ARG COMPLIANCE MANUAL - Rathi Online

ARG COMPLIANCE MANUAL - Rathi Online

ARG COMPLIANCE MANUAL - Rathi Online

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

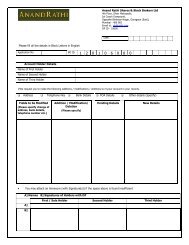

23 August 2006Policy for Trading in Shares & Commodities by Employees of Anand<strong>Rathi</strong> GroupEmployees of Anand<strong>Rathi</strong> Group their spouses, dependent parents and dependent children wishing to deal in securities are requiredto abide by the following code of conduct:As per SEBI Guidelines:1. An order of value greater than Rs. 25 Lakhs or 25000 shares whichever is lower for any single day should be placed onlyafter prior written approval from the Compliance department (Mr.kapila Kabra/ Mr.Pravin Kamble – 022 40013951/3958,(Deepakkedia@rathi.com, kapilakabra@rathi.com , pravinkamble@rathi.com ). Approval shall be validfor one week from the date of approval.2. Secondary market trading in shares of FPOs (Follow up Public Offers) Lead Managed by us would not be allowed for aperiod of 30 days prior to date of opening of FPO. Investment Banking Division would inform all employees about this 45days prior to date of opening of FPO.3. All the employees shall maintain the confidentiality of all Price Sensitive Information. (Price sensitive information in ourbusiness will be bulk trades of Clients/Institutions executed in our office, any information acquired during the course ofconducting research which may not be available to general public and any information acquired during the course ofbusiness which otherwise would not have been available to general public)4. Department & persons for whom restrictions for buying and selling of securities is applicable (Directors, Heads ofdepartments (VP & above), Compliance, Equity dealing Department, Derivative dealing department, Research Department,Risk Management Department) would strictly follow „Code of Conduct for Prevention of Insider Trading‟ (as per sheetenclosed)Organizations Guidelines:5. Dealing in securities must be only through Anand <strong>Rathi</strong> Group. However, exceptions shall be allowed in case of the spouseof a staff member who is working in some other broking house where similar policy is in place. Such exceptions shall begranted only after prior approval is obtained from Compliance Officer at Anand <strong>Rathi</strong> Group.6. DP account should be with Anand <strong>Rathi</strong> Group only and would be provided at a discount of Rs. 50 per account.7. All the trades should be executed only through the Employee Central Dealing Desk in Mumbai; orders may be sent to Mr.Kalpesh Pandey / Mr. Chintan through telephone (022 4001 3803) or email (employeetrading@rathi.com). Dealers at theCentral Dealing Desk would send confirmation of all the transactions executed through email on same day.8. Concessional Brokerage Rates to be decided from time to time would be charged. Current rates would be 0.10% for cashsegment and 0.02% each side on F &O segment.9. Buying and selling shares of the same company within the same settlement shall normally not be allowed.10. Trading in F & O, would be permitted only for the limited purpose of hedging / arbitrage. Trading in commodities would beallowed through investment in arbitrage – structured products.11. Concerned Business Head / Head of Department should be vigilant about policy implementation by his/her team membersand should inform relevant authorities in case the policy is violated. However, the compliance officer shall have the right tocall for relevant information from any staff member. All the employees would submit a self certification of following thispolicy to HR department; this would be coordinated by HR department.12. If any employee is found to be breaking this policy, management may take strict disciplinary action, which may includereflecting in the appraisal and even termination of services from the company.74