Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

<strong>Islamic</strong> <strong>Finance</strong> news Guide 2008<br />

S&P Foresees Mounting Demand for <strong>Islamic</strong> Products (<strong>continued</strong>...)<br />

<strong>Islamic</strong> banks in the Gulf have demonstrated, and should<br />

continue to show, strong profi tability so long as oil revenues<br />

pour into their economies, maintaining economic momentum<br />

through a powerful multiplier effect. The Gulf banks rated<br />

by S&P (<strong>Islamic</strong> and conventional) <strong>continued</strong> to post strong<br />

fi nancial performance in 2007. The ratio of RoA (Return on<br />

Assets) for these banks reached about 3.0%, compared with<br />

3.2% in 2006. Cumulated core earnings <strong>continued</strong> to grow<br />

during the same period, although at a slower pace — about<br />

10% compared with more than 20% in 2006.<br />

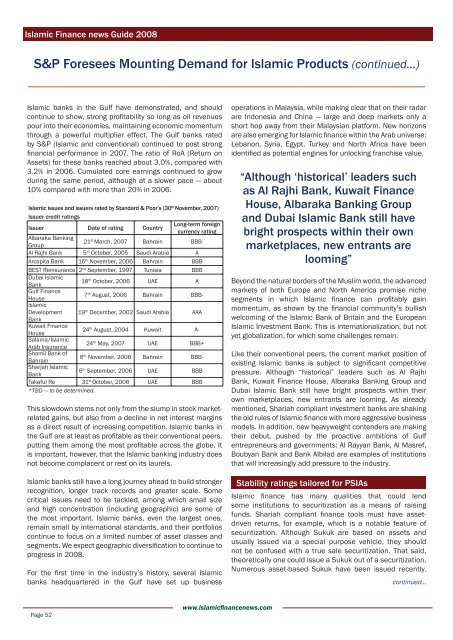

<strong>Islamic</strong> issues and issuers rated by Standard & Poor’s (30th November, 2007)<br />

Issuer credit ratings<br />

Issuer Date of rating Country<br />

Long-term foreign<br />

currency rating<br />

Albaraka Banking<br />

Group<br />

21st March, 2007 Bahrain BBB-<br />

Al Rajhi Bank 5th October, 2005 Saudi Arabia A<br />

Arcapita Bank 16th November, 2006 Bahrain BBB<br />

BEST Reinsurance 2nd September, 1997 Tunisia BBB<br />

Dubai <strong>Islamic</strong><br />

Bank<br />

18th October, 2006 UAE A<br />

Gulf <strong>Finance</strong><br />

House<br />

7th <strong>Islamic</strong><br />

August, 2006 Bahrain BBB-<br />

Development<br />

Bank<br />

19th December, 2002 Saudi Arabia AAA<br />

Kuwait <strong>Finance</strong><br />

House<br />

24th August, 2004 Kuwait A-<br />

Salama/<strong>Islamic</strong><br />

Arab Insurance<br />

24th May, 2007 UAE BBB+<br />

Shamil Bank of<br />

Bahrain<br />

6th November, 2006 Bahrain BBB-<br />

Sharjah <strong>Islamic</strong><br />

Bank<br />

6th September, 2006 UAE BBB<br />

Takaful Re 31st October, 2006 UAE BBB<br />

*TBD — to be determined.<br />

This slowdown stems not only from the slump in stock marketrelated<br />

gains, but also from a decline in net interest margins<br />

as a direct result of increasing competition. <strong>Islamic</strong> banks in<br />

the Gulf are at least as profi table as their conventional peers,<br />

putting them among the most profi table across the globe. It<br />

is important, however, that the <strong>Islamic</strong> banking industry does<br />

not become complacent or rest on its laurels.<br />

<strong>Islamic</strong> banks still have a long journey ahead to build stronger<br />

recognition, longer track records and greater scale. Some<br />

critical issues need to be tackled, among which small size<br />

and high concentration (including geographic) are some of<br />

the most important. <strong>Islamic</strong> banks, even the largest ones,<br />

remain small by international standards, and their portfolios<br />

continue to focus on a limited number of asset classes and<br />

segments. We expect geographic diversifi cation to continue to<br />

progress in 2008.<br />

For the fi rst time in the industry’s history, several <strong>Islamic</strong><br />

banks headquartered in the Gulf have set up business<br />

Page 52<br />

www.islamicfi nancenews.com<br />

operations in Malaysia, while making clear that on their radar<br />

are Indonesia and China — large and deep markets only a<br />

short hop away from their Malaysian platform. New horizons<br />

are also emerging for <strong>Islamic</strong> fi nance within the Arab universe:<br />

Lebanon, Syria, Egypt, Turkey and North Africa have been<br />

identifi ed as potential engines for unlocking franchise value.<br />

“Although ‘historical’ leaders such<br />

as Al Rajhi Bank, Kuwait <strong>Finance</strong><br />

House, Albaraka Banking Group<br />

and Dubai <strong>Islamic</strong> Bank still have<br />

bright prospects within their own<br />

marketplaces, new entrants are<br />

looming”<br />

Beyond the natural borders of the Muslim world, the advanced<br />

markets of both Europe and North America promise niche<br />

segments in which <strong>Islamic</strong> fi nance can profi tably gain<br />

momentum, as shown by the fi nancial community’s bullish<br />

welcoming of the <strong>Islamic</strong> Bank of Britain and the European<br />

<strong>Islamic</strong> Investment Bank. This is internationalization, but not<br />

yet globalization, for which some challenges remain.<br />

Like their conventional peers, the current market position of<br />

existing <strong>Islamic</strong> banks is subject to signifi cant competitive<br />

pressure. Although “historical” leaders such as Al Rajhi<br />

Bank, Kuwait <strong>Finance</strong> House, Albaraka Banking Group and<br />

Dubai <strong>Islamic</strong> Bank still have bright prospects within their<br />

own marketplaces, new entrants are looming. As already<br />

mentioned, Shariah compliant investment banks are shaking<br />

the old rules of <strong>Islamic</strong> fi nance with more aggressive business<br />

models. In addition, new heavyweight contenders are making<br />

their debut, pushed by the proactive ambitions of Gulf<br />

entrepreneurs and governments: Al Rayyan Bank, Al Masref,<br />

Boubyan Bank and Bank Albilad are examples of institutions<br />

that will increasingly add pressure to the industry.<br />

Stability ratings tailored for PSIAs<br />

<strong>Islamic</strong> fi nance has many qualities that could lend<br />

some institutions to securitization as a means of raising<br />

funds. Shariah compliant fi nance tools must have assetdriven<br />

returns, for example, which is a notable feature of<br />

securitization. Although Sukuk are based on assets and<br />

usually issued via a special purpose vehicle, they should<br />

not be confused with a true sale securitization. That said,<br />

theoretically one could issue a Sukuk out of a securitization.<br />

Numerous asset-based Sukuk have been issued recently.<br />

<strong>continued</strong>...