john-lewis-partnership-plc-annual-report-2015

john-lewis-partnership-plc-annual-report-2015

john-lewis-partnership-plc-annual-report-2015

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

62<br />

John Lewis Partnership <strong>plc</strong> Annual Report and Accounts <strong>2015</strong><br />

Waitrose performance (continued)<br />

FINANCIAL review<br />

Gross sales for the year grew by<br />

6.5% to £6.51bn (4.6% on a 52 week<br />

basis), with like-for-like sales up 1.4%.<br />

On average, we had 400,000 more<br />

customer transactions a week<br />

compared to last year, and our market<br />

share grew to 5.4% (Kantar).<br />

Operating profit was down by 23.4% to<br />

£237.4m (down 24.4% on a 52 week basis).<br />

This was held back by a significantly higher<br />

level of investment in the year in new branches<br />

and IT resilience, and the impact of one-off<br />

items. The year-on-year impact on our profits<br />

from these factors was approximately £30m<br />

and £27m respectively. The remaining profit<br />

decline of £26m, after excluding property<br />

profits, is primarily the impact of trading in a<br />

highly competitive and deflationary market.<br />

One-off items include property impairments<br />

and onerous lease costs (£16m), and costs<br />

associated with the planned closure of our<br />

Acton dotcom fulfilment centre (£4m).<br />

In 2014/15, we opened 13 new core branches<br />

(including eight acquired from the Cooperative)<br />

and another 20 convenience shops.<br />

The launch costs associated with this opening<br />

programme and the expected lower returns<br />

from new space in the early months both<br />

impacted profit this year.<br />

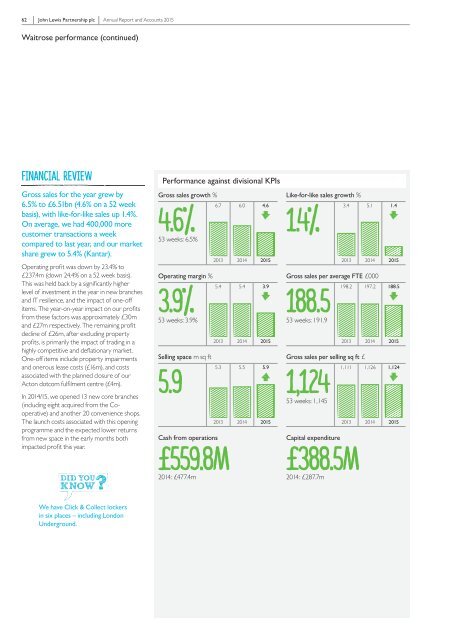

Performance against divisional KPIs<br />

Gross sales growth %<br />

4.6%<br />

6.7 6.0 4.6<br />

53 weeks: 6.5%<br />

Operating margin %<br />

3.9%<br />

5.4 5.4 3.9<br />

53 weeks: 3.9%<br />

Selling space m sq ft<br />

5.9<br />

Cash from operations<br />

£559.8m<br />

2014: £477.4m<br />

2013 2014 <strong>2015</strong><br />

2013 2014 <strong>2015</strong><br />

5.3 5.5 5.9<br />

2013 2014 <strong>2015</strong><br />

Like-for-like sales growth %<br />

1.4%<br />

3.4 5.1 1.4<br />

2013 2014 <strong>2015</strong><br />

Gross sales per average FTE £000<br />

188.5<br />

198.2 197.2 188.5<br />

53 weeks: 191.9<br />

Gross sales per selling sq ft £<br />

1,124<br />

1,111 1,126 1,124<br />

53 weeks: 1,145<br />

Capital expenditure<br />

£388.5m<br />

2014: £287.7m<br />

2013 2014 <strong>2015</strong><br />

2013 2014 <strong>2015</strong><br />

We have Click & Collect lockers<br />

in six places – including London<br />

Underground.