Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

www.islamicfi nancenews.com<br />

<strong>Islamic</strong> <strong>Finance</strong> news Guide 2008<br />

Accelerating <strong>Islamic</strong> Banking Growth in Indonesia (<strong>continued</strong>...)<br />

of <strong>Islamic</strong> banking grow from 98.9% at the end of 2005 to<br />

99.8%. During the same period, third-party funds increased<br />

to IDR7.3 trillion (US$792 million). This indicated that almost<br />

all funds mobilized by the bank were fully distributed by<br />

<strong>Islamic</strong> banking; in other words, <strong>Islamic</strong> banks had optimally<br />

performed their intermediary function.<br />

However, due to the slow recovery of the investment<br />

climate and economic conditions in the fi rst quarter, fund<br />

channeling was slightly affected. This condition infl uenced<br />

investors to be more cautious about placing their funds in<br />

banks; moreover, as an alternative, portfolio placements in<br />

the money market became more attractive as they offered<br />

better fi nancial stability. The shortage of funds on investment<br />

fi nally impeded the expansion of their business. This was<br />

refl ected by the volume of <strong>Islamic</strong> banking growth that lost<br />

its momentum in the beginning of the year (growth was only<br />

9.3%, or 28.7% year-on-year) and fi nally reached 36.7% at<br />

the end of 2006.<br />

Institutional development<br />

Last year, the total number of banks operating on Shariah<br />

principles increased, as evidenced by the opening of nine<br />

<strong>Islamic</strong> rural banks (BPRS) and six <strong>Islamic</strong> business units<br />

(UUS). Therefore, at the end of 2007, the number of <strong>Islamic</strong><br />

banking institutions increased to three <strong>Islamic</strong> commercial<br />

banks (BUS), 26 UUS and 114 BPRS.<br />

In line with the increasing number of <strong>Islamic</strong> banking<br />

institutions, the offi ce network also signifi cantly increased.<br />

During the reporting period, the number of offi ces (including<br />

cash units, sub-branch offi ces) increased by 75 offi ces from<br />

636 offi ces at the end of 2006 (see Table 1). From area of<br />

distribution, the <strong>Islamic</strong> banking networks reached people in<br />

more than 70 districts in 31 provinces. The number excludes<br />

the 1,135 conventional offi ces opening Shariah services<br />

(offi ce channeling) which offi cially started in the second<br />

quarter of 2006. This phenomenon indicates that investors<br />

still considered <strong>Islamic</strong> banks as potential developing<br />

institutions, especially in rural areas.<br />

Table 1: <strong>Islamic</strong> banking (IB) institutional development<br />

2003 2004 2005 2006 2007<br />

Full-fl edged <strong>Islamic</strong> banks 2 3 3 3 3<br />

<strong>Islamic</strong> banking division of<br />

conventional banks<br />

8 15 19 20 26<br />

<strong>Islamic</strong> rural banks (BPRS) 84 88 92 105 114<br />

Number of <strong>Islamic</strong> banks 337 443 550 636 711<br />

IB outlet in conventional bank<br />

offi ce (offi ce channeling)<br />

— — — 456 1,135<br />

Development of BUS and UUS<br />

Last year, the business volume of <strong>Islamic</strong> banking grew by<br />

IDR9.8 trillion (US$1.06 billion). At the end of the period, it<br />

reached IDR36.5 trillion (US$4 billion). <strong>Islamic</strong> banking assets<br />

by national banking grew from 1.6% at the end of 2006 to<br />

1.8% at the end of 2007, in which the assets were dominated<br />

by fi nancing products. Although BUS still dominated as the<br />

main player in the industry, UUS market share improved from<br />

20.8% in 2006 to 23.5% in 2007.<br />

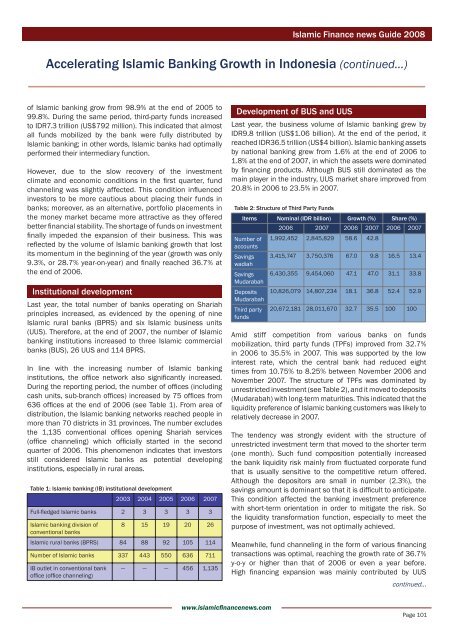

Table 2: Structure of Third Party Funds<br />

Items Nominal (IDR billion) Growth (%) Share (%)<br />

2006 2007 2006 2007 2006 2007<br />

Number of<br />

accounts<br />

1,992,452 2,845,829 58.6 42.8<br />

Savings<br />

wadiah<br />

3,415,747 3,750,376 67.0 9.8 16.5 13.4<br />

Savings<br />

Mudarabah<br />

6,430,355 9,454,060 47.1 47.0 31.1 33.8<br />

Deposits<br />

Mudarabah<br />

10,826,079 14,807,234 18.1 36.8 52.4 52.9<br />

Third party<br />

funds<br />

20,672,181 28,011,670 32.7 35.5 100 100<br />

Amid stiff competition from various banks on funds<br />

mobilization, third party funds (TPFs) improved from 32.7%<br />

in 2006 to 35.5% in 2007. This was supported by the low<br />

interest rate, which the central bank had reduced eight<br />

times from 10.75% to 8.25% between November 2006 and<br />

November 2007. The structure of TPFs was dominated by<br />

unrestricted investment (see Table 2), and it moved to deposits<br />

(Mudarabah) with long-term maturities. This indicated that the<br />

liquidity preference of <strong>Islamic</strong> banking customers was likely to<br />

relatively decrease in 2007.<br />

The tendency was strongly evident with the structure of<br />

unrestricted investment term that moved to the shorter term<br />

(one month). Such fund composition potentially increased<br />

the bank liquidity risk mainly from fl uctuated corporate fund<br />

that is usually sensitive to the competitive return offered.<br />

Although the depositors are small in number (2.3%), the<br />

savings amount is dominant so that it is diffi cult to anticipate.<br />

This condition affected the banking investment preference<br />

with short-term orientation in order to mitigate the risk. So<br />

the liquidity transformation function, especially to meet the<br />

purpose of investment, was not optimally achieved.<br />

Meanwhile, fund channeling in the form of various fi nancing<br />

transactions was optimal, reaching the growth rate of 36.7%<br />

y-o-y or higher than that of 2006 or even a year before.<br />

High fi nancing expansion was mainly contributed by UUS<br />

<strong>continued</strong>...<br />

Page 101