The Broken Link - Digital Transactions

The Broken Link - Digital Transactions

The Broken Link - Digital Transactions

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

consumer disputes. Also, the bank<br />

said it would have been difficult to<br />

perform risk assessments on aggregated<br />

transactions.<br />

Aggregated transactions would<br />

affect NACHA also, McEntee says.<br />

“We didn’t feel we could analyze the<br />

data because the merchant would not<br />

appear on the transaction,” he says.<br />

Some observers assert the new<br />

ruling was aimed at Capital One, and<br />

could force the company to spend<br />

money to retool some of its processes.<br />

But McEntee denies the rule targets<br />

any particular issuer. <strong>The</strong> spokesperson<br />

at Capital One says the company<br />

will follow NACHA guidelines.<br />

Tempo Payments does not aggregate<br />

transactions, Grossman says.<br />

Real-Time Balances<br />

Another worry for the bank holding<br />

the checking account is how disputes<br />

will be resolved. Consumers may be<br />

confused about whom<br />

to call when problems<br />

arise. “It’s unclear to<br />

what extent the product<br />

is tricky for customers<br />

to use,” says Aite’s<br />

Bézard.<br />

Both HSBC and<br />

Capital One list their<br />

customer-service telephone<br />

numbers on the<br />

back of their cards. By<br />

regulation, the issuer of<br />

the card is responsible<br />

for dispute resolution.<br />

“In our program,<br />

we have seen very little<br />

consumer confusion,”<br />

says HSBC’s Eckert. “We are the<br />

point of first resolution because we<br />

are the [phone] number on the back<br />

of the card.”<br />

Others think consumers will call<br />

the bank where they have their DDA<br />

if, say, fraud occurs. A customer who<br />

sees money flowing out of his checking<br />

account isn’t likely to call the<br />

30 • digitaltransactions • February 2008<br />

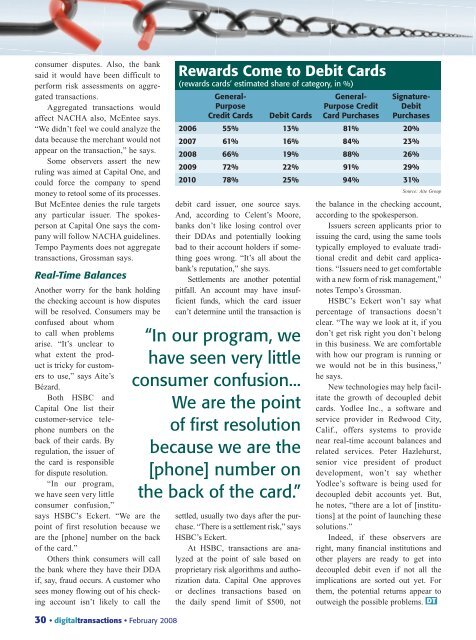

Rewards Come to Debit Cards<br />

(rewards cards’ estimated share of category, in %)<br />

General-<br />

Purpose<br />

Credit Cards Debit Cards<br />

General-<br />

Purpose Credit<br />

Card Purchases<br />

Signature-<br />

Debit<br />

Purchases<br />

2006 55% 13% 81% 20%<br />

2007 61% 16% 84% 23%<br />

2008 66% 19% 88% 26%<br />

2009 72% 22% 91% 29%<br />

2010 78% 25% 94% 31%<br />

debit card issuer, one source says.<br />

And, according to Celent’s Moore,<br />

banks don’t like losing control over<br />

their DDAs and potentially looking<br />

bad to their account holders if something<br />

goes wrong. “It’s all about the<br />

bank’s reputation,” she says.<br />

Settlements are another potential<br />

pitfall. An account may have insufficient<br />

funds, which the card issuer<br />

can’t determine until the transaction is<br />

“In our program, we<br />

have seen very little<br />

consumer confusion...<br />

We are the point<br />

of first resolution<br />

because we are the<br />

[phone] number on<br />

the back of the card.”<br />

settled, usually two days after the purchase.<br />

“<strong>The</strong>re is a settlement risk,” says<br />

HSBC’s Eckert.<br />

At HSBC, transactions are analyzed<br />

at the point of sale based on<br />

proprietary risk algorithms and authorization<br />

data. Capital One approves<br />

or declines transactions based on<br />

the daily spend limit of $500, not<br />

Source: Aite Group<br />

the balance in the checking account,<br />

according to the spokesperson.<br />

Issuers screen applicants prior to<br />

issuing the card, using the same tools<br />

typically employed to evaluate traditional<br />

credit and debit card applications.<br />

“Issuers need to get comfortable<br />

with a new form of risk management,”<br />

notes Tempo’s Grossman.<br />

HSBC’s Eckert won’t say what<br />

percentage of transactions doesn’t<br />

clear. “<strong>The</strong> way we look at it, if you<br />

don’t get risk right you don’t belong<br />

in this business. We are comfortable<br />

with how our program is running or<br />

we would not be in this business,”<br />

he says.<br />

New technologies may help facilitate<br />

the growth of decoupled debit<br />

cards. Yodlee Inc., a software and<br />

service provider in Redwood City,<br />

Calif., offers systems to provide<br />

near real-time account balances and<br />

related services. Peter Hazlehurst,<br />

senior vice president of product<br />

development, won’t say whether<br />

Yodlee’s software is being used for<br />

decoupled debit accounts yet. But,<br />

he notes, “there are a lot of [institutions]<br />

at the point of launching these<br />

solutions.”<br />

Indeed, if these observers are<br />

right, many financial institutions and<br />

other players are ready to get into<br />

decoupled debit even if not all the<br />

implications are sorted out yet. For<br />

them, the potential returns appear to<br />

outweigh the possible problems. DT