john-lewis-partnership-plc-annual-report-2015

john-lewis-partnership-plc-annual-report-2015

john-lewis-partnership-plc-annual-report-2015

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

142<br />

John Lewis Partnership <strong>plc</strong> Annual Report and Accounts <strong>2015</strong><br />

Notes to the consolidated financial statements (continued)<br />

11 Property, plant and equipment (continued)<br />

In accordance with IAS 36 ‘Impairment of Assets’, the Partnership tests its property, plant and equipment for impairment, whenever events<br />

or circumstances indicate that the value on the balance sheet may not be recoverable. For the purpose of impairment testing, each branch is a<br />

Cash Generating Unit (‘CGU’).<br />

The impairment test compares the recoverable amount for each CGU to the carrying value on the balance sheet. The key assumptions used in the<br />

calculations are the discount rate, long term growth rate and expected sales performance and branch costs.<br />

The value in use calculation is based on five year cash flow projections using the latest budget and forecast data. Any changes in sales performance<br />

and branch costs are based on past experience and expectations of future changes in the market. The forecasts are then extrapolated beyond the<br />

five year period using a long term growth rate of 2.0% (2014: 3.2%). The discount rate is based on the Partnership’s pre-tax weighted average cost of<br />

capital of between 9 to 10% (2014: 9 to 10%).<br />

Having applied the above methodology and assumptions, the Partnership recognised an impairment charge of £10.3m to land and buildings in the<br />

Waitrose division. The impairment charge reflects the revision of the long term forecast cashflows as a result of trading in a highly competitive and<br />

deflationary market.<br />

A reduction of 0.5% in the long term growth rate would result in an additional impairment charge of £9.9m. An increase in the discount rate of 0.5%<br />

would result in an additional impairment charge of £22.4m.<br />

12 Inventories<br />

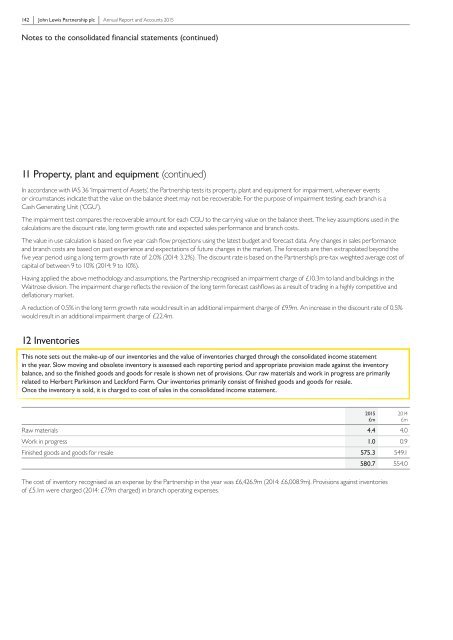

This note sets out the make-up of our inventories and the value of inventories charged through the consolidated income statement<br />

in the year. Slow moving and obsolete inventory is assessed each <strong>report</strong>ing period and appropriate provision made against the inventory<br />

balance, and so the finished goods and goods for resale is shown net of provisions. Our raw materials and work in progress are primarily<br />

related to Herbert Parkinson and Leckford Farm. Our inventories primarily consist of finished goods and goods for resale.<br />

Once the inventory is sold, it is charged to cost of sales in the consolidated income statement.<br />

Raw materials 4.4 4.0<br />

Work in progress 1.0 0.9<br />

Finished goods and goods for resale 575.3 549.1<br />

580.7 554.0<br />

<strong>2015</strong><br />

£m<br />

2014<br />

£m<br />

The cost of inventory recognised as an expense by the Partnership in the year was £6,426.9m (2014: £6,008.9m). Provisions against inventories<br />

of £5.1m were charged (2014: £7.9m charged) in branch operating expenses.