The Broken Link - Digital Transactions

The Broken Link - Digital Transactions

The Broken Link - Digital Transactions

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Also, last year, PayPal began<br />

offering its debit card holders backup<br />

funding through a traditional bank<br />

account. If the card user isn’t sure the<br />

PayPal account has enough funds to<br />

complete a transaction, the user can<br />

authorize an ACH withdrawal from<br />

his or her bank account. Or, the cardholder<br />

can institute a charge against<br />

a PayPal credit line. PayPal charges<br />

no fee for the transaction. But if the<br />

bank account is used as the backup<br />

funding source when there isn’t<br />

enough money in the DDA, then the<br />

bank typically charges an insufficientfunds<br />

fee, George says. He adds that<br />

customers who sign up for the backup<br />

funding tend to be those who use<br />

their PayPal account as their primary<br />

transaction card.<br />

“<strong>The</strong>y aren’t so worried about<br />

limiting their purchases to the PayPal<br />

balance,” he says.<br />

As with other decoupled debit<br />

cards out so far, rewards are an<br />

important part of the PayPal program.<br />

Card users get 1% cash back<br />

on all signature-debit transactions.<br />

PayPal’s George notes that some<br />

accounts from the program’s early<br />

days are grandfathered in with a<br />

1.5% rebate on purchases.<br />

In general, rewards linked to debit<br />

cards are on the rise (chart, page 30).<br />

Part of that is due to rising interchange<br />

making rewards more affordable for<br />

issuers, according to Bézard. (Credit<br />

cards still offer richer rewards because<br />

issuers can fund them from lucrative<br />

interest revenues.) But competition<br />

may be equally if not more important.<br />

“Consumers’ embrace of debit<br />

cards has forced banks to increasingly<br />

compete on the features of debit<br />

cards, with big banks increasingly<br />

competing with smaller banks,” he<br />

says. “<strong>The</strong>ir embrace of debit cards is<br />

having a ripple effect across the banking<br />

industry, prompting even small<br />

institutions to offer debit rewards as a<br />

defensive measure.”<br />

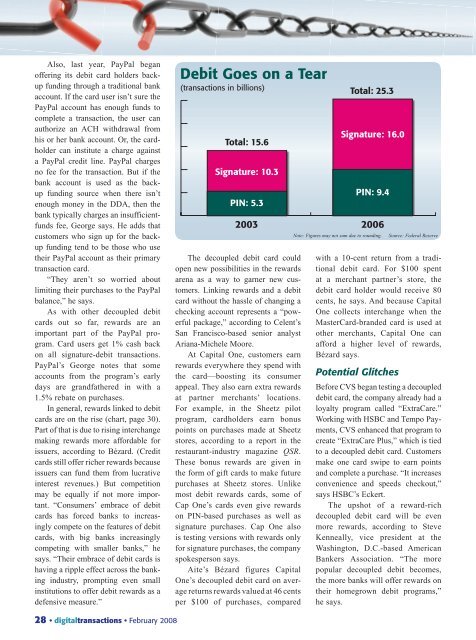

Debit Goes on a Tear<br />

(transactions in billions)<br />

Total: 15.6<br />

Signature: 10.3<br />

PIN: 5.3<br />

<strong>The</strong> decoupled debit card could<br />

open new possibilities in the rewards<br />

arena as a way to garner new customers.<br />

<strong>Link</strong>ing rewards and a debit<br />

card without the hassle of changing a<br />

checking account represents a “powerful<br />

package,” according to Celent’s<br />

San Francisco-based senior analyst<br />

Ariana-Michele Moore.<br />

At Capital One, customers earn<br />

rewards everywhere they spend with<br />

the card—boosting its consumer<br />

appeal. <strong>The</strong>y also earn extra rewards<br />

at partner merchants’ locations.<br />

For example, in the Sheetz pilot<br />

program, cardholders earn bonus<br />

points on purchases made at Sheetz<br />

stores, according to a report in the<br />

restaurant-industry magazine QSR.<br />

<strong>The</strong>se bonus rewards are given in<br />

the form of gift cards to make future<br />

purchases at Sheetz stores. Unlike<br />

most debit rewards cards, some of<br />

Cap One’s cards even give rewards<br />

on PIN-based purchases as well as<br />

signature purchases. Cap One also<br />

is testing versions with rewards only<br />

for signature purchases, the company<br />

spokesperson says.<br />

Aite’s Bézard figures Capital<br />

One’s decoupled debit card on average<br />

returns rewards valued at 46 cents<br />

per $100 of purchases, compared<br />

Total: 25.3<br />

Signature: 16.0<br />

PIN: 9.4<br />

2003 2006<br />

Note: Figures may not sum due to rounding.<br />

Source: Federal Reserve<br />

with a 10-cent return from a traditional<br />

debit card. For $100 spent<br />

at a merchant partner’s store, the<br />

debit card holder would receive 80<br />

cents, he says. And because Capital<br />

One collects interchange when the<br />

MasterCard-branded card is used at<br />

other merchants, Capital One can<br />

afford a higher level of rewards,<br />

Bézard says.<br />

Potential Glitches<br />

Before CVS began testing a decoupled<br />

debit card, the company already had a<br />

loyalty program called “ExtraCare.”<br />

Working with HSBC and Tempo Payments,<br />

CVS enhanced that program to<br />

create “ExtraCare Plus,” which is tied<br />

to a decoupled debit card. Customers<br />

make one card swipe to earn points<br />

and complete a purchase. “It increases<br />

convenience and speeds checkout,”<br />

says HSBC’s Eckert.<br />

<strong>The</strong> upshot of a reward-rich<br />

decoupled debit card will be even<br />

more rewards, according to Steve<br />

Kenneally, vice president at the<br />

Washington, D.C.-based American<br />

Bankers Association. “<strong>The</strong> more<br />

popular decoupled debit becomes,<br />

the more banks will offer rewards on<br />

their homegrown debit programs,”<br />

he says.<br />

28 • digitaltransactions • February 2008