problems involving accounting<br />

of special transactions and their effects and presentation in<br />

the financial statements.<br />

BSA 121.1<br />

Prerequisite:<br />

Auditing Problems<br />

Integrated Accounting 3 (3 units)<br />

BSA-115 (Applied Auditing)<br />

This course enhances the students’ proficiency in applying<br />

audit standards, techniques, and procedures to a typical<br />

independent audit of a medium-sized service, trading or<br />

manufacturing concern. The student should be able to plan<br />

and perform an audit, analyze data for possible errors and<br />

irregularities, formulate adjusting entries, resolve audit<br />

issues, prepare audit working papers and complete the audit<br />

including the preparation of the audit report. In all the areas<br />

included, the candidate shall apply the Philippine Standards<br />

on Auditing (PSA) and other regulatory laws and regulations<br />

in effect at the time of offering of the course.<br />

Prerequisite: BSA-117 (Management Accounting 1)<br />

BSA-118 (Management Accounting 2)<br />

BSA-119 (Management Consultancy)<br />

BSA-125 (Financial Management 2)<br />

Management Services<br />

This course enhances the students’ knowledge and<br />

proficiency in the concepts, standards, techniques, and<br />

methodology applicable to management services/consultancy<br />

practice by CPAs; management accounting; financial<br />

management–related services; capital budgeting concepts and<br />

techniques; and project feasibility studies.<br />

BSA 121.3<br />

Prerequisite:<br />

Auditing Theory<br />

Integrated Accounting 5 (2 units)<br />

BSA-114 (Assurance Principles, Professional Ethics<br />

and Good Governance)<br />

This course enhances the student’s conceptual knowledge<br />

and understanding of assurance and related services<br />

performed by professional accounts. The student will have<br />

a better understanding of the nature of assurance and<br />

related services particularly independent audits of financial<br />

statements, the responsibilities of professional accounts;<br />

the audit process; audit objectives, evidence, procedures,<br />

auditing standards, and the elements of the independent<br />

auditors’ report. In all the areas included, the student will<br />

apply the Philippine Standards on Auditing (PSA) and<br />

other regulatory laws and regulations in effect at the time<br />

of offering of the course.<br />

BSA 121.4<br />

Integrated Accounting 6 (2 units)<br />

Prerequisites: BL-102 (Law on Obligations and Contracts),<br />

BL-103 (Law on Business Organizations),<br />

BL-104 (Law on Negotiable Instruments),<br />

BL-105 (Sales, Agency, Labor and<br />

Other Commercial Laws),<br />

TAX-102 (Income Taxation),<br />

TAX-103 (Business and Transfer Taxes)<br />

Business Law<br />

This course enhances the students’ knowledge of the laws<br />

relating to obligations and contracts, business associations,<br />

and negotiable instruments, particularly as it relate to<br />

accounting and auditing situations. The students should<br />

know and understand the pertinent legal provisions, general<br />

principles, concepts, and underlying philosophy of the law.<br />

Taxation<br />

This course enhances the students of the conceptual<br />

knowledge and proficiency in the practical application of<br />

the basic principles of taxation as they relate to accounting<br />

practice. The emphasis is on the application of the theory and<br />

principles in solving tax problems. The students are expected<br />

to know, understand and be able to apply the laws on income<br />

tax, business taxes (value-added and percentage taxes), estate<br />

tax, donors tax, as well as Revenue Regulations and Court of<br />

Tax Appeals and Supreme Court decisions.<br />

Prerequisites: BSA-106 (Financial Accounting & Reporting 4),<br />

BSA-110 (Advanced Financial Accounting<br />

& Reporting 2), and<br />

BSA‐113 (Accounting for Governmental,<br />

Not-for-Profit Entities & Specialized Industries)<br />

Theory of Accounts<br />

This course enhances the student’s conceptual knowledge<br />

of financial accounting for business enterprises and<br />

understanding of the objectives, basic concepts, principles,<br />

and terminology of financial accounting and financial<br />

statements, including related issues and topics. The student<br />

will also gain familiarity of the basic accounting concepts<br />

and practices.<br />

BSA-122<br />

Prerequisite:<br />

Practicum (3 units)<br />

Completion of at least 80% of courses<br />

in the entire curriculum<br />

This course is an applied academic experience conducted<br />

under joint faculty and employer supervision which requires<br />

a minimum of 200 contact hours. This may be in the areas of<br />

accounting, external audit, internal audit, or tax.<br />

Each internship assignment shall meet the following<br />

requirements:<br />

1. Be substantial and practical, including analysis,<br />

evaluation, and application of business accounting,<br />

and auditing concepts<br />

2. Be subject to periodic documentation of progress<br />

and review of both the employer and the Practicum<br />

Coordinator<br />

The course culminates in a final evaluation prepared by<br />

the employer and a final course grade awarded by the<br />

Practicum Coordinator<br />

BSA-123<br />

Basic Finance (3 units)<br />

This course is a study of the functions of business finance. It<br />

covers basic financial principles such as money, banking and<br />

interest rates. Discussed in detail are the nature of money,<br />

financial intermediaries, money creation, central banking,<br />

demand for money, how interest rates are determined and<br />

fiscal policies, interest rate and investment. Also discussed<br />

are basic concepts in international business and the role<br />

of global financing, investing and operating activities and<br />

their impact on business and trade. The main purpose of<br />

the course is to provide students with the basic financial<br />

background necessary to understand the corporate segment<br />

of the economy.<br />

Prerequisite:<br />

BSA-123 (Basic Finance)<br />

This course provides the synthesis of financial policy into<br />

a grand strategy which integrates organizational purpose<br />

and goal. The focus of the course is on current thinking<br />

regarding valuation of the firm, investment decision<br />

processes, financing, and dividend policy, asset management<br />

and financial strategies and portfolio theory. This course<br />

also covers the financial analysis (interpreting and analyzing<br />

financial statements for indications of business performance<br />

and use of computers for financial analysis, assessing<br />

information weaknesses in financial statements), planning,<br />

and concept of risk. It includes the formation and use of<br />

current assets, working capital, and credit policy. Finally, the<br />

course includes the understanding of long term financing<br />

instruments and the capital structure.<br />

BSA-125<br />

Financial Management 2 (3 units)<br />

Prerequisite: BSA-124 (Financial Management 1)<br />

This course is a continuation of Financial Management 1<br />

and provides a conceptual framework within key financial<br />

decisions and risks relating to corporations are analyzed.<br />

This analysis considers shareholder wealth maximization,<br />

long term financing, capital budgeting, risk management (the<br />

nature of risk, risk concepts, benefits of risk management, risk<br />

management processes, enterprise-wide risk management,<br />

managing operating risk and financial risk, credit risk<br />

models including Base 2) capital acquisition analysis, capital<br />

structure decision, valuation of financial instruments, and the<br />

dividend decision. It also examines the main types of derivate<br />

contracts: forward contracts, futures, swaps and options, and<br />

how these instruments are used in managing and modifying<br />

financial risks.<br />

BSA-126<br />

Fundamentals of Computer Software<br />

and Applications (3 units)<br />

This is a course designed to assure a basic level of computer<br />

applications literacy to include word processing, spreadsheet,<br />

presentation software, database, local area network (LAN),<br />

e-mail, and internet utilization. The main objective is for the<br />

students to understand how information technology aids<br />

business decision making. The students learn to demonstrate<br />

knowledge of computer hardware and software, including<br />

“multimedia” as well as understand the legal, ethical, and<br />

privacy issues relating to the use of hardware and software in<br />

a business environment.<br />

BSA-127<br />

Prerequisite:<br />

Database Theory and Applications<br />

(3 units)<br />

BSA-126 (Computer Software and Applications)<br />

This course is designed to provide the students with<br />

the basic principles and topics of database management<br />

systems. The students learn the theoretical topics and<br />

database design methodologies. Topics include introduction<br />

to database systems, working with data, relational model<br />

and query languages, commercial relational languages,<br />

schema refinement and normal forms, relational data base<br />

management system (RDBMS), indexing and hashing, and<br />

query processing and optimization.<br />

164 | Miriam College Bulletin of Information<br />

www.mc.edu.ph | 165