- Page 1 and 2: COMPLIANCEMANUAL

- Page 3 and 4: ACTIVITY SCHEDULE FOR BRANCH OPENIN

- Page 5 and 6: DISPLAY OF NOTICE BOARDNote: 1. All

- Page 7: NOTICE BOARD:BSE1. Name of the Trad

- Page 10 and 11: 1 Name of the Trading Member(Commod

- Page 12 and 13: CONTRACT NOTES (CN) & APPOINTMENT O

- Page 14: - BSE-AUTHORISATION FOR SIGNING CON

- Page 18 and 19: Procedure to be followed by branche

- Page 20 and 21: Trading terminals to be located at

- Page 22 and 23: NCDEX CTCL ID :- Details to be Prov

- Page 24 and 25: IF NOT SATISFIEDCRF PROCEDURE - OFF

- Page 26 and 27: FORMAT FOR CRF REQUISITIONDate :To,

- Page 28 and 29: DOCUMENTARY REQUIREMENTS[ check the

- Page 30 and 31: List of documents approved as Addre

- Page 32 and 33: Appropriate UCI category to be allo

- Page 34 and 35: Checklist to be confirmed by Branch

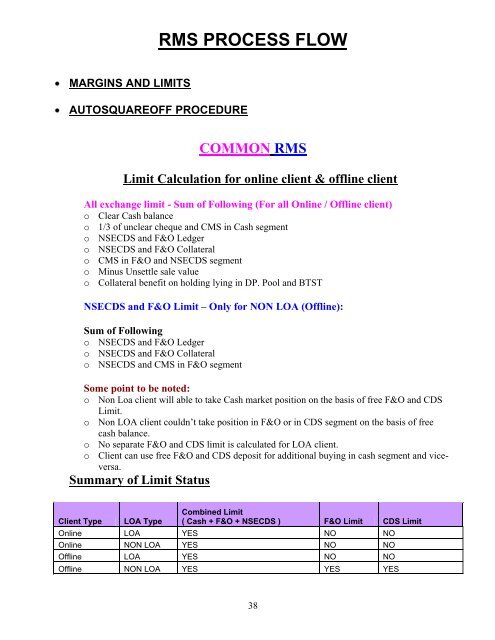

- Page 36 and 37: Guidelines to be followed before tr

- Page 40 and 41: AUTO SQUARE OFF - BSE AND NSE CASH

- Page 42 and 43: Square Off ReportOtherSegCreditTota

- Page 44 and 45: Final Auto Square Off Report - foll

- Page 46 and 47: REPORTABLE MARGIN(includes Ledger b

- Page 48 and 49: PartyCodeClient AClient AOverall Po

- Page 50 and 51: 21. Square off value - square off q

- Page 52 and 53: For e.g - Client AParticularsTraded

- Page 54 and 55: lient CSYBEANIDR 20-Mar-08 -10 2274

- Page 56 and 57: Undertaking to be procured from cli

- Page 58 and 59: Under Certificate of PostingDate: _

- Page 60 and 61: 5. We further state that believing

- Page 62 and 63: Sr.NoCustomerServiceStandardsLedger

- Page 64 and 65: DEALING WITH CLIENTS1. Branch must

- Page 66 and 67: ISSUES PERTAINING TO INSURANCE CLAI

- Page 69 and 70: REPORTING OF BULK DEAL / BLOCK DEAL

- Page 71 and 72: USEFUL WEB SITESwww.bseindia.comwww

- Page 73 and 74: 25262728Statement of accounts Secur

- Page 75 and 76: Code of conduct for Prevention of I

- Page 77 and 78: SECURITIES AND EXCHANGE BOARD OF IN

- Page 79 and 80: (3) Transactions With Stock-Brokers

- Page 81 and 82: (7) INVESTMENT ADVICE : A sub-broke

- Page 83 and 84: 45. Following part of clause B in S

- Page 85 and 86: 19 Contract notes have been issuedt

- Page 87 and 88: On T+1 day16 Client Direct Payout F

- Page 89 and 90:

SEBI-PMSSr.No.Name of thereport/sta

- Page 91 and 92:

MCX:Sr.No. Name of the report/state

- Page 93 and 94:

k) An undertaking should be submitt

- Page 95 and 96:

Final ApprovalJugal Mantri(Group CF

- Page 97 and 98:

CHECKLISTFor Individuals/Sole Propr

- Page 99 and 100:

For Partnership/CorporatesSUB-BROKE

- Page 101 and 102:

Remiser in BSE Cash Segment101

- Page 103 and 104:

completion of all the closure forma

- Page 105 and 106:

with brokerages to be charged to cl

- Page 107 and 108:

PART -I OVER VIEWA. Introduction1.1

- Page 109 and 110:

C. Guiding Principles3.1.1. These G

- Page 111 and 112:

33. Gender34. Introducer DetailsII.

- Page 113 and 114:

IF NOT SATISFIEDProcess FlowSTARTCR

- Page 115 and 116:

B. Code Of Conduct For Prevention O

- Page 117 and 118:

II. Dealing With Employee Clients1.

- Page 119 and 120:

B. Monitoring & ReportingI. Cash Tr

- Page 121 and 122:

III. Branch / Associates Inspection

- Page 123 and 124:

AppendixCash Transaction ReportSusp

- Page 125 and 126:

Why Comply ?Stand alone benefits:

- Page 127 and 128:

SCOPE OF COMPLIANCECompliance requi

- Page 129 and 130:

Broad Areas CoveredMajor compliance

- Page 131 and 132:

REGISTRATION OF CLIENTS• Know You

- Page 133 and 134:

REGISTRATION OF CLIENTS (Contd…)A

- Page 135 and 136:

REGISTRATION OF CLIENTS (Coned…)S

- Page 137 and 138:

REGISTRATION OF CLIENTS (Coned…)S

- Page 139 and 140:

REGISTRATION OF CLIENTS (Contd…)U

- Page 141 and 142:

DEALING WITH CLIENTS (contd..)Compl

- Page 143 and 144:

DEALING WITH CLIENTS (contd..)Funds

- Page 145 and 146:

DEALING WITH CLIENTS (contd..)State

- Page 147 and 148:

DEALING WITH CLIENTS (contd..)Margi

- Page 149 and 150:

DEALING WITH CLIENTS (contd..)Strai

- Page 151 and 152:

Compliances relating toTrading requ

- Page 153 and 154:

MARGIN TRADING• Maintenance of se

- Page 155 and 156:

Financing of securities transaction

- Page 157 and 158:

INTERNET TRADING• Client specific

- Page 159 and 160:

OFFICE MANAGEMENT (contd..)Complian

- Page 161 and 162:

OFFICE MANAGEMENT (contd..)Complian

- Page 163 and 164:

Prevention of Money Laundering Act,

- Page 165 and 166:

Compliances relating toDealing with

- Page 167 and 168:

DEALING WITH INTERMEDIARIES(Contd..

- Page 169 and 170:

Compliances relating toMembership R

- Page 171 and 172:

MEMBERSHIP REQUIREMENT• Trading m

- Page 173 and 174:

MAINTENANCE OF BOOKSAND RECORDS Sec

- Page 175 and 176:

MAINTENANCE OF BOOKSAND RECORDS (Co

- Page 177 and 178:

MAINTENANCE OF BOOKSAND RECORDS (Co

- Page 179 and 180:

MAINTENANCE OF BOOKSAND RECORDS (Co

- Page 181 and 182:

Compliances relating toCode of Cond

- Page 183 and 184:

CODE OF CONDUCT (Contd…)Misconduc

- Page 185 and 186:

CODE OF CONDUCT (Contd…)Unprofess

- Page 187 and 188:

OBLIGATIONS OF A TRADINGMEMBER (con

- Page 189 and 190:

RIGHTS OF THE INSPECTINGOFFICIALS (

- Page 191 and 192:

PERIODIC SUBMISSIONSMonthly Submiss

- Page 193 and 194:

Trading members to comply with the

- Page 195 and 196:

CommoditiesContents1 Maintenance Of

- Page 197 and 198:

1.2. Trade FilesTrade file is downl

- Page 199 and 200:

(Applicable to Corporate Entity), C

- Page 201 and 202:

a) As per Bye-law 8.6.5, the member

- Page 203 and 204:

trading system after submission of

- Page 205 and 206:

11. HANDLING THE COMMODITIES OF CLI

- Page 207 and 208:

13.3 Advertisementa) Member of the