Volume 2, ISSUE2/2011 - Review of Applied Socio-Economic ...

Volume 2, ISSUE2/2011 - Review of Applied Socio-Economic ...

Volume 2, ISSUE2/2011 - Review of Applied Socio-Economic ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

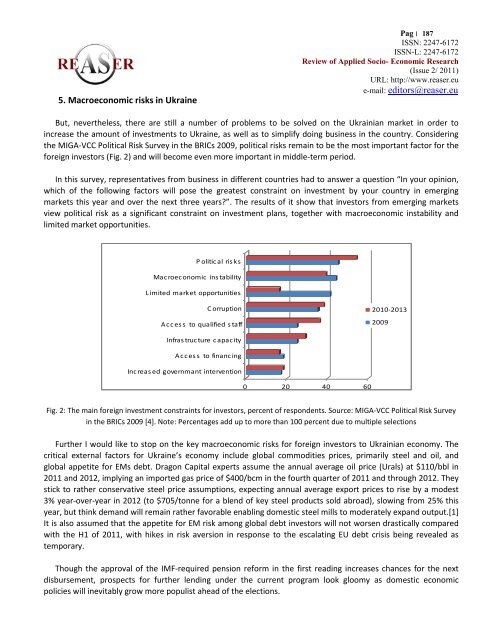

5. Macroeconomic risks in UkrainePag׀ 187 ISSN: 2247-6172ISSN-L: 2247-6172<strong>Review</strong> <strong>of</strong> <strong>Applied</strong> <strong>Socio</strong>- <strong>Economic</strong> Research(Issue 2/ <strong>2011</strong>)URL: http://www.reaser.eue-mail: editors@reaser.euBut, nevertheless, there are still a number <strong>of</strong> problems to be solved on the Ukrainian market in order toincrease the amount <strong>of</strong> investments to Ukraine, as well as to simplify doing business in the country. Consideringthe MIGA-VCC Political Risk Survey in the BRICs 2009, political risks remain to be the most important factor for theforeign investors (Fig. 2) and will become even more important in middle-term period.In this survey, representatives from business in different countries had to answer a question “In your opinion,which <strong>of</strong> the following factors will pose the greatest constraint on investment by your country in emergingmarkets this year and over the next three years?”. The results <strong>of</strong> it show that investors from emerging marketsview political risk as a significant constraint on investment plans, together with macroeconomic instability andlimited market opportunities.P olitical ris ksMacroeconomic ins tabilityL imited market opportunitiesC orruptionAcces s to qualified s taff2010-20132009Infras tructure capacityAcces s to financingIncreas ed governmant intervention0 20 40 60Fig. 2: The main foreign investment constraints for investors, percent <strong>of</strong> respondents. Source: MIGA-VCC Political Risk Surveyin the BRICs 2009 [4]. Note: Percentages add up to more than 100 percent due to multiple selectionsFurther I would like to stop on the key macroeconomic risks for foreign investors to Ukrainian economy. Thecritical external factors for Ukraine’s economy include global commodities prices, primarily steel and oil, andglobal appetite for EMs debt. Dragon Capital experts assume the annual average oil price (Urals) at $110/bbl in<strong>2011</strong> and 2012, implying an imported gas price <strong>of</strong> $400/bcm in the fourth quarter <strong>of</strong> <strong>2011</strong> and through 2012. Theystick to rather conservative steel price assumptions, expecting annual average export prices to rise by a modest3% year-over-year in 2012 (to $705/tonne for a blend <strong>of</strong> key steel products sold abroad), slowing from 25% thisyear, but think demand will remain rather favorable enabling domestic steel mills to moderately expand output.[1]It is also assumed that the appetite for EM risk among global debt investors will not worsen drastically comparedwith the H1 <strong>of</strong> <strong>2011</strong>, with hikes in risk aversion in response to the escalating EU debt crisis being revealed astemporary.Though the approval <strong>of</strong> the IMF-required pension reform in the first reading increases chances for the nextdisbursement, prospects for further lending under the current program look gloomy as domestic economicpolicies will inevitably grow more populist ahead <strong>of</strong> the elections.