The Broken Link - Digital Transactions

The Broken Link - Digital Transactions

The Broken Link - Digital Transactions

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

typically required retailers to equip<br />

every lane with a check scanner. In<br />

addition, merchants using POP are<br />

required to get explicit customer<br />

authorization for the transaction and<br />

to return the voided check.<br />

But the BOC rules give retailers<br />

more flexibility in how they handle<br />

imaging of the check, says Amy<br />

Gutierrez, vice president of strategic<br />

market development at Nova<br />

Information Services, the merchantacquiring<br />

unit of Minneapolis-based<br />

U.S. Bancorp. BOC enables merchants<br />

that accept checks at the point<br />

of sale to convert them into electronic<br />

debits by scanning them in<br />

their back office for submission to<br />

the ACH network. Herndon, Va.-<br />

based NACHA, which governs the<br />

ACH, views BOC as a supplement<br />

to POP.<br />

<strong>The</strong> BOC rules have “really<br />

opened the doors for a lot of the<br />

larger retailers, especially in a multilane<br />

environment, to make a POP<br />

solution work,” Gutierrez says.<br />

“We’re seeing more and more market<br />

demand from the retailer community,<br />

especially the very large multilane<br />

retailers that are national.”<br />

Acquirers now offer solutions that<br />

eliminate the need for purchasing new<br />

equipment for check conversion at the<br />

point of sale. Nova, for example, has<br />

built its e-check conversion products<br />

on the backbone of its credit card processing<br />

system.<br />

“Our network infrastructure<br />

is supporting debit and credit card<br />

processing,” Gutierrez says. “And the<br />

point-of-sale terminals that we certify<br />

now take electronic check transactions.<br />

Basically, we offer a full<br />

payment solution for a merchant or<br />

business to be able to take all of their<br />

non-cash payments directly through<br />

Nova network.”<br />

In its Electronic Check Service<br />

package, Nova converts the transaction<br />

at the point of sale. Merchants<br />

can upload images on their own time<br />

from the back office. “<strong>The</strong> retailer can<br />

keep the check in their cash drawer<br />

and later image that check,” she says.<br />

Nova’s e-check solution also<br />

doesn’t involve special training of<br />

cashiers. “We do all the point-of-sale<br />

upgrades so the product goes electronic<br />

but as far as the cashier is concerned,<br />

it operates the same way as it<br />

always did,” Gutierrez says.<br />

<strong>The</strong> processor offers several<br />

imaging options: Merchants can buy<br />

scanning equipment for their back<br />

offices or send the checks to Nova<br />

for scanning. Nova sells both POP<br />

and BOC solutions, and processing<br />

of non-ACH check transactions<br />

under the Check Clearing Act for the<br />

21st Century, or Check 21. But the<br />

“essence of our delivery is to take the<br />

check at the earliest point of entry,<br />

when it comes in at the point of sale<br />

and goes through the cash register<br />

and convert it at that point of time<br />

similar to how we handle a credit<br />

card transaction,” Gutierrez says.<br />

Nova has more then 10,000 merchants—ranging<br />

from the small momand-pop<br />

locations to some of the largest<br />

national, multilane retailers—using its<br />

e-check services, Gutierrez says.<br />

<strong>Link</strong>ing to QuickBooks<br />

TeleCheck Services Inc., a First Data<br />

Corp. subsidiary, as part of its Electronic<br />

Check Acceptance service also<br />

offers a POP solution that doesn’t<br />

require installation of imaging scanners<br />

at the point of sale. “If a merchant has a<br />

high-quality MICR [magnetic ink character<br />

recognition] reader at the point of<br />

sale but not an imaging device, we are<br />

still able to accept those transactions<br />

for ECA,” says Mark Wallin, general<br />

manager. That’s because TeleCheck<br />

has offered POP for more than five<br />

years, primarily to regional merchants,<br />

and has amassed a large database of<br />

customer information, including name,<br />

address, and other information typically<br />

found on a check.<br />

“That is a big part of the value<br />

proposition that has helped gain<br />

momentum among the national merchant<br />

base,” Wallin says.<br />

About 60% of retailers already<br />

capture check code lines by scanning<br />

the check’s MICR line as part of the<br />

verification and guarantee process,<br />

and would require no further hardware<br />

investment to do electronic check<br />

conversion, Celent’s Meara says.<br />

<strong>The</strong> implementation of BOC also<br />

gives retailers unhappy with POP<br />

another option for electronic check<br />

conversion. That was the case with<br />

West Des Moines, Iowa-based supermarket<br />

chain Hy-Vee Inc., which<br />

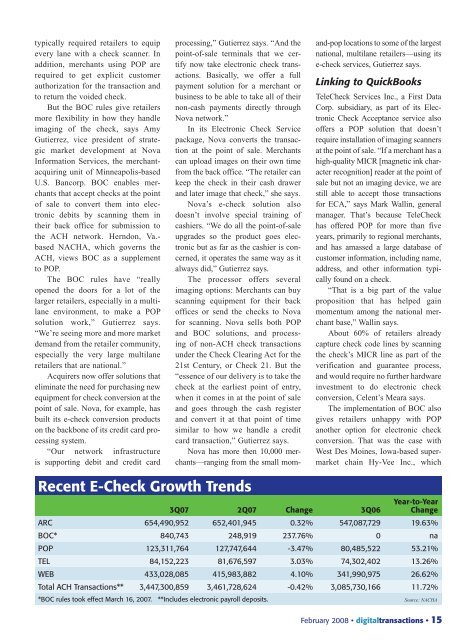

Recent E-Check Growth Trends<br />

3Q07 2Q07 Change 3Q06<br />

Year-to-Year<br />

Change<br />

ARC 654,490,952 652,401,945 0.32% 547,087,729 19.63%<br />

BOC* 840,743 248,919 237.76% 0 na<br />

POP 123,311,764 127,747,644 -3.47% 80,485,522 53.21%<br />

TEL 84,152,223 81,676,597 3.03% 74,302,402 13.26%<br />

WEB 433,028,085 415,983,882 4.10% 341,990,975 26.62%<br />

Total ACH <strong>Transactions</strong>** 3,447,300,859 3,461,728,624 -0.42% 3,085,730,166 11.72%<br />

*BOC rules took effect March 16, 2007. **Includes electronic payroll deposits.<br />

Source: NACHA<br />

February 2008 • digitaltransactions • 15