You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

www.islamicfi nancenews.com<br />

<strong>Islamic</strong> <strong>Finance</strong> news Guide 2008<br />

Accelerating <strong>Islamic</strong> Banking Growth in Indonesia (<strong>continued</strong>...)<br />

risk. The risk is refl ected by the high ratio of non-performing<br />

fi nancing (NPF) gross in both sectors. Besides, the NPF ratio in<br />

other factors, including the three main factors, also increased<br />

so that in general the NPF ratio of <strong>Islamic</strong> banking increased<br />

from 4.8% in 200 to 5.66% at November 2007.<br />

From profi tability side, <strong>Islamic</strong> banking drew a profi t of IDR540<br />

billion (US$58.6 million) in 2007, IDR185 billion (US$20.1<br />

million) higher than the previous year. From the sources,<br />

the <strong>Islamic</strong> banking profi t was dominated from accounts<br />

receivable margin, especially from Murabahah margin and<br />

profi t and loss sharing fi nancing.<br />

Development of BPRS<br />

In line with the growth of BUS and <strong>Islamic</strong> business units,<br />

BPRS also showed signifi cant growth. In 2007, the BPRS<br />

business expanded to IDR3 billion (US$325,622;31%). The<br />

expansion increased BPRS’s share of national BPR industry<br />

to 4.21%. Growth was mainly supported by the expansion of<br />

fi nancing products, namely IDR25 billion (US$2.71 million) or<br />

an increase of 40% from the previous year.<br />

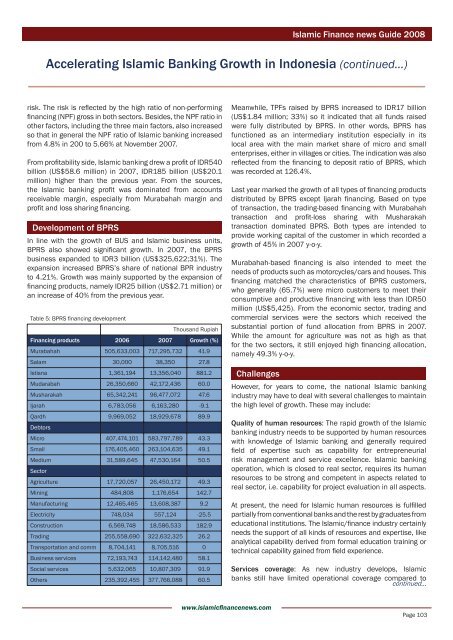

Table 5: BPRS fi nancing development<br />

Financing products 2006 2007<br />

Thousand Rupiah<br />

Growth (%)<br />

Murabahah 505,633,003 717,295,732 41.9<br />

Salam 30,000 38,350 27.8<br />

Istisna 1,361,194 13,356,040 881.2<br />

Mudarabah 26,350,660 42,172,436 60.0<br />

Musharakah 65,342,241 96,477,072 47.6<br />

Ijarah 6,783,056 6,163,280 -9.1<br />

Qardh<br />

Debtors<br />

9,969,052 18,929,678 89.9<br />

Micro 407,474,101 583,797,789 43.3<br />

Small 176,405,460 263,104,635 49.1<br />

Medium<br />

Sector<br />

31,589,645 47,530,164 50.5<br />

Agriculture 17,720,057 26,450,172 49.3<br />

Mining 484,808 1,176,654 142.7<br />

Manufacturing 12,465,465 13,608,387 9.2<br />

Electricity 748,034 557,124 -25.5<br />

Construction 6,569,748 18,586,533 182.9<br />

Trading 255,558,690 322,632,325 26.2<br />

Transportation and comm 8,704,141 8,705,516 0<br />

Business services 72,193,743 114,142,480 58.1<br />

Social services 5,632,065 10,807,309 91.9<br />

Others 235,392,455 377,766,088 60.5<br />

Meanwhile, TPFs raised by BPRS increased to IDR17 billion<br />

(US$1.84 million; 33%) so it indicated that all funds raised<br />

were fully distributed by BPRS. In other words, BPRS has<br />

functioned as an intermediary institution especially in its<br />

local area with the main market share of micro and small<br />

enterprises, either in villages or cities. The indication was also<br />

refl ected from the fi nancing to deposit ratio of BPRS, which<br />

was recorded at 126.4%.<br />

Last year marked the growth of all types of fi nancing products<br />

distributed by BPRS except Ijarah fi nancing. Based on type<br />

of transaction, the trading-based fi nancing with Murabahah<br />

transaction and profi t-loss sharing with Musharakah<br />

transaction dominated BPRS. Both types are intended to<br />

provide working capital of the customer in which recorded a<br />

growth of 45% in 2007 y-o-y.<br />

Murabahah-based fi nancing is also intended to meet the<br />

needs of products such as motorcycles/cars and houses. This<br />

fi nancing matched the characteristics of BPRS customers,<br />

who generally (65.7%) were micro customers to meet their<br />

consumptive and productive fi nancing with less than IDR50<br />

million (US$5,425). From the economic sector, trading and<br />

commercial services were the sectors which received the<br />

substantial portion of fund allocation from BPRS in 2007.<br />

While the amount for agriculture was not as high as that<br />

for the two sectors, it still enjoyed high fi nancing allocation,<br />

namely 49.3% y-o-y.<br />

Challenges<br />

However, for years to come, the national <strong>Islamic</strong> banking<br />

industry may have to deal with several challenges to maintain<br />

the high level of growth. These may include:<br />

Quality of human resources: The rapid growth of the <strong>Islamic</strong><br />

banking industry needs to be supported by human resources<br />

with knowledge of <strong>Islamic</strong> banking and generally required<br />

fi eld of expertise such as capability for entrepreneurial<br />

risk management and service excellence. <strong>Islamic</strong> banking<br />

operation, which is closed to real sector, requires its human<br />

resources to be strong and competent in aspects related to<br />

real sector, i.e. capability for project evaluation in all aspects.<br />

At present, the need for <strong>Islamic</strong> human resources is fulfi lled<br />

partially from conventional banks and the rest by graduates from<br />

educational institutions. The <strong>Islamic</strong>/fi nance industry certainly<br />

needs the support of all kinds of resources and expertise, like<br />

analytical capability derived from formal education training or<br />

technical capability gained from fi eld experience.<br />

Services coverage: As new industry develops, <strong>Islamic</strong><br />

banks still have limited operational coverage compared to<br />

<strong>continued</strong>...<br />

Page 103