You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

<strong>Islamic</strong> <strong>Finance</strong> news Guide 2008<br />

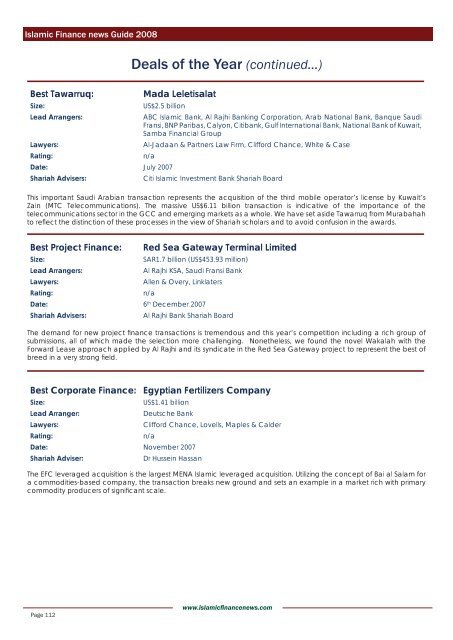

Best Tawarruq: Mada Leletisalat<br />

Size: US$2.5 billion<br />

Lead Arrangers: ABC <strong>Islamic</strong> Bank, Al Rajhi Banking Corporation, Arab National Bank, Banque Saudi<br />

Fransi, BNP Paribas, Calyon, Citibank, Gulf International Bank, National Bank of Kuwait,<br />

Samba Financial Group<br />

Lawyers: Al-Jadaan & Partners Law Firm, Clifford Chance, White & Case<br />

Rating: n/a<br />

Date: July 2007<br />

Shariah Advisers: Citi <strong>Islamic</strong> Investment Bank Shariah Board<br />

This important Saudi Arabian transaction represents the acquisition of the third mobile operator’s license by Kuwait’s<br />

Zain (MTC Telecommunications). The massive US$6.11 billion transaction is indicative of the importance of the<br />

telecommunications sector in the GCC and emerging markets as a whole. We have set aside Tawarruq from Murabahah<br />

to refl ect the distinction of these processes in the view of Shariah scholars and to avoid confusion in the awards.<br />

Best Project <strong>Finance</strong>: Red Sea Gateway Terminal Limited<br />

Size: SAR1.7 billion (US$453.93 million)<br />

Lead Arrangers: Al Rajhi KSA, Saudi Fransi Bank<br />

Lawyers: Allen & Overy, Linklaters<br />

Rating: n/a<br />

Date: 6th December 2007<br />

Shariah Advisers: Al Rajhi Bank Shariah Board<br />

The demand for new project fi nance transactions is tremendous and this year’s competition including a rich group of<br />

submissions, all of which made the selection more challenging. Nonetheless, we found the novel Wakalah with the<br />

Forward Lease approach applied by Al Rajhi and its syndicate in the Red Sea Gateway project to represent the best of<br />

breed in a very strong fi eld.<br />

Page 112<br />

Deals of the Year (<strong>continued</strong>...)<br />

Best Corporate <strong>Finance</strong>: Egyptian Fertilizers Company<br />

Size: US$1.41 billion<br />

Lead Arranger: Deutsche Bank<br />

Lawyers: Clifford Chance, Lovells, Maples & Calder<br />

Rating: n/a<br />

Date: November 2007<br />

Shariah Adviser: Dr Hussein Hassan<br />

The EFC leveraged acquisition is the largest MENA <strong>Islamic</strong> leveraged acquisition. Utilizing the concept of Bai al Salam for<br />

a commodities-based company, the transaction breaks new ground and sets an example in a market rich with primary<br />

commodity producers of signifi cant scale.<br />

www.islamicfi nancenews.com