The Broken Link - Digital Transactions

The Broken Link - Digital Transactions

The Broken Link - Digital Transactions

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Merchants Roll Out Private-Label Gift Cards<br />

(% of category merchants offering gift cards)<br />

21%<br />

19%<br />

6%<br />

4%<br />

0% 0%<br />

Retail MO/TO Hotels Restaurants<br />

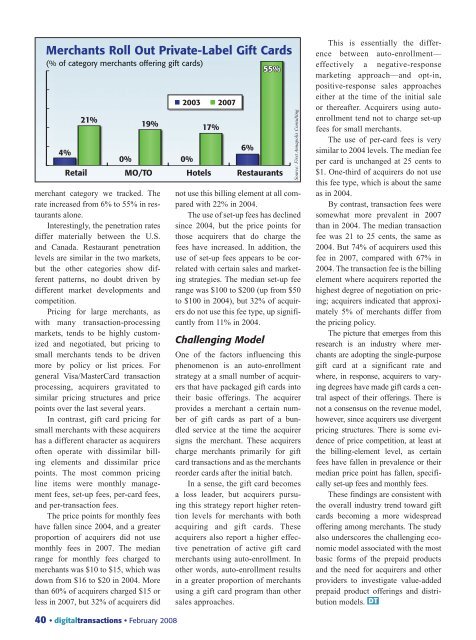

merchant category we tracked. <strong>The</strong><br />

rate increased from 6% to 55% in restaurants<br />

alone.<br />

Interestingly, the penetration rates<br />

differ materially between the U.S.<br />

and Canada. Restaurant penetration<br />

levels are similar in the two markets,<br />

but the other categories show different<br />

patterns, no doubt driven by<br />

different market developments and<br />

competition.<br />

Pricing for large merchants, as<br />

with many transaction-processing<br />

markets, tends to be highly customized<br />

and negotiated, but pricing to<br />

small merchants tends to be driven<br />

more by policy or list prices. For<br />

general Visa/MasterCard transaction<br />

processing, acquirers gravitated to<br />

similar pricing structures and price<br />

points over the last several years.<br />

In contrast, gift card pricing for<br />

small merchants with these acquirers<br />

has a different character as acquirers<br />

often operate with dissimilar billing<br />

elements and dissimilar price<br />

points. <strong>The</strong> most common pricing<br />

line items were monthly management<br />

fees, set-up fees, per-card fees,<br />

and per-transaction fees.<br />

<strong>The</strong> price points for monthly fees<br />

have fallen since 2004, and a greater<br />

proportion of acquirers did not use<br />

monthly fees in 2007. <strong>The</strong> median<br />

range for monthly fees charged to<br />

merchants was $10 to $15, which was<br />

down from $16 to $20 in 2004. More<br />

than 60% of acquirers charged $15 or<br />

less in 2007, but 32% of acquirers did<br />

• 2003 • 2007<br />

17%<br />

55%<br />

Source: First Annapolis Consulting<br />

not use this billing element at all compared<br />

with 22% in 2004.<br />

<strong>The</strong> use of set-up fees has declined<br />

since 2004, but the price points for<br />

those acquirers that do charge the<br />

fees have increased. In addition, the<br />

use of set-up fees appears to be correlated<br />

with certain sales and marketing<br />

strategies. <strong>The</strong> median set-up fee<br />

range was $100 to $200 (up from $50<br />

to $100 in 2004), but 32% of acquirers<br />

do not use this fee type, up significantly<br />

from 11% in 2004.<br />

Challenging Model<br />

One of the factors influencing this<br />

phenomenon is an auto-enrollment<br />

strategy at a small number of acquirers<br />

that have packaged gift cards into<br />

their basic offerings. <strong>The</strong> acquirer<br />

provides a merchant a certain number<br />

of gift cards as part of a bundled<br />

service at the time the acquirer<br />

signs the merchant. <strong>The</strong>se acquirers<br />

charge merchants primarily for gift<br />

card transactions and as the merchants<br />

reorder cards after the initial batch.<br />

In a sense, the gift card becomes<br />

a loss leader, but acquirers pursuing<br />

this strategy report higher retention<br />

levels for merchants with both<br />

acquiring and gift cards. <strong>The</strong>se<br />

acquirers also report a higher effective<br />

penetration of active gift card<br />

merchants using auto-enrollment. In<br />

other words, auto-enrollment results<br />

in a greater proportion of merchants<br />

using a gift card program than other<br />

sales approaches.<br />

This is essentially the difference<br />

between auto-enrollment—<br />

effectively a negative-response<br />

marketing approach—and opt-in,<br />

positive-response sales approaches<br />

either at the time of the initial sale<br />

or thereafter. Acquirers using autoenrollment<br />

tend not to charge set-up<br />

fees for small merchants.<br />

<strong>The</strong> use of per-card fees is very<br />

similar to 2004 levels. <strong>The</strong> median fee<br />

per card is unchanged at 25 cents to<br />

$1. One-third of acquirers do not use<br />

this fee type, which is about the same<br />

as in 2004.<br />

By contrast, transaction fees were<br />

somewhat more prevalent in 2007<br />

than in 2004. <strong>The</strong> median transaction<br />

fee was 21 to 25 cents, the same as<br />

2004. But 74% of acquirers used this<br />

fee in 2007, compared with 67% in<br />

2004. <strong>The</strong> transaction fee is the billing<br />

element where acquirers reported the<br />

highest degree of negotiation on pricing;<br />

acquirers indicated that approximately<br />

5% of merchants differ from<br />

the pricing policy.<br />

<strong>The</strong> picture that emerges from this<br />

research is an industry where merchants<br />

are adopting the single-purpose<br />

gift card at a significant rate and<br />

where, in response, acquirers to varying<br />

degrees have made gift cards a central<br />

aspect of their offerings. <strong>The</strong>re is<br />

not a consensus on the revenue model,<br />

however, since acquirers use divergent<br />

pricing structures. <strong>The</strong>re is some evidence<br />

of price competition, at least at<br />

the billing-element level, as certain<br />

fees have fallen in prevalence or their<br />

median price point has fallen, specifically<br />

set-up fees and monthly fees.<br />

<strong>The</strong>se findings are consistent with<br />

the overall industry trend toward gift<br />

cards becoming a more widespread<br />

offering among merchants. <strong>The</strong> study<br />

also underscores the challenging economic<br />

model associated with the most<br />

basic forms of the prepaid products<br />

and the need for acquirers and other<br />

providers to investigate value-added<br />

prepaid product offerings and distribution<br />

models. DT<br />

40 • digitaltransactions • February 2008