john-lewis-partnership-plc-annual-report-2015

john-lewis-partnership-plc-annual-report-2015

john-lewis-partnership-plc-annual-report-2015

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Annual Report and Accounts <strong>2015</strong> John Lewis Partnership <strong>plc</strong> 143<br />

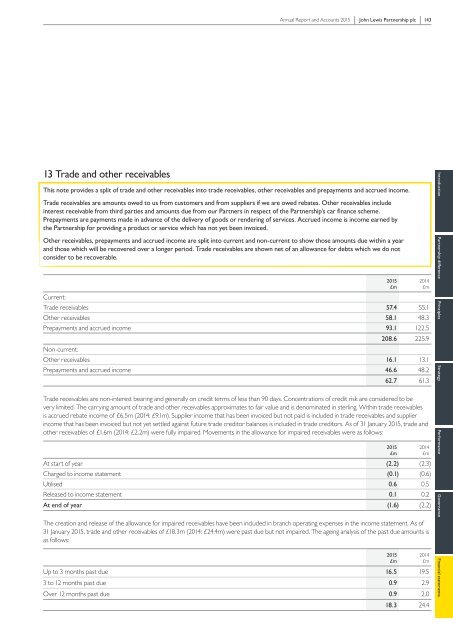

13 Trade and other receivables<br />

This note provides a split of trade and other receivables into trade receivables, other receivables and prepayments and accrued income.<br />

Trade receivables are amounts owed to us from customers and from suppliers if we are owed rebates. Other receivables include<br />

interest receivable from third parties and amounts due from our Partners in respect of the Partnership’s car finance scheme.<br />

Prepayments are payments made in advance of the delivery of goods or rendering of services. Accrued income is income earned by<br />

the Partnership for providing a product or service which has not yet been invoiced.<br />

Other receivables, prepayments and accrued income are split into current and non-current to show those amounts due within a year<br />

and those which will be recovered over a longer period. Trade receivables are shown net of an allowance for debts which we do not<br />

consider to be recoverable.<br />

Current:<br />

Trade receivables 57.4 55.1<br />

Other receivables 58.1 48.3<br />

Prepayments and accrued income 93.1 122.5<br />

208.6 225.9<br />

Non-current:<br />

Other receivables 16.1 13.1<br />

Prepayments and accrued income 46.6 48.2<br />

62.7 61.3<br />

Trade receivables are non-interest bearing and generally on credit terms of less than 90 days. Concentrations of credit risk are considered to be<br />

very limited. The carrying amount of trade and other receivables approximates to fair value and is denominated in sterling. Within trade receivables<br />

is accrued rebate income of £6.5m (2014: £9.1m). Supplier income that has been invoiced but not paid is included in trade receivables and supplier<br />

income that has been invoiced but not yet settled against future trade creditor balances is included in trade creditors. As of 31 January <strong>2015</strong>, trade and<br />

other receivables of £1.6m (2014: £2.2m) were fully impaired. Movements in the allowance for impaired receivables were as follows:<br />

At start of year (2.2) (2.3)<br />

Charged to income statement (0.1) (0.6)<br />

Utilised 0.6 0.5<br />

Released to income statement 0.1 0.2<br />

At end of year (1.6) (2.2)<br />

The creation and release of the allowance for impaired receivables have been included in branch operating expenses in the income statement. As of<br />

31 January <strong>2015</strong>, trade and other receivables of £18.3m (2014: £24.4m) were past due but not impaired. The ageing analysis of the past due amounts is<br />

as follows:<br />

Up to 3 months past due 16.5 19.5<br />

3 to 12 months past due 0.9 2.9<br />

Over 12 months past due 0.9 2.0<br />

18.3 24.4<br />

<strong>2015</strong><br />

£m<br />

<strong>2015</strong><br />

£m<br />

<strong>2015</strong><br />

£m<br />

2014<br />

£m<br />

2014<br />

£m<br />

2014<br />

£m<br />

Introduction Partnership difference Principles Strategy Performance Governance Financial statements