The Broken Link - Digital Transactions

The Broken Link - Digital Transactions

The Broken Link - Digital Transactions

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

TRENDS & TACTICS<br />

TRENDS & TACTICS<br />

Will the U.S. Meddle in Interchange?<br />

Regulatory fever over interchange is<br />

rising in Europe, and the U.S. may not<br />

be immune.<br />

<strong>The</strong> latest challenge came late<br />

last year, when the European Commission<br />

ruled that MasterCard<br />

Worldwide’s interchange-fee structure<br />

is illegal in that region. <strong>The</strong> ruling<br />

will affect relatively few transactions<br />

in Europe but could encourage<br />

regulators—including those in the<br />

U.S.—to act.<br />

“On balance, the EC decision<br />

is negative,” Eric Grover, principal<br />

at Intrepid Ventures, a Menlo Park,<br />

Calif.-based consulting firm and a former<br />

executive at Visa International,<br />

said in an e-mail message to this<br />

magazine’s sister publication, <strong>Digital</strong><br />

<strong>Transactions</strong> News.<strong>The</strong> decision “will<br />

spur regulators in other jurisdictions<br />

to intervene and treat card payment<br />

networks like public utilities.”<br />

<strong>The</strong> stakes potentially involve<br />

billions of dollars. U.S. issuers of<br />

Visa- and MasterCard-branded credit<br />

and debit cards collectively garnered<br />

nearly $40 billion in interchange last<br />

year, <strong>Digital</strong> <strong>Transactions</strong> estimates<br />

(chart). If U.S. regulators followed<br />

the example set by Australia’s central<br />

bank several years ago and cut<br />

8 • digitaltransactions • February 2008<br />

interchange by about 40%, the hit<br />

would be nearly $16 billion.<br />

Not even interchange’s most<br />

vehement retailer opponents expect<br />

that will happen. Still, the EC’s interchange<br />

policies could embolden those<br />

in Congress or the federal bankregulatory<br />

agencies to take another<br />

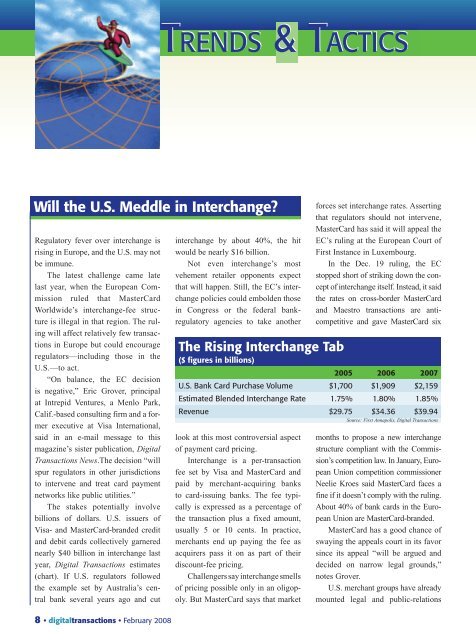

<strong>The</strong> Rising Interchange Tab<br />

($ figures in billions)<br />

look at this most controversial aspect<br />

of payment card pricing.<br />

Interchange is a per-transaction<br />

fee set by Visa and MasterCard and<br />

paid by merchant-acquiring banks<br />

to card-issuing banks. <strong>The</strong> fee typically<br />

is expressed as a percentage of<br />

the transaction plus a fixed amount,<br />

usually 5 or 10 cents. In practice,<br />

merchants end up paying the fee as<br />

acquirers pass it on as part of their<br />

discount-fee pricing.<br />

Challengers say interchange smells<br />

of pricing possible only in an oligopoly.<br />

But MasterCard says that market<br />

forces set interchange rates. Asserting<br />

that regulators should not intervene,<br />

MasterCard has said it will appeal the<br />

EC’s ruling at the European Court of<br />

First Instance in Luxembourg.<br />

In the Dec. 19 ruling, the EC<br />

stopped short of striking down the concept<br />

of interchange itself. Instead, it said<br />

the rates on cross-border MasterCard<br />

and Maestro transactions are anticompetitive<br />

and gave MasterCard six<br />

2005 2006 2007<br />

U.S. Bank Card Purchase Volume $1,700 $1,909 $2,159<br />

Estimated Blended Interchange Rate 1.75% 1.80% 1.85%<br />

Revenue $29.75 $34.36 $39.94<br />

Source: First Annapolis, <strong>Digital</strong> <strong>Transactions</strong><br />

months to propose a new interchange<br />

structure compliant with the Commission’s<br />

competition law. In January, European<br />

Union competition commissioner<br />

Neelie Kroes said MasterCard faces a<br />

fine if it doesn’t comply with the ruling.<br />

About 40% of bank cards in the European<br />

Union are MasterCard-branded.<br />

MasterCard has a good chance of<br />

swaying the appeals court in its favor<br />

since its appeal “will be argued and<br />

decided on narrow legal grounds,”<br />

notes Grover.<br />

U.S. merchant groups have already<br />

mounted legal and public-relations