You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

www.islamicfi nancenews.com<br />

<strong>Islamic</strong> <strong>Finance</strong> news Guide 2008<br />

Profi t Rate Swap — Breaking New Frontiers (<strong>continued</strong>...)<br />

Now, in a profi t rate swap, the same payoffs should be<br />

achieved as in the interest rate swap i.e. while constructing<br />

a profi t rate swap, the ultimate objective to be achieved is<br />

to enable swapping of one set of dollar amount with another<br />

set of dollar amount with reference to some reference rate of<br />

return and predetermined principal.<br />

The current popular Shariah compliant method commonly<br />

used to achieve this payoff is the execution of two opposite<br />

Murabahah contracts between X and Y. While one Murabahah<br />

transaction achieves the fi xed rate payment element, the other<br />

achieves the fl oating rate element. However, the structure that<br />

is currently employed by majority of the market makers in the<br />

<strong>Islamic</strong> fi nance world is quite cumbersome and burdensome.<br />

We will see why as we proceed.<br />

The <strong>Islamic</strong> Bank of Asia has developed a new and novel<br />

Shariah compliant structure to achieve a payoff similar to<br />

its conventional sibling, the interest rate swap but in a more<br />

effi cient manner.<br />

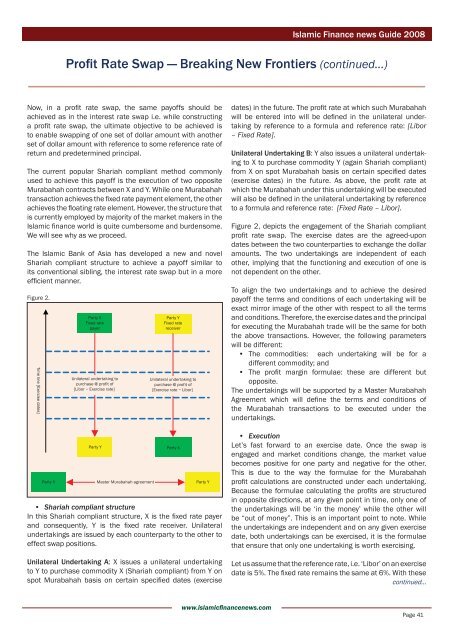

Figure 2.<br />

Time line [Exercise dates]<br />

Party X<br />

Fixed rate<br />

payer<br />

Unilateral undertaking to<br />

purchase @ profit of<br />

[Libor − Exercise rate]<br />

Party Y<br />

Party Y<br />

Fixed rate<br />

receiver<br />

Unilateral undertaking to<br />

purchase @ profit of<br />

[Exercise rate − Libor]<br />

Party X<br />

Party X Master Murabahah agreement<br />

Party Y<br />

• Shariah compliant structure<br />

In this Shariah compliant structure, X is the fi xed rate payer<br />

and consequently, Y is the fi xed rate receiver. Unilateral<br />

undertakings are issued by each counterparty to the other to<br />

effect swap positions.<br />

Unilateral Undertaking A: X issues a unilateral undertaking<br />

to Y to purchase commodity X (Shariah compliant) from Y on<br />

spot Murabahah basis on certain specifi ed dates (exercise<br />

dates) in the future. The profi t rate at which such Murabahah<br />

will be entered into will be defi ned in the unilateral undertaking<br />

by reference to a formula and reference rate: [Libor<br />

– Fixed Rate].<br />

Unilateral Undertaking B: Y also issues a unilateral undertaking<br />

to X to purchase commodity Y (again Shariah compliant)<br />

from X on spot Murabahah basis on certain specifi ed dates<br />

(exercise dates) in the future. As above, the profi t rate at<br />

which the Murabahah under this undertaking will be executed<br />

will also be defi ned in the unilateral undertaking by reference<br />

to a formula and reference rate: [Fixed Rate – Libor].<br />

Figure 2, depicts the engagement of the Shariah compliant<br />

profi t rate swap. The exercise dates are the agreed-upon<br />

dates between the two counterparties to exchange the dollar<br />

amounts. The two undertakings are independent of each<br />

other, implying that the functioning and execution of one is<br />

not dependent on the other.<br />

To align the two undertakings and to achieve the desired<br />

payoff the terms and conditions of each undertaking will be<br />

exact mirror image of the other with respect to all the terms<br />

and conditions. Therefore, the exercise dates and the principal<br />

for executing the Murabahah trade will be the same for both<br />

the above transactions. However, the following parameters<br />

will be different:<br />

• The commodities: each undertaking will be for a<br />

different commodity; and<br />

• The profi t margin formulae: these are different but<br />

opposite.<br />

The undertakings will be supported by a Master Murabahah<br />

Agreement which will defi ne the terms and conditions of<br />

the Murabahah transactions to be executed under the<br />

undertakings.<br />

• Execution<br />

Let’s fast forward to an exercise date. Once the swap is<br />

engaged and market conditions change, the market value<br />

becomes positive for one party and negative for the other.<br />

This is due to the way the formulae for the Murabahah<br />

profi t calculations are constructed under each undertaking.<br />

Because the formulae calculating the profi ts are structured<br />

in opposite directions, at any given point in time, only one of<br />

the undertakings will be ‘in the money’ while the other will<br />

be “out of money”. This is an important point to note. While<br />

the undertakings are independent and on any given exercise<br />

date, both undertakings can be exercised, it is the formulae<br />

that ensure that only one undertaking is worth exercising.<br />

Let us assume that the reference rate, i.e. ‘Libor’ on an exercise<br />

date is 5%. The fi xed rate remains the same at 6%. With these<br />

<strong>continued</strong>...<br />

Page 41